It’s A Wonderful Life Is A Wonderful Lesson To Hold Gold Outside of The Banking System – Christmas film serves as reminder that savings are not guaranteed protection by banks – Savers are today more exposed to banking risks than ever before – Gold and silver investment reduce exposure to counterparty risks seen in financial system – Basket of Christmas goods has climbed since 2016 thanks to 11% climb in gold price...

Read More »Swiss court stops handover of bank employee details to US

Unlocked boxes: Swiss banking secrecy is not what it used to be. (Keystone) - Click to enlarge Switzerland’s highest court has ruled against the transfer of details of third parties such as bank employees or solicitors in cases of information handovers involving tax dodgers. Wednesday’s ruling by the Federal Court upheld an earlier decision in a case brought by a US expat in Switzerland who disputed the...

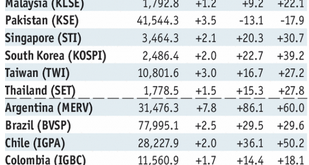

Read More »Emerging Markets: What Changed

Summary Tensions on the Korean peninsula appear to be easing. Relations between Pakistan and the US have worsened. The Philippine central bank is tilting more hawkish. The ANC may consider removing Zuma from the presidency at the January 10 meeting of its National Executive Committee. Turkish banker Atilla was convicted of helping Iran evade US financial sanctions. Argentina sold $9 bln of dollar-denominated external...

Read More »Why the Financial System Will Break: You Can’t “Normalize” Markets that Depend on Extreme Monetary Stimulus

Central banks are now trapped. In a nutshell, central banks are promising to “normalize” their monetary policy extremes in 2018. Nice, but there’s a problem: you can’t “normalize” markets that are now entirely dependent on extremes of monetary stimulus. Attempts to “normalize” will break the markets and the financial system. Let’s start with the core dynamic of the global economy and nosebleed-valuation markets:...

Read More »FX Daily, January 05: Dollar Given Reprieve Ahead of Employment Report

Swiss Franc The Euro has risen by 0.04% to 1.1753 CHF. EUR/CHF and USD/CHF, January 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates As the US dollar finished last year, so too did it begin the New Year, and after extending its losses, the bears have paused. Technical factors had been stretched, but it appears to have been old-fashioned macroeconomic considerations to...

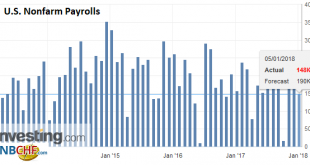

Read More »Headline US Jobs Disappoint, but Earnings as Expected

United States The headline US non-farm payrolls disappointed, rising by 148k instead of the consensus of 180k-200k. However, the other details were largely as expected and are unlikely to change views about the trajectory of Fed policy or the general direction of markets. It is a very much steady as she goes story. The headline miss is not really made up for by the upward revision in the November series from 228k to...

Read More »Fintech and fake cannabis drive record number of Swiss start-ups

Keen to ride the digital wave: Switzerland is attracting many fintech startups (Keystone) - Click to enlarge The year 2017 saw a record number of businesses created in Switzerland, many of them centred in the booming ‘crypto valley’ region, according to online platform startups.ch. Some 43,416 businesses were created, said the information and advisory websiteexternal link, an increase of 5% on 2016 and an...

Read More »Gold and Gold Stocks – Patterns, Cycles and Insider Activity, Part 2

Cycles and Sentiment Another recurring pattern consists of the seasonally strong period in gold around the turn of the year, which is bisected by a mid to late December interim low in the gold price. An additional boost can be expected in January and Feburary from the strong seasonal uptrend in silver and platinum group metals as well (to see the seasonal PGM charts, scroll down to our addendum to this recent article...

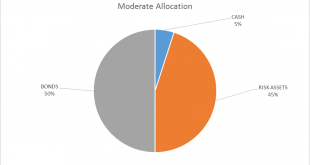

Read More »Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market persists so I will continue to hold a modest amount of cash. There are some minor changes within the portfolios but the overall allocation is unchanged. - Click to enlarge There have been two major developments since...

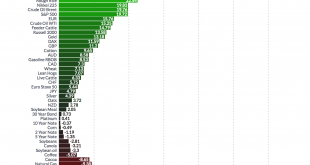

Read More »Gold Has Best Year Since 2010 With Near 14percent Gain In 2017

Gold Has Best Year Since 2010 With Near 14% Gain In 2017 – Gold posted second straight annual gain in USD in 2017– Gold in 2017: up 13.6% USD, up 2.7% GBP, down 1.4% EUR– 2017 is gold’s best year since 29.5% gain in 2010– Strong performance despite rate hikes and stock bubble – India’s gold imports surged 67% in 2017, Turkish, Chinese demand strong – Gold finished 2017 with longest rally since June 2016 – 2018:...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org