Head of the Financial Markets Division of the Dutch central bank, Aerdt Houben, stated in an interview for newspaper Het Financieele Dagblad published in October 2016 that releasing a bar list of the Dutch official gold reserves “would cost hundreds of thousands of euros”. In this post we’ll expose this is virtually impossible – the costs to publish the bar list should be close to zero – and speculate about the far...

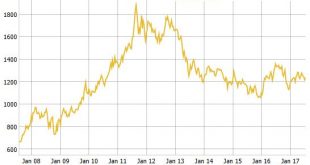

Read More »Gold Hedges Against Currency Devaluation and Cost Of Fuel, Food, Beer and Housing

Gold Hedges Against Currency Devaluation and Cost Of Fuel, Food, Beer and Housing - Gold hedge against currency devaluation - cost of fuel, food, housing- True inflation figures reflect impact on household spending- Household items climbed by average 964%- Pint of beer sees biggest increase in basket of goods - rise of 2464%- Bread rises 836%, butter by 1023% and fuel (diesel) up by 1375%- Gold rises 2672% and hold's its value over 40 years- Savings eaten away by money creation and...

Read More »“Time To Position In Gold Is Right Now” – Rickards

“Time To Position In Gold Is Right Now” – Rickards - "Time to position in gold is right now” - James Rickards- Fed has hit the ‘pause’ button; No more rate hikes for foreseeable future- Fed’s theories "bear no relation to reality" and has "blundered by raising rates"- Growth is weak, inflation is weak, retail sales and real incomes are weak- Tight money, weak economy & stock bubble classic recipe for market crash- Reduce allocations to stocks and reallocate to...

Read More »Stockholm Syndrome – Precious Metals Supply and Demand

Hostages of Irredeemable Scrip Stockholm Syndrome is defined as “…a condition that causes hostages to develop a psychological alliance with their captors as a survival strategy during captivity.” While observers would expect kidnapping victims to fear and loathe the gang who imprison and threaten them, the reality is that some don’t. There is a loose analogy between being held hostage and being an investor in a regime...

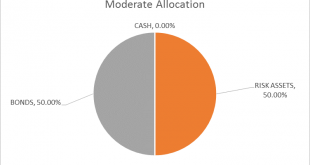

Read More »Global Asset Allocation Update: Not Yet

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolio this month. Growth and inflation expectations rose somewhat since last month’s update. The change is minor though and within the range of what we’ve seen in recent months. The most significant change from last month is the continued...

Read More »Silver Analysts Forecast $20 In Bloomberg Silver Price Survey

Silver Analysts Forecast $20 In Bloomberg Silver Price Survey - Bloomberg silver price survey - Large majority bullish on silver- Silver median "12 month-forecast" of $20- Precious metal analysts see silver "24 percent rally from current levels"- Investors are pouring money into silver ETFs- Speculative funds bearish even as ETF assets rise to record- Spec funds being bearish is bullish as frequently signals bottom- Important to focus not just on silver price but on silver...

Read More »Bi-Weekly Economic Review: Attention Shoppers

The majority of the economic reports over the last two weeks have been disappointing, less than the consensus expectations. The minor rebound in activity we’ve been tracking since last summer appears to have stalled. Retail sales continue to disappoint and inventory/sales ratios are once again rising – from already elevated levels. Even the positive reports were clouded by negative undertones. So far though our market...

Read More »The Three Headed Debt Monster That’s Going to Ravage the Economy

Mass Infusions of New Credit “The bank is something more than men, I tell you. It’s the monster. Men made it, but they can’t control it.” – John Steinbeck, The Grapes of Wrath Something strange and somewhat senseless happened this week. On Tuesday, the price of gold jumped over $13 per ounce. This, in itself, is nothing too remarkable. However, at precisely the same time gold was jumping, the yield on the 10-Year...

Read More »Negative Rates: The New Gold Rush… For Gold Vaults

Negative interest rates and the populist uprising that spurred the UK to vote for Brexit and Americans to elect Trump has helped reignite a rush into physical safe haven assets like gold and silver, which however has led to a shortage of safe venues where to store the precious metals (unlike bitcoin, gold actually has a physical dimension). And now companies that operate storage facilities for precious metals and other...

Read More »The New Gold Rush… For Gold Vaults

Negative interest rates and the populist uprising that spurred the UK to vote for Brexit and Americans to elect Trump has helped reignite a rush into physical safe haven assets like gold and silver, which however has led to a shortage of safe venues where to store the precious metals (unlike bitcoin, gold actually has a physical dimension). And now companies that operate storage facilities for precious metals and other valuables are ramping up their capacity to help cash in on the soaring...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org