Summary Moody’s raised India’s sovereign debt rating for the first time since 2004 by a notch to Baa2. Nigerian officials are on a global roadshow to support plans to issue its longest-dated Eurobonds ever The head of South Africa’s budget office resigned. President Robert Mugabe was placed under house arrest by the Zimbabwe military. Turkey’s central bank will introduce FX hedges for domestic companies with FX liabilities. President Erdogan has reignited tensions with Turkey’s central bank. Colombia’s fiscal rule may be adjusted by the next government. Stock Markets In the EM equity space as measured by MSCI, Korea (+4.2%), South Africa (+3.2%), and Thailand (+1.9%) have outperformed this week, while Egypt (-5.1%),

Topics:

Win Thin considers the following as important: emerging markets, Featured, newslettersent, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Summary

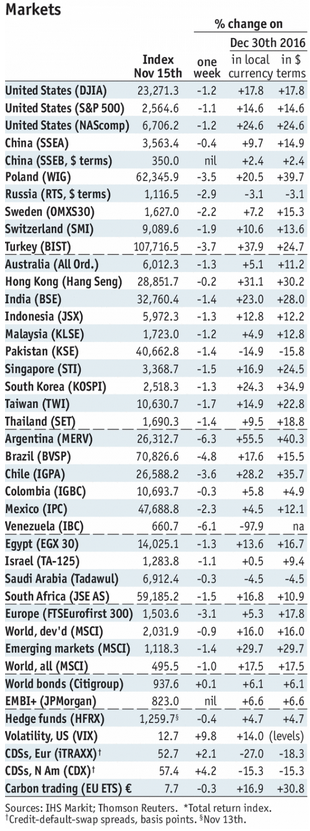

Stock MarketsIn the EM equity space as measured by MSCI, Korea (+4.2%), South Africa (+3.2%), and Thailand (+1.9%) have outperformed this week, while Egypt (-5.1%), Turkey (-1.9%), and Russia (-1.8%) have underperformed. To put this in better context, MSCI EM rose 0.7% this week while MSCI DM fell -0.3%. In the EM local currency bond space, Malaysia (10-year yield -13 bp), South Africa (-13 bp), and Colombia (-12 bp) have outperformed this week, while Turkey (10-year yield +22 bp), Lebanon (+19 bp), and Peru (+12 bp) have underperformed. To put this in better context, the 10-year UST yield fell 5 bp to 2.35%. In the EM FX space, ZAR (+2.3% vs. USD), KRW (+1.8% vs. USD), and ILS (+1.0% vs. USD) have outperformed this week, while TRY (-0.6% vs. USD), PLN (-0.3% vs. EUR), and RUB (-0.3% vs. USD) have underperformed. |

Stock Markets Emerging Markets, November 15 Source: economist.com - Click to enlarge |

IndiaMoody’s raised India’s sovereign debt rating for the first time since 2004 by a notch to Baa2 with a stable outlook. This puts it one notch above the other two major rating agencies, Fitch and S&P. However, note that our own sovereign ratings model shows India’s implied rating at BBB+/Baa1/BBB+, and so further upgrades are likely. Moody’s cited progress on institutional and economic reforms. NigeriaNigerian officials are on a global roadshow to support plans to issue its longest-dated Eurobonds ever. Total of $2.5 bln in 10- and 30-year foreign currency bonds is reportedly planned, but details have yet to be released. Currently, the longest is a 15-year issued this February. Size could be increased, as parliament authorized the government’s plan to issue $5.5 bln of external debt. South AfricaThe head of South Africa’s budget office resigned. Michael Sachs said he wanted to continue serving the public sector but “in a different capacity.” He added that he won’t leave the National Treasury immediately in order to ensure a proper handover and smooth transition. Local press reports that Sachs resigned after President Zuma’s office ordered the National Treasury to find additional money to fund a plan for free higher education. ZimbabwePresident Robert Mugabe was placed under house arrest by the Zimbabwe military. The trigger for the action was pulled last week, when Mugabe fired Vice President Emmerson Mnangagwa to pave the way for his wife Grace to become the next president in 2018. It is not clear yet how long the military plans to stay in power. Elections were scheduled for July 2018 but are unlikely to go as planned. Mugabe is reportedly refusing to resign, complicating the transition to post-Mugabe rule. TurkeyTurkey’s central bank will introduce FX hedges for domestic companies with FX liabilities. The bank will auction NDFs that settle in local currency to protect foreign reserves, according to the central bank. Basically, FX risk will be transferred from Turkish companies to the central bank, and is very similar to programs in place in Brazil and Mexico. President Erdogan has reignited tensions with Turkey’s central bank. He criticized the bank for its repeated revisions to its economic targets and for taking the “wrong path” to address rising inflation. Erdogan also railed against what he calls “the interest rate lobby.” In the past, Erdogan has blamed high inflation on high interest rates, which is a rather unorthodox view on monetary policy. ColombiaColombia’s fiscal rule may be adjusted by the next government. Leading presidential candidate German Vargas said he wants to make it more “flexible,” while also expanding the central bank’s mandate to include targets for growth and employment. Fitch noted that “If they keep on changing targets and change the rule, you might be able to kind of question a little bit the credibility in terms of fiscal policy, and that’s where it would be a negative.” Moody’s said “We think that a revision or an amendment of the fiscal rule is not credit negative, per se. |

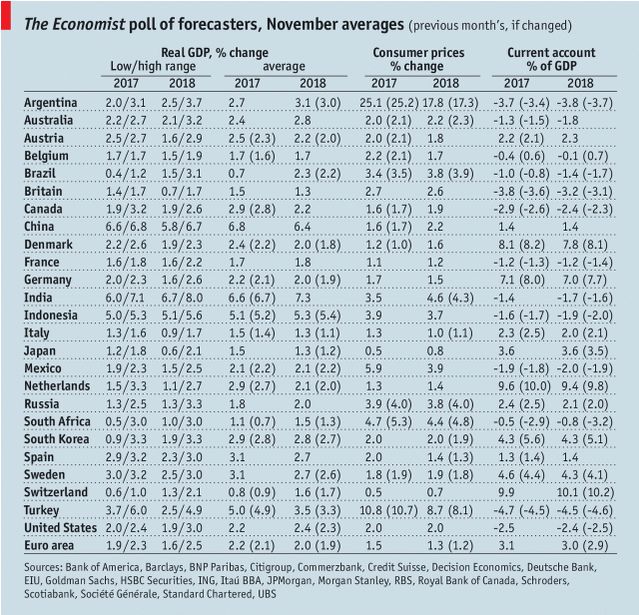

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, November 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newslettersent,win-thin