Standing In Your Way Governments across the planet will go to any length to meddle in the lives and private affairs of their citizens. This is what our experiences and observations have shown. What gives? For one, politicians have an aversion to freedom and liberty. They want to control your behavior, choices, and decisions. What’s more, they want to use your money to do so. As this by now famous cartoon...

Read More »Great Graphic: Is that a Potential Head and Shoulders Pattern in the Euro?

Summary The euro is breaking out to the upside. The measuring objective is near $1.2150, which is near the 50% retracement of the euro’s drop from the mid-2014 high. Key caveat: It is about the upper Bollinger Band and rate differentials make it the most expensive to hold since the late 1990s. The head and shoulders pattern in technical analysis is most commonly seen as a reversal pattern. As this Great...

Read More »Les banques centrales demandent aux banques commerciales de créer la monnaie. La preuve.

M Marc Luckx Ghisi, ancien conseiller de M Jacques Delors apporte la preuve que nous défendons depuis des années sur ce site: Les banques centrales ne créent pas de monnaie. Elles s’endettent auprès des banques commerciales! - Click to enlarge Cette entrée a été publiée dans Autres articles. Bookmarquez ce permalien. [embedded content] Related...

Read More »Les banques centrales demandent aux banques commerciales de créer la monnaie. La preuve. Vidéo Thinkerview

M Marc Luckx Ghisi, ancien conseiller de M Jacques Delors apporte la preuve que nous défendons depuis des années sur ce site: Les banques centrales ne créent pas de monnaie. Elles s’endettent auprès des banques commerciales! - Click to enlarge Cette entrée a été publiée dans Autres articles. Bookmarquez ce permalien. [embedded content] Related...

Read More »Where an average Swiss household spends its income

© Bigpressphoto | Dreamstime - Click to enlarge A recent report from Switzerland Federal Statistical Office shows how an average Swiss household spends its income. In 2015, the mean income was CHF 9,946 per month, including all forms of income and any 13th month payment received at the end of the year. This means an average Swiss household of 2.17 people had CHF 119,352 coming in across the year. According to the...

Read More »Ne conservez pas votre or dans une banque. Egon Von Greyerz

Ne détenez pas d’or dans une banque suisse ou dans n’importe quelle autre banque. Nous voyons régulièrement des exemples dans des banques suisses de taille moyenne et de grande taille qui devraient fortement inquiéter les clients. En voici quelques-uns : Un client entrepose de l’or physique dans une banque, mais lorsqu’il souhaite le transférer vers des coffres privés, l’or n’y est plus et la banque doit s’en...

Read More »Durable Goods Only About Halfway To Real Reflation

Durable goods were boosted for a second month by the after-effects of Harvey and Irma. New orders excluding those from transportation industries rose 8.5% year-over-year in October 2017, a slight acceleration from the 6.5% average of the four previous months. Shipments of durable goods (ex transportation) also rose by 8% last month. US Core Durable Goods Orders, Jan 1993 - Jan 2017(see more posts on U.S. Core Durable...

Read More »FX Daily Rates, November 24: Euro Continues to Push Higher

Swiss Franc The Euro has risen by 0.38% to 1.1674 CHF. EUR/CHF and USD/CHF, November 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro is edging higher to trade at its best levels since the middle of last month. It is drawing closer to the $1.1880 area, which if overcome, could point to return to the year’s high seen in early September near $1.2100. There is a...

Read More »Gold Versus Bitcoin: The Pro-Gold Argument Takes Shape

Gold versus Bitcoin: The pro-gold argument takes shape Why cryptocurrencies will not replace gold as a store of value Similarities between crypto and gold but that does not make them substitutes Gold remains a highly liquid market, cryptocurrencies continue to be fragmented and difficult to spend Bitcoin does not make it an effective hedge against stocks This weekend saw bitcoin shoot up over $8,000 and Bloomberg...

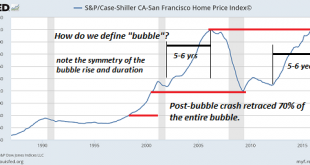

Read More »Beware the Marginal Buyer, Borrower and Renter

Bubbles always look unstoppable, yet they always burst.When times are good, the impact of the marginal buyer, borrower and renter on the market is often overlooked. By “marginal” I mean buyers, borrowers and renters who have to stretch their finances to the maximum to afford the purchase, loan or rent. In bubble manias, buyers of real estate reckon the potential appreciation gains are worth the risk of buying a house...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org