Of the economic releases of the past two weeks the one that got the most attention was the employment report. That report is seen by many market analysts as one of the most important and of course the Fed puts a lot of emphasis on it so the press spends an inordinate amount of time dissecting it. I don’t waste much time on it myself because it is subject to large revisions and has little predictive capability. In...

Read More »Bitcoin Forked – Precious Metals Supply and Demand Report

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. A Fork in the Cryptographic Road So bitcoin forked. You did not know this. Well, if you’re saving in gold perhaps not. If you’re betting in the crypto-coin casino, you knew it, bet on it, and now we assume are happily diving into your greater quantity of dollars after the fork. You don’t have a greater quantity of...

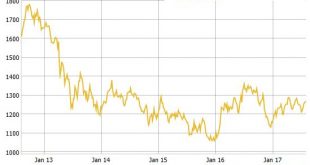

Read More »Gold Consolidates On 2.5percent Gain In July After Dollar Has 5th Monthly Decline

Gold consolidates on 2.5% gain in July as the dollar has fifth monthly decline Trump administration and vicious “civil war” politics casting shadow over America and impacting dollar All eyes on non farm payrolls today for further signs of weakness in U.S. economy Gold recovers from 1.7% decline in June as dollar falls Gold outperforms stocks and benchmark S&P 500 YTD Gold gains 10.8% versus 10.6% gain for S&P...

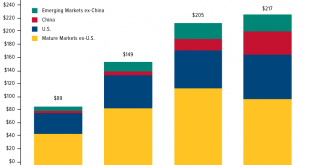

Read More »Estimated Chinese Gold Reserves Surpass 20,000t

My best estimate as of June 2017 with respect to total above ground gold reserves within the Chinese domestic market is 20,193 tonnes. The majority of these reserves are held by the citizenry, an estimated 16,193 tonnes; the residual 4,000 tonnes, which is a speculative yet conservative estimate, is held by the Chinese central bank the People’s Bank of China. I’m aware I’ve been absent from writing about the Chinese...

Read More »Bi-Weekly Economic Review: Extending The Cycle

This economic cycle is one of the longest on record for the US, eight years and counting since the end of the last recession. It has also been, as almost everyone knows, a fairly weak expansion, one that has managed to disappoint both bull and bear. Growth has oscillated around a 2% rate for most of the expansion, falling at times perilously close to recession while at others rising tantalizingly close to escape...

Read More »Bitcoin, Gold and Silver

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Precious Metals Supply and Demand Report That’s it. It’s the final straw. One of the alternative investing newsletters had a headline that screamed, “Bitcoin Is About to Soar, But You Must Act by August 1 to Get In”. It was missing only the call to action “call 1-800-BIT-COIN now! That number again is 800...

Read More »Gold A Good Store Of Value – Protect From $217 Trillion Global Debt Bubble

‘Mother of all debt bubbles’ keeps gold in focus Global debt alert: At all time high of astronomical $217 T India imports “phenomenal” 525 tons in first half of 2017 Record investment demand – ETPs record $245B in H1, 17 Investors, savers should diversify into “safe haven” gold Gold good ‘store of value’ in coming economic contraction Gold’s medium- to long-term investment case, I believe, looks even brighter. Many...

Read More »Gold Seasonal Sweet Spot – August and September – Coming

– Gold seasonal sweet spot – August and September – is coming– Gold’s performance by month from 1979 to 2016 – must see table– August sees average return of 1.4% and September of 2.5%– September is best month to own gold, followed by January, November & August Looking back at gold’s performance since 1979, August and September are big months for the yellow metal. What is the cause? No one really knows but there are...

Read More »Le prix de l’or est manipulé. Egon von Greyerz

La léthargie estivale des marchés a tendance à insuffler un sentiment de fausse sécurité. Les actions et l’immobilier approchent de leurs plus hauts historiques, les taux d’intérêt sont à un plus bas de 72 ans, et la plupart des investisseurs se sentent plus riches que jamais. Les banques centrales envoient les signaux d’économies fortes en annonçant des hausses de taux et une réduction de leurs bilans. Source image:...

Read More »Against Irredeemable Paper – Precious Metals Supply and Demand

The Antidote Something needs to be said. We are against the existence of irredeemable paper currency, central banking and central planning, cronyism, socialized losses and privatized gains, counterfeit credit, wealth transfers and bailouts, and welfare both corporate and personal. When we write to debunk the conspiracy theories that say manipulation is keeping gold from hitting $5,000 (one speaker here at Freedom Fest...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org