It has been a full century since Mises dropped the economic calculation bomb, but the argument apparently still haunts socialists. It should, since Mises managed to show that a socialist economy is not an economy at all but calculational chaos. Yet it is curious that it does, since most have (incorrectly) concluded that Mises’s argument, after decades of debate, was debunked. Why does a presumably debunked argument still, drive even non-Austrian critics to pen new...

Read More »Most want masks made compulsory on Swiss public transport, suggests survey

© Artzzz | Dreamstime.com More than two thirds are in favour of making masks compulsory on Switzerland’s public suggests a survey run by Tamedia, according to the newspaper Le Matin. In addition, the survey showed widespread support for tracing apps (60%) and reopening schools (70%). Confidence is Switzerland’s government (84%) was high. 45% thought the pace of reopening was appropriate, while 15% thought it was too slow and 38% thought it was too fast. The survey...

Read More »Dollar Firm as China’s Hong Kong Gambit Triggers Risk-Off Trading

Legislation was introduced that allows Beijing to directly impose a national security law on Hong Kong; US-China tensions are still rising; the dollar is bid as risk-off sentiment takes hold There are no US data reports or Fed speakers today; Canada reports March retail sales; Mexico reports mid-May CPI ECB publishes the account of its April 30 meeting; UK reported April retail sales and public sector net borrowing; parts of the UK curve remain negative China...

Read More »Banking and Monetary Policy from the Perspective of Austrian Economics

The editors are to be heartily congratulated for putting together this book, which covers an impressive range of topics in monetary economics from an explicitly Austrian perspective. Most of the twelve essays are of a very high quality and one will learn much about money and related topics by a careful reading of them. The chapters range from an insightful interpretation of Austrian monetary theory as a rehabilitation and development of classical monetary theory to...

Read More »Swiss Stamp Tax Duty – All you need to know

(Disclosure: Some of the links below may be affiliate links) If you have been investing in Switzerland, you probably have heard about the Swiss Stamp Tax or the Swiss Stamp Duty. This Stamp Tax is a tax that is collected when you do certain transactions on the stock market. Even though this stamp tax is really simple to understand, there is a lot of confusion about it. Therefore, I wanted to cover it in detail to dispel the confusion once and for all. When you are...

Read More »Let’s Hope Deflation Is Headed Our Way

The yearly growth rate of the US consumer price index (CPI) fell to 0.4 percent in April from 2 percent in April last year while the annual growth of the producer price index (PPI) plunged to –1.2 percent last month against 2.4 percent in April 2019. Furthermore, the yearly growth rate of the import price index fell to –6.8 percent in April from –0.2 percent in April last year. A general decline in the prices of goods and services is regarded as bad news since it is...

Read More »FX Daily, May 22: US-China Escalation Sinks Hong Kong and Hits Risk Appetites

Swiss Franc The Euro has fallen by 0.42% to 1.0579 EUR/CHF and USD/CHF, May 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US has ratcheted up pressure on China on several fronts and has sapped risk appetites ahead of the weekend. Equity markets are lower across the world. Even in India, where the central bank unexpectedly cut the repo rate 40 bp, shares fell 0.7%. It was Hong Kong’s 5.5% that led the...

Read More »Swiss central bank could take negative rates lower

© Marekusz | Dreamstime.com The rate on deposits at the Swiss National Bank (SNB) is currently -0.75%. And while taking the rate further into negative territory is not the base case scenario, it cannot be excluded, according to some economists at the bank UBS. The probability that the SNB lowers rates further is not a base scenario, according to Thomas Jordan, the bank’s chief, reported the newspaper 20 Minutes. However, economists at UBS think it is possible, and...

Read More »Swiss maker of clean aviation fuel gets boost from Lufthansa

Efforts are underway in Switzerland to accelerate the development of sustainable aviation fuel. The aviation industry is a top greenhouse gas emitter. (Keystone) The Lufthansa Group has entered a partnership with the Swiss solar fuel developer Synhelion. The Swiss start-up is working to produce a fuel that emits 50% less CO2 by 2022 and plans to market a 100% renewable fuel in 2030. “We really have something here that demonstrates in a solid way that there is an...

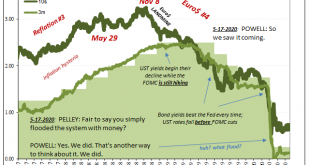

Read More »No Flight To Recognize Shortage

If there’s been one small measure of progress, and a needed one, it has been the mainstream finally pushing commentary into the right category. Back in ’08, during the worst of GFC1 you’d hear it all described as “flight to safety.” That, however, didn’t correctly connote the real nature of what was behind the global economy’s dramatic wreckage. Flight to safety, whether Treasuries or dollars, wasn’t it. Back in March, while “it” was very obvious, even the New...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org