It’s almost Christmas time again, and that means its time for White House politicians and staff to spend hundreds of thousands of dollars on Christmas decorations and events for the White House. Parties and pricey decor have, unfortunately, become “tradition” at the White House where the holiday season has become an excuse for the staffs of the White House and the First Lady’s staff to put on a wide variety of “social” events which are really just public relations...

Read More »Credit Suisse: FINMA appoints independent investigator

The logo of FINMA, the Swiss financial watchdog (© Keystone / Gaetan Bally) The Swiss Financial Market Supervisory Authority FINMA says it will have an independent auditor investigate Swiss bank Credit Suisse “in the context of observation activities”. “The observation activities carried out by Credit Suisse raise various compliance issues,” FINMA said in a statement on Friday eveningexternal link. “FINMA’s ongoing investigations of this matter will now be stepped up...

Read More »Welcome to the Era of Intensifying Chaos and New Weapons of Conflict

Geopolitics has moved from a slow-moving, relatively predictable chess match to rapidly evolving 3-D chess in which the rules keep changing in unpredictable ways. A declining standard of living in the developed world, declining growth for the developed world and geopolitical jockeying for control of resources make for a highly combustible mix awaiting a spark: welcome to the era of intensifying chaos and the rapid advance of new weapons of conflict as ruling elites...

Read More »Economics and the Revolt against Reason

The Revolt Against Reason It is true that some philosophers were ready to overrate the power of human reason. They believed that man can discover by ratiocination the final causes of cosmic events, the inherent ends the prime mover aims at in creating the universe and determining the course of its evolution. They expatiated on the “Absolute” as if it were their pocket watch. They did not shrink from announcing eternal absolute values and from establishing moral codes...

Read More »Credit Suisse Ex-Employee Says “Striking Tall Blonde” Spy Followed Her In Manhattan And Long Island

When Colleen Graham heard a story of investigators looking into Credit Suisse for spying on its recently departed head of wealth management, something sounded familiar. She had recalled, years prior, when she was working on a JV between the bank and Palantir Technologies, a “striking tall blonde” had followed her in Manhattan after she refused to sign off on how revenue from the JV would be booked. She filed a complaint in 2017 alleging the bank had taken retaliatory...

Read More »Real High Crimes and Misdemeanors

World Class Entertainer in the Cross-Hairs Christmas is no time to be given the old heave-ho. This is a time of celebration, redemption, and excess libation. A time to shop ‘til you drop; the economy depends on it. Don’t get us wrong. There really is no best time to receive the dreaded pink slip. But Christmas is the absolute worst. Has this ever happened to you? Well, believe it or not, this is precisely what House Speaker Nancy Pelosi and her Democrat...

Read More »Failing to Emigrate Does Not Mean You Give Consent to the State

Eric Nelson, a Professor Government at Harvard, has published this year a brilliant and imaginative book, The Theology of Liberalism (Harvard University Press, 2019). Nelson, it should be said, is no leftist, despite what you might expect from his Harvard affiliation. To the contrary, he is a conservative and favors, though not to the fullest extent, the free market and private property rights. I hope to address on future occasions his penetrating and original views...

Read More »FX Weekly Preview: Economic Data in the Holiday-Shortened Week

The capital markets will turn increasingly quiet in the week ahead as the Christmas holiday thins participation. If this is the season of goodwill, investors are lapping it up. Global equity markets are finishing a strong year on a high note. Record highs were recorded in the S&P 500 and the Dow Jones Stoxx 600. The MSCI Emerging Markets equity index is at its best level since August 2018. Risk assets are doing well, while interest rates have backed up. The CRB...

Read More »USD/CHF Technical Analysis: Further recovery likely amid sustained break of 10-DMA

USD/CHF stays above 10-DMA for the first time in three weeks. 50% Fibonacci retracement can guard immediate upside ahead of 0.9885/90 resistance confluence. A downside break below 61.8% Fibonacci retracement can recall monthly low. Following its break of 10-Day Simple Moving Average (DMA) on Friday, USD/CHF trades around 0.9830 during early Monday. The pair remains positive above 61.8% Fibonacci retracement of August-October upside. In doing so, 50% Fibonacci...

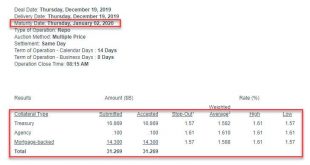

Read More »Repo Crisis Fades Away: For The First Time, A “Turn” Repo Is Not Oversubscribed

It looks like the year-end repocalypse that was predicted by Credit Suisse strategist Zoltan Pozsar is taking a raincheck. Today’s Term Repo saw $26.25BN in security submissions ($15.75BN in TSYs, $10.5BN in MBS), below the $35BN in total availability. This was the first “turn” repo that was not fully subscribed (on Monday, there was $54.25BN in demand for $50BN in repos maturing on Jan 17). As such, for the second day in a row, the Fed’s term repo operation was...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org