EM FX was mostly firmer last week. ZAR, PEN, and CLP outperformed while TRY, HUF, and CNY underperformed. MSCI EM traded at new highs for the cycle but ran out of steam near the 1110 area, while MSCI EM FX lagged a bit and has yet to surpass its July high. Overall, the backdrop for EM remains constructive but investors must be prepared to differentiate amongst credits in 2020. AMERICAS Mexico reports mid-December CPI Monday, which is expected to rise 2.71% y/y vs....

Read More »Do Negative Rates Work? Yes, But Not by Much

Sweden’s central bank on Thursday raised its policy rate back to zero, bringing an end to its experiment with negative interest rates. Photo: Mikael Sjoberg/Bloomberg News - Click to enlarge Federal Reserve policy makers opposed to taking interest rates negative in the next recession might take comfort from the end of Sweden’s dalliance with below-zero rates. But investors shouldn’t expect the neighboring eurozone to follow suit: Just hours after the Riksbank...

Read More »Switzerland’s high prices – a European comparison

© Julija Sapic | Dreamstime.com Recently published data shows how prices compare across Europe. The data, collected by Eurostat, compares prices across a number of categories of spending in 2018. Average prices across the EU-28 are used as a base. Overall, residents of Switzerland spent 59% more on the same items than an average resident of the EU-28. Switzerland was 57% more expensive than Italy, 54% more expensive than Germany, 49% more expensive than France, 41%...

Read More »Parliament approves CHF6 billion fighter jet package

The country’s current fleet of F-5 Tigers and F/A-18s is ageing. (Keystone / Peter Klaunzer) The Swiss parliament has approved the purchase of a new fleet of fighter jets to the tune of some CHF6 billion ($6.1 billion). The plans may yet face approval by citizens. Both chambers of parliament have now accepted plans proposed by the government to buy up to 30 new fighter jets, a step it says is vital for the stability and security of the country. As the current fleet...

Read More »Good Economic Theory Focuses on Explanation, Not Prediction

In order to establish the state of the economy, economists employ various theories. Yet what are the criteria for how they decide whether the theory employed is helpful in ascertaining the facts of reality? According to the popular way of thinking, our knowledge of the world of economics is elusive — it is not possible to ascertain how the world of economics really works. Hence, it is held the criterion for the selection of a theory should be its predictive power. So...

Read More »Our Fragmentation Accelerates

As our fragmentation accelerates, shared economic interests are ignored in favor of divisive warring camps that share no common interests. That our society and economy are fragmenting is self-evident. This fragmentation is accelerating rapidly, as middle ground vanishes and competing camps harden their positions to solidify the loyalty of the “tribe.” All or nothing, either-or binaries are the order of the day: you’re either 100% with us or 100% against us, you’re...

Read More »Marx and Left Revolutionary Hegelianism

[This article is excerpted from volume 2, chapter 11 of An Austrian Perspective on the History of Economic Thought (1995).] Hegel’s death in 1831 inevitably ushered in a new and very different era in the history of Hegelianism. Hegel was supposed to bring about the end of history, but now Hegel was dead, and history continued to march on. So if Hegel himself was not the final culmination of history, then perhaps the Prussian state of Friedrich Wilhelm III was not...

Read More »Swiss visit doctor less often than most of Europe

© Tero Vesalainen | Dreamstime.com In 2017, an average Swiss resident visited a medical professional 4.32 times, according to data recently published by Eurostat. Only residents of Denmark (4.30), Sweden (2.77) and Cyprus (2.09) went to see a doctor less often. The average number of visits across those European countries with 2017 data was 6.84. Countries with the highest frequency were Hungary (10.9), Slovakia (10.9), Germany (9.9), Lithuania (9.5) and Liechtenstein...

Read More »Parliament rubber stamps free trade deal with Indonesia

The Swiss Senate sitting in Bern earlier this week. (Keystone / Anthony Anex) The Swiss parliament has given the go-ahead for a free trade deal with Indonesia, although not without debates about sustainability and the Asian country’s production of palm oil. Almost exactly a year after the deal was signed between the European Free Trade Association (EFTA) and Indonesia, the Swiss parliament gave its green light on Thursday. Switzerland and EFTA members Liechtenstein,...

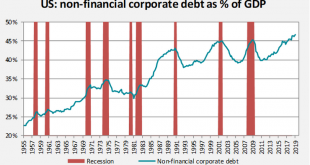

Read More »Corporate Debt Time Bomb

While I have reportedly highlighted the many risks of the current monetary policy direction and the multiple distortions that it has created in the markets, in the economy, and even in society, one of the most pressing dangers of the unnaturally low rates and cheap money is the staggering accumulation of debt. Nowhere is this more obvious than in the ballooning corporate debt, especially in the US. It has been growing so rapidly and for so long, that many investors...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org