If we no longer have the capacity to distinguish between moral legitimacy and self-serving corruption, then we might as well eliminate the Middleman and vote directly for Pfizer or Merck. There’s a fancy word for cutting out the Middleman: disintermediation. Removing intermediaries who take a cut but neither produce nor add value makes perfect sense, reducing costs and increasing efficiency. Maybe it’s time to eliminate the politicians who soak up hundreds of...

Read More »The Federal Reserve Keeps Buying Mortgages

Runaway house price inflation continues to characterize the U.S. market. House prices across the country rose 15.8% on average in October 2021 from the year before. U.S. house prices are far over their 2006 Bubble peak, and remain over the Bubble peak even after adjustment for consumer price inflation. They will keep on rising at the annual rate of 14–16% for the rest of 2021, according to the AEI Housing Center. Unbelievably, in this situation the Federal Reserve...

Read More »No weakening expected in Swiss house prices

© Alyssand | Dreamstime.com The Swiss housing market continues to rise with no signs of weakening, reported RTS this week. According to the real estate platform immoscout24, the average price per m2 for a family home in Switzerland has risen from CHF 6,700 to CHF 7,200 over the last 12 months, a rise of 7%. Apartment prices have risen even further in some places. According to Roxane Montagner, who works for CiFi, a company that advises real estate professionals, the...

Read More »Previewing Payrolls By PMIs

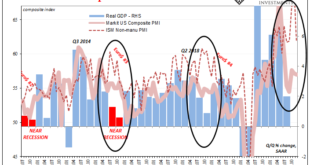

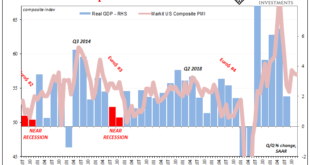

With the monthly Friday Payroll Ritual lurking tomorrow morning, and having been focused on PMI estimates before it, a quick look at the ISM’s Non-manufacturing PMI especially its employment index to bridge the latter to the former. The update today for the month of December put the headline estimate at 62.0, down from 69.1 the month prior. Omicron? While a rather sharp and unexpected 7-point drop, other than the size of the decline at 62.0 there’s little to suspect...

Read More »Switzerland writes off small portion of flight repatriation bill

Repatriated passengers were expected to cover 80% of their flight bills. Keystone / Salvatore Di Nolfi The majority of stranded Swiss people repatriated during the first pandemic wave have paid back their share of flight bills. But the foreign ministry has been forced to write off CHF210,000 ($230,000) and is still haggling over another CHF360,000. In spring 2020, Switzerland arranged for over 7,000 people (4,000 Swiss and 3,000 non-Swiss) to be flown homeExternal...

Read More »Ending Fiat Money Won’t Destroy the State

A certain meme has become popular among advocates of both gold and cryptocurrencies. This is the “Fix the money, fix the world” meme. This slogan is based on the idea that by switching to some commodity money—be it crypto or metal—and abandoning fiat currency, the world will improve greatly. Taken in its moderate form, of course, this slogan is indisputably correct. State-controlled money is immoral, dangerous, and impoverishing. It paves the way for government theft...

Read More »Gold Price News: Gold Down 1% in Wake of More Hawkish Federal Reserve Meeting Minutes

Gold price fell to $1,808 an ounce in the wake of the release of the minutes of the December Federal Reserve meeting, having hit an intra-day high of $1,829. Silver price fell to $22.72 an ounce from an intra-day high of $23.26. Gold and silver have continued to sell off this morning with gold trading as low as $1,794 and silver trading down to $22.14. The FOMC minutes showed a much more hawkish Fed than markets had been expecting. The minute suggests that the Fed...

Read More »Inflation and Geopolitics in the Week Ahead

The Omicron variant may be less fatal than the earlier versions, but it is disrupting economies. The surge in the Delta variant well into Q4 in the US and Europe was already slowing the recoveries. Investors will likely take the high-frequency real sector data with the proverbial pinch of salt until January data available beginning later this month. While the tribalist approach, exemplified by “team transition” and “team permanent” debates about inflation, the...

Read More »As The Fed Seeks To Justify Raising Rates, Global Growth Rates Have Been Falling Off Uniformly Around The World

Sentiment indicators like PMI’s are nice and all, but they’re hardly top-tier data. It’s certainly not their fault, these things are made for very times than these (piggy-backing on the ISM Manufacturing’s long history without having the long history). Most of them have come out since 2008, if only because of the heightened professional interest in macroeconomics generated by a global macro economy that can never get itself going. What PMI’s do have going for them is...

Read More »Bitcoin mit schwachem Start ins neue Jahr

Die erste Woche des neuen Jahres nähert sich dem Ende. Und für den BTC lief der Start ins Jahr 2022 nicht zufriedenstellend. Zu Beginn der Woche stieg die Hashrate deutlich an, so dass viele Experten ein Kursplus erwarteten, doch letztlich ging es um weitere 10 Prozent im Wochenvergleich runter. Bitcoin News: Bitcoin mit schwachem Start ins neue Jahr Arcane Research sah einen Anstieg der Hashrate zum Jahresbeginn, der sogar das Allzeithoch aus Mai 2021 überstieg....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org