THE GLOBAL financial crisis of 2007-09 was socially divisive as well as economically destructive. It inspired a resentful backlash, exemplified by America’s Tea Party. That crisis at least had the tact to spread financial pain across the rich as well as the poor, however. The share of global wealth held by the top “one percent” actually fell in 2008. The pandemic has been different. Amid all the misery and mortality, the number of millionaires rose last year by 5.2m...

Read More »Keynes Said Inflation Fixed the Problems of Sticky Wages. He Was Wrong.

Britain’s economy had been suffering chronic unemployment for a decade prior to 1936. Economic theory as it was then understood clearly showed that the cause of a market surplus was sellers asking a price in excess of what buyers are willing to pay. If buyers and sellers simply disagree, then so be it. But if the situation is aggravated by excessive regulation or other institutional problems, then economists would advise dissolving institutional barriers that prevent...

Read More »Money Supply Growth Dropped in May to a 15-Month Low

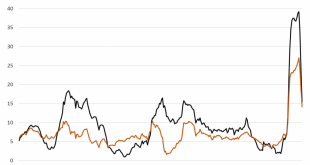

Money supply growth slowed again in May, falling for the third month in a row, and to a 15-month low. That is, money supply growth in the US has come down from its unprecedented levels, and if the current trend continues will be returning to more “normal” levels. Yet, even with this slowdown, money-supply growth remains near some of the highest levels recorded in past cycles. During May 2021, year-over-year (YOY) growth in the money supply was at 15.3 percent....

Read More »Covid: Swiss Health Minister Concerned by Rest Home Staff Vaccine Refusal

In Switzerland, 20% of people over 80 have not been vaccinated against Covid-19 at a time when the fast spreading Delta variant is gaining ground, said Alain Berset, Switzerland’s health minister, in an interview with the NZZ reported RTS. © Arne9001 | Dreamstime.com Berset said he’s concerned that too many people do not want to get vaccinated. But in rest homes we have a worse problem, he said. A considerable portion of staff working in rest homes or offering home...

Read More »FX Daily, July 07: Dollar Stabilizes at Elevated Levels After Surging Yesterday

Swiss Franc The Euro has fallen by 0.03% to 1.0922 EUR/CHF and USD/CHF, July 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dollar has steadied after surging yesterday and has so far retained the lion’s share of its gains, though it remains lower against most major currencies today. The dollar-bloc and Norwegian krone are the best performers while the yen is underperforming. The freely accessible...

Read More »ISM’s Nasty Little Surprise Isn’t Actually A Surprise

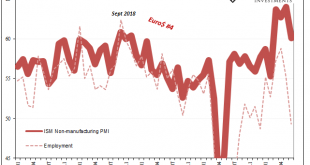

Completing the monthly cycle, the ISM released its estimates for non-manufacturing in the US during the month of June 2021. The headline index dropped nearly four points, more than expected. From 64.0 in May, at 60.1 while still quite high it’s the implication of being the lowest in four months which got so much attention. Consistent with IHS Markit’s estimates as well as the ISM’s Manufacturing PMI released last week, there are growing (confirmed) concerns that...

Read More »Nearly 40% have Long Covid after 7 months, finds Swiss study

The longer term effects of Covid-19 can take many forms and there are numerous definitions of the disease. A study undertaken by HUG and UNIGE in Geneva, published on 6 July 2021, found that 39% of a group of Covid-19 patients still had symptoms after 7 months. © Wavebreakmedia Ltd | Dreamstime.com Of the 629 participants in the study who completed the interviews, 410 completed the follow-up at 7 to 9 months after a COVID-19 diagnosis in early 2020. Of this group,...

Read More »Weekly Market Pulse (VIDEO)

[embedded content] Weekly Market Pulse interview with Joe Calhoun. [embedded content] You Might Also Like SNB Sight Deposits: Inflation Fear Decreasing, SNB Selling Euros 2021-07-05 Sight Deposits have fallen: The change is -0.5 bn. compared to last week, this means the SNB is selling euros and dollars. Weekly Market Pulse (VIDEO) 2021-06-22 Weekly Market Pulse...

Read More »FX Daily, July 06: Greenback Shows Some Resilency after Follow-Through Selling Dried up

Swiss Franc The Euro has fallen by 0.13% to 1.0921 EUR/CHF and USD/CHF, July 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Follow-through dollar selling stalled as key levels were approached, including $1.19 in the euro, $1.3900 in sterling, $0.7600 in the Australian dollar, and CAD1.2300. Sentiment is mixed after the greenback sold-off before last weekend despite the fastest jobs growth in 10-months....

Read More »A Few Things About Reinforced Concrete High-Rise Condos

There is a downside to steel reinforcing bars: they rust. The second most remarkable thing about the sudden collapse of the Florida condo building was the rush to assure everyone that this was a one-off catastrophe: all the factors fingered as causes were unique to this building, the implication being all other high-rise reinforced concrete condos without the exact same mix of causal factors were not in danger. Before we accept this conveniently feel-good conclusion,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org