Neocolonial “capitalist paradise” or crony “socialist paradise”: the net result is the same: expropriation and impoverishment. Yesterday I noted that not all assets will make it through the inevitable financial re-set. ( Which Assets Are Most Likely to Survive the Inevitable “System Re-Set”?) Those that are easy to expropriate will be expropriated, and those assets vulnerable to soaring taxes, inflation and currency...

Read More »The Dollar: Real or Nominal Rates?

Real interest rates are nominal rates adjusted for inflation expectations. Inflation expectations are tricky to measure. The Federal Reserve identifies two broad metrics. There are surveys, like the University of Michigan’s consumer confidence survey, and the Fed conducts a regular survey of professional forecasters. There are also market-based measures, like the breakevens, which compare the conventional yield to the...

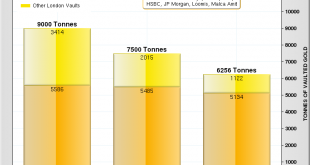

Read More »Gold Bullion Banks To “Open Vaults” In Transparency Push

London Gold Bullion Banks To “Open Vaults” In Transparency Push London’s gold bullion market, which is centuries old, is said to be seeking transparency with plans to reveal how much gold bullion is held in vaults in and around London city according to gold bullion banks. These include gold bullion bars held and controlled by the Bank of England, as reported by Henry Sanderson in the Financial Times. The move is being...

Read More »A recent purchase shows how hard it is to trust product packaging

Volkswagen shocked the world when it was revealed it was cheating on emissions tests on a grand scale. Now some television makers may be gaming the energy efficiency ratings of some of their televisions, according to the Economist. In their efforts to compete and sell more, some brands decide to cut corners. Sometime transgressions are major, like at Volkswagen. However, much of the time they are minor, perfectly legal...

Read More »Which Assets Are Most Likely to Survive the Inevitable “System Re-Set”?

Your skills, knowledge and and social capital will emerge unscathed on the other side of the re-set wormhole. Your financial assets held in centrally controlled institutions will not. Longtime correspondent C.A. recently asked a question every American household should be asking: which assets are most likely to survive the “system re-set” that is now inevitable? It’s a question of great import because not all assets...

Read More »Weekly Sight Deposits and Speculative Positions: SNB Intervenes for 2.4 bn CHF, while Speculators increase CHF Shorts

Headlines Week February 06, 2017 Recently inflation rose more quickly in the euro zone, but this was mostly caused by a temporary oil price effect. Therefore the ECB might be dovish for a longer period than the SNB. Consumer price inflation will decide who is more dovish. Ultimately inflation will depend on the two key parameters wages and rents. Rents will rise first in Switzerland, while the Euro zone has downwards...

Read More »FX Weekly Preview: Politics Not Economics is Driving the Markets

Summary: The Fed is more confident this year of stable growth and rising inflation. The new US Administration’s economic agenda is beginning to take shape, though it is not clear that consumer interests will be pursued. There are several considerations, including politics in Europe, that are driving European rates higher. The RBA and RBNZ meet next week. Neither is expected to change policy. United States The...

Read More »Emerging Markets: Week Ahead Preview

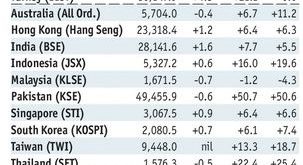

Stock Markets EM ended the week on a firm note, with markets digesting what they perceived as a dovish Fed bias. We disagree, and continue to believe that markets are underestimating the Fed’s capacity to tighten this year. EM FX could continue gaining some traction if the dollar correction continues, but we think US interest rates will ultimately move higher and put pressure on EM once again. Stock Markets Emerging...

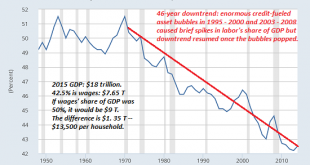

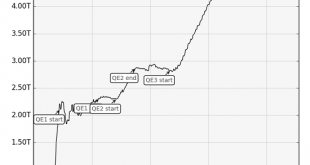

Read More »The Central Banks Face Unwelcome Realities: Their Policies Boosted Wealth Inequality, Failed to Generate “Growth”

Rather than be seen to be further enriching the rich, I think central banks will start closing the “free money for financiers” spigots. Take a quick glance at these charts of the Federal Reserve balance sheet and bank credit in the U.S. Notice what happened to bank credit after the Fed “tapered” and stopped expanding its balance sheet? U.S. Fed Summary - Click to enlarge Bank credit exploded higher: U.S. Bank...

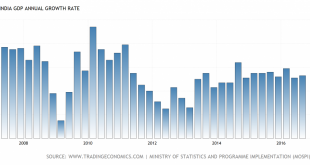

Read More »India: The World’s Fastest Growing Large Economy?

Popular Narrative India has been the world’s favorite country for the last three years. It is believed to have superseded China as the world’s fastest growing large economy. India is expected to grow at 7.5%. Compare that to the mere 6.3% growth that China has “fallen” to. The IMF, the World Bank, and the international media have celebrated this event. Declining commodity prices and other problems in Russia, Brazil and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org