The Panama Papers, leaked from the Panamanian law firm Mossack Fonseca, revealed that 1,339 Swiss lawyers, financial advisors and other middlemen had set up more than 38,000 offshore entities over the past 40 years (Keystone) - Click to enlarge Switzerland must not go to war on its own against offshore tax havens in the wake of the Panama Papers scandal, the lower chamber of parliament has agreed. It prefers...

Read More »Retail Sales Bounce (Way) Too Much

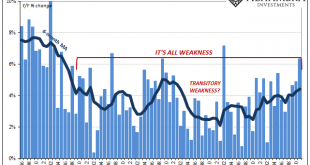

Retail sales had a good month of November, or at least what counts as decent over the last five and a half years. Total retail sales (unadjusted) rose 6.35% last month, up from 4.9% (revised higher) in October. It was the highest rate of growth since the 29-day month of February 2016. For retailers, what matters is that it comes at the start of the Christmas shopping season. The question is why, or more so why now?...

Read More »Swiss Trade Balance November 2017: Foreign Trade in Verve

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

Read More »Swiss National Bank acquires majority stake in Landqart AG

- Click to enlarge Production of new banknote series is safeguarded Yesterday, the Swiss National Bank (SNB) acquired 90% of the shares in Landqart AG. The remaining 10% of the share capital will be purchased by Orell Füssli Holding Ltd. The vendor is a subsidiary of Fortress Paper Ltd, which is listed on the Toronto stock exchange. At the same time, and at the same 90/10 split, the share capital in Landqart...

Read More »Bubble Watch: Warning Signs That The Everything Bubble Will Burst in 2018

I believe 2018 will be the year inflation arrives. The reason, as I’ve noted throughout mid-2017, is that multiple Central Banks, particularly the European Central Bank (ECB), Bank of Japan (BoJ) and Swiss National Bank (SNB) have maintained emergency levels of QE and money printing, despite the fact that globally the economy is performing relatively well. All told, in 2017 alone, these Central Banks will printed over...

Read More »Euro area: The sky is the limit

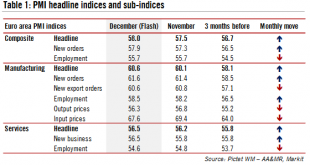

Momentum in the euro area picked up further at the end of the year. The flash composite purchasing managers’ index (PMI) increased to 58.0 in December, from 57.5 in November, above consensus expectations (57.2). The improvement was once again broad-based across sectors. Both the manufacturing (+0.5 to 60.6) and services (+0.3 to 56.5) indices improved in December, with the former reaching its highest level since the...

Read More »China tops export destination ranking for Swiss SMEs

Switzerland has a free trade agreement with China since 2014 (Keystone) - Click to enlarge A study commissioned by Switzerland Global Enterprise (SGE) indicates that China is the most attractive export destination for Swiss small and medium enterprises (SMEs). A total of 107 countries were evaluated using a set of 15 criteria that included market size, market potential, export volume and average market...

Read More »A Gold Guy’s View Of Crypto, Bitcoin, And Blockchain

Bitcoin was on my radar far back as 2011, but for years, I didn’t think much of it. It was a curiosity. Nothing more. Sort of like the virtual money you use in World of Warcraft or something. In 2015, looking deeper, I slowly (not the sharpest tool in the shed) arrived at that “aha” inflection point that most advocates of honest money arrive at. I realized that a distributed public ledger has the power to change, well,...

Read More »Bi-Weekly Economic Review: Animal Spirits Haunt The Market

The economic data over the last two weeks continued the better than expected trend. Some of the data was quite good and makes one wonder if maybe, just maybe, we are finally ready to break out of the economic doldrums. Is it possible that all that new normal, secular stagnation stuff was just a lack of animal spirits? Is it possible that the mere anticipation of tax cuts was sufficient to break us out of the 2% growth...

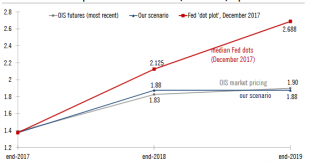

Read More »Fed’s enthusiasm on tax cut plans remains limited

The 13 December Fed decision – and Chair Yellen’s last press conference – was much as expected. The Fed hiked rates 25bps, bringing the interest rate on excess reserves to 1.5%. Meanwhile, Fed officials maintained their rate-hiking forecasts for next year: three rate increases, according to the ‘dot plot’. A salient take -away from the meeting was the Fed’s relative caution about Congress’s tax-cutting plan. Even...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org