Summary: The UK reports inflation, employment and retail sales this week. The BOE meets but will keep rates steady. The US 2-year premium over the UK is the highest since at least 1992 today. United Kingdom While the Federal Reserve meeting is the highlight this week, the UK has a number economic reports and the Bank of England’s Monetary Policy Committee meets. The UK reports inflation tomorrow, followed...

Read More »FX Daily, December 12: Dollar and Yen Trade Lower to Start the Week

Swiss Franc The EUR/CHF improved today. The OPEC-non-OPEC agreement was the reason. Always when oil gets more expensive, the euro, gold, CHF and the whole “Asian bloc” rises against dollar and yen. Still it was astonishing that the euro improved more against USD than the inflation hedge CHF. Reason might be that investors now consider the ECB the most dovish central bank. Higher oil prices, however, may lead to more...

Read More »FX Daily, December 12: Dollar and Yen Trade Lower to Start the Week

Swiss Franc The EUR/CHF improved today. The OPEC-non-OPEC agreement was the reason. Always when oil gets more expensive, the euro, gold, CHF and the whole “Asian bloc” rises against dollar and yen. Still it was astonishing that the euro improved more against USD than the inflation hedge CHF. Reason might be that investors now consider the ECB the most dovish central bank. Higher oil prices, however, may lead to more...

Read More »Weekly Speculative Positions: Short CHF Close to Records of 2015

Speculators appeared mostly interested in reducing exposure in the run-up to the US jobs data and the Italian referendum. They liquidated gross longs in the currency futures market and covered shorts. Of the eight currencies we track there were two exceptions, the Japanese yen and the Swiss franc. Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K...

Read More »Weekly Speculative Positions: Short CHF Close to Records of 2015

Speculators appeared mostly interested in reducing exposure in the run-up to the US jobs data and the Italian referendum. They liquidated gross longs in the currency futures market and covered shorts. Of the eight currencies we track there were two exceptions, the Japanese yen and the Swiss franc. Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K...

Read More »FX Weekly Preview: What the FOMC Says may be More Important than What it Does

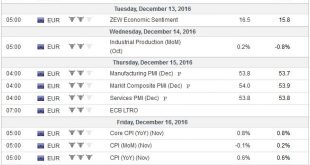

Summary: FOMC meeting is the last highlight of the year. OPEC and non-OPEC producers strike a deal: optics good and that can lift prices further in near term. Italy will have a new Prime Minister, the fourth unelected PM. Provided that the Federal Reserve delivers the widely tipped and expected 25 bp hike in the Fed funds target range, the key to investors’ reaction will be a function of the FOMC statement and...

Read More »FX Weekly Preview: What the FOMC Says may be More Important than What it Does

Summary: FOMC meeting is the last highlight of the year. OPEC and non-OPEC producers strike a deal: optics good and that can lift prices further in near term. Italy will have a new Prime Minister, the fourth unelected PM. Provided that the Federal Reserve delivers the widely tipped and expected 25 bp hike in the Fed funds target range, the key to investors’ reaction will be a function of the FOMC statement and...

Read More »FX Weekly Review, December 05 – December 09: Dollar Bulls Running Out of Time to See Parity vs Euro in 2016

Swiss Franc Currency Index The Swiss Franc index remained in a losing position compared to the dollar index. However since November 25, it has remained stable. Given that the ECB extended the QE period, the EUR/CHF has fallen to 1.0730 again. Trade-weighted index Swiss Franc, December 09(see more posts on Swiss Franc Index, ) Source: FT.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss...

Read More »FX Weekly Review, December 05 – December 09: Dollar Bulls Running Out of Time to See Parity vs Euro in 2016

Swiss Franc Currency Index The Swiss Franc index remained in a losing position compared to the dollar index. However since November 25, it has remained stable. Given that the ECB extended the QE period, the EUR/CHF has fallen to 1.0730 again. Trade-weighted index Swiss Franc, December 09(see more posts on Swiss Franc Index, ) Source: FT.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss...

Read More »FX Daily, December 09: Euro Chopped Lower before Stabilizing

Swiss Franc EUR/CHF - Euro Swiss Franc, December 09(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge FX Rates The euro has stabilized after extending yesterday’s ECB-driven losses. The euro’s drop yesterday was the largest since the UK referendum to leave the EU. Ahead of the weekend, there may be some room for additional corrective upticks, but they will likely be limited, with the $1.0650...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org