Is the global economy on the mend as everyone at least here in America is now assuming? For anyone else to attempt to answer that question, they might first have to figure out what went wrong in the first place. Most have simply assumed, and continue to assume, it has been fallout from the “trade wars.” That is a demonstrably false guess, one easily dispelled by the facts. A trade war produces winners from its losers. But we cannot find a single one. There have...

Read More »Consumer Preferences Are Harder to Measure than the Behavioral Economists Think

A recent paper in the Journal of Consumer Psychology (JCP) has started a debate on the accuracy of “loss aversion,” the idea that people are driven by fear of losses more than they are by the potential for gain. Core to behavioral economics, this idea has been rather universally accepted and been part of the awarding of two economics Nobel Prizes, in 2002 to Daniel Kahneman and in 2017 to Richard Thaler. One of the authors of the JCP article, Professor David Gal...

Read More »FX Daily, December 20: Sterling Trades Higher after Test on $1.30

Swiss Franc The Euro has fallen by 0.04% to 1.0875 EUR/CHF and USD/CHF, December 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The holiday mood has tightened its grip on the capital markets, and global investors have nearly completely ignored the impeachment of the US President as it has little economic or policy significance. US equities reached new record highs yesterday with the S&P 500 moving above...

Read More »Swiss Balance of Payments and International Investment Position: Q3 2019

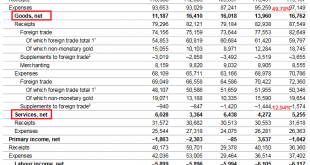

Current Account In summary: Nearly any change against the third quarter of 2018. About the same figures. But clearly and – as usual – a massive surplus. Key figures: Current Account: Up 39.15% against Q3/2018 to 18.09 bn. CHF of which Goods Trade Balance: Plus 49.78% against Q3/2018 to 16.76 bn. of which the Services Balance: Minus 12.94% to 5.25 bn. of which Investment Income: Plus 25.74% to 5.08 bn. CHF. Current Account Switzerland Q3 2019(see more posts on...

Read More »Swiss Balance of Payments and International Investment Position: Q3 2019

Current Account In summary: Nearly any change against the third quarter of 2018. About the same figures. But clearly and – as usual – a massive surplus. Key figures: Current Account: Up 39.15% against Q3/2018 to 18.09 bn. CHF of which Goods Trade Balance: Plus 49.78% against Q3/2018 to 16.76 bn. of which the Services Balance: Minus 12.94% to 5.25 bn. of which Investment Income: Plus 25.74% to 5.08 bn. CHF. Current Account Switzerland Q3 2019(see more posts on...

Read More »Rosenblatt Goes Full Bear On Apple With $150 Target As China iPhone Sales Slump

Rosenblatt Securities analyst Jun Zhang maintained a sell rating on Apple with a price target of $150 per share, citing a decline in iPhone sales in China is leading to a wave of production cuts by the company. “Based on our recent channel checks, we believe Apple’s total iPhone sales in China were down ~-30% y/y in November,” said Zhang in a note to clients on Tuesday. Zhang stated that consumers are opting for cheaper models than the iPhone 11 Pro, which retails...

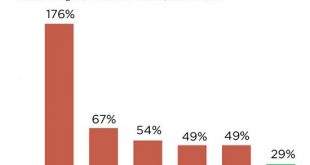

Read More »Skyrocketing Costs Will Pop All the Bubbles

The reckoning is coming, and everyone who counted on “eternal growth of borrowing” to stave off the reckoning is in for a big surprise. We’ve used a simple trick to keep the status quo from imploding for the past 11 years: borrow whatever it takes to keep paying the skyrocketing costs for housing, healthcare, college, childcare, government, permanent wars and so on. The trick has worked because central banks pushed interest rates to zero, lowering the costs of...

Read More »The Strongest Seasonal Advance in Precious Metals Begins Now

Plans and Consequences You are probably already getting into the holiday spirit, perhaps you are even under a little stress. But the turn of the year will soon be here – an occasion to review the past year and make plans for the new one. Many people are doing just that – and their behavior is creating the strongest seasonal rally in the precious metals markets. Anonymous industrial stackers showing off their freshly purchased silver hoard. PT Silver is seasonally...

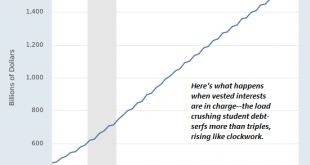

Read More »OK Boomer, OK Fed

Eventually the younger generations will connect all the economic injustices implicit in ‘OK Boomer’ with the Fed. Much of the cluelessness and economic inequality behind the OK Boomer meme is the result of Federal Reserve policies that have favored those who already own the assets (Boomers) that the Fed has relentlessly pumped higher, to the extreme disadvantage of younger generations who were not given the opportunity to buy assets cheap and ride the Fed wave...

Read More »Outlook 2020 | Buy Gold and Silver To Hedge Massive Risks including U.S. ‘Insolvency’

Buy gold and silver to hedge risks in 2020. IG interview Mark O’Byrne of GoldCore With late cycle risks and concerns about global growth, many Wall Street analysts are increasingly bullish on gold. Mark O’Byrne, founder at GoldCore spoke to IGTV’s Victoria Scholar about the outlook for gold in 2020. He explained why most analysts including GoldCore are optimistic on both gold and silver. He also tells IGTV why he thinks palladium is looking overvalued in the near...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org