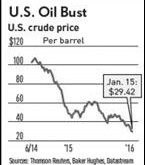

The S&P 500 now stands at 1880.33 points, only 31.97 points from its 2015 opening price of 1848.36; for the broad market, a year’s meager gains almost wiped clean. The index’s P/E ratio now stands at 19.81, and is still well above its historic average of 15.57. S&P 500 Year To Date Performance The market confirmed my fears of last week that it was in free-fall. In fact, it posted its worst ever 10-day losses for a year-begin! The week saw only Utilities post a modest gain of...

Read More »That was the week that was!

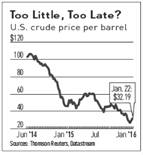

Week January 17-22 This was the first winning week of 2016 and of some relief to ordinary investors. The question is whether it is sustainable, or just a short-covering bounce, as is frequently the case when the market is undergoing a correction. Currently the S&P 500 has sunk 10.5%, the DJ-30 12.1%, and the NASDAQ 12.0%, since mid-2015. Calling a bottom, or a top, is a challenge even for professional investors. I would cite three short-term factors bearing on the question ‘Where do we...

Read More »The Market’s Bad Omens mount as the Black Swan population grows!

Last week’s market action confirmed clearly its corrective trend. I cannot say more than that, because when systematic risk kicks in the good, the bad, and the ugly all suffer the same slippery fate. Clearly it prophecies a healthy renewal once this bear trend is over, but first this downward phase has to be over-done before there is a capitulation that would signal a key reversal. For now, there is not much to expect. As the market is in the grip of a profit recession on the one side, and...

Read More »Miserable week that ended a miserable year

It was a miserable week that ended a miserable year, followed by an apparently bad first week in 2016. In fact it was the S&P 500’s worst since the start of the bull market in 2009, ending the year down 0.73% at 2043.94 points! Volume was seasonally very low. If you are frustrated with the stock market’s performance, I can well understand it, but if you look at the video (Ctrl + Click) below, “Ouch! 5 CEOs lost a combined $20 billion in 2015!”, you may be comforted to see that Warren...

Read More »Only high-Alpha Investing in 2016 will be profitable!

As you may have expected, last week the market moved more into wind-down mode as the week progressed and dosed to a near-sleep on Friday’s half-day with the S&P500’s volume down 53%. This is the usual script at this time of year, so that the market ignored the WTI crude oil price, which it had recently been closely correlated to, when it moved from last week’s close $34.73 per barrel to this week’s price of $38.10, an increase of 3.38%. The market still languishes in its ‘under...

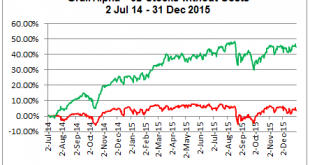

Read More »The Low Volatility Anomaly and the Failures of Your Asset Manager

According to John Henry Smith, fund managers are too much focused on bench-marking their performance to a market index, over-emphasizing the importance of “alpha”. But asset managers should abstract from alpha and construct portfolios that have lower risk and higher return than the market. Impossible? This post is the second part of The Fallacies of Portfolio Volatility Measurements. The Market Return For reasons of consistency, fund managers are primarily focused on benchmarking their...

Read More »The Fallacies of Portfolio Volatility Measurements

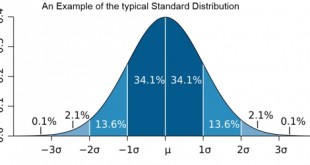

Standard deviation (sigma σ) measures volatility or the dispersion of random values around the mean of a variable such as a portfolio or individual stock prices, but does not measure the direction of a trend. Standard Deviation as volatility measure What has become the bedrock of finance is an out-of-date almost universally accepted finance theory, which uses the statistical normal distribution (the Gaussian bell curve) as the measure of risk per se. In reality stocks are found not to be...

Read More »Mark of a true investor: He disregards instincts

The stock market works very differently than the natural world. When an animal is spooked, its first reaction is to freeze. Naturalists say that freezing helps animals escape the attention of predators, which hunt by sensing movement. Try that trick in the stock market – freezing when you should be taking action – and you’ll either be knocked silly by the bears or left behind by the bulls. Instincts are counter-productive We do not believe in the “rely on your gut” principle, propagated on...

Read More »Listen to the Sirens of the Stock Market at your Peril!

John Henry Smith of Grail Securities (Switzerland) shows that the financial markets have always been awash with its own brand of Sirens, who dolefully prophesied the complete collapse of whole economic systems. For him Pericles gave the best advice: “The key is not to predict the future, but to be prepared for it!” —————————————————————————————— In Homer’s Odyssey, the Sirens were dangerous and beautiful maidens, who irresistibly lured sailors with their enchanting, but sad, music and...

Read More »Adjust Your Sales in today’s Choppy Market!

This year began with the U.S. stock market facing ever increasing headwinds that whipped up choppier waves with whiter crests and deeper troughs. These harsh winds have blown from the four points of the compass, namely the U.S. Federal Reserve Board, the Euro/Greek crisis, the energy and commodity maelstroms, and now the icy chills out of China, all combining to stir up the treacherous currents of globally unstable economic weather patterns.When the market’s weather is sunny and breezy, the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org