It’s A Wonderful Life Is A Wonderful Lesson To Hold Gold Outside of The Banking System – Christmas film serves as reminder that savings are not guaranteed protection by banks – Savers are today more exposed to banking risks than ever before – Gold and silver investment reduce exposure to counterparty risks seen in financial system – Basket of Christmas goods has climbed since 2016 thanks to 11% climb in gold price Frank Capra’s 1946 film It’s A Wonderful Life is one that many families will be settling down to watch this Christmas weekend. A story that is ultimately about a suicidal man is one of the most watched holiday films of all time. Interestingly it wasn’t all that big a hit upon its release (despite garnering

Topics:

Jan Skoyles considers the following as important: Featured, GoldCore, newsletter, Weekly Market Update

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| It’s A Wonderful Life Is A Wonderful Lesson To Hold Gold Outside of The Banking System

– Christmas film serves as reminder that savings are not guaranteed protection by banks Frank Capra’s 1946 film It’s A Wonderful Life is one that many families will be settling down to watch this Christmas weekend. A story that is ultimately about a suicidal man is one of the most watched holiday films of all time. Interestingly it wasn’t all that big a hit upon its release (despite garnering five Academy Award nominations) and was disliked by some of the highest intelligence authorities and political thinkers. Ayn Rand worked with the FBI to identify Hollywood Communist propaganda and helped them to conclude that the Christmas film contained several subversive tendencies, including “demonising bankers” and “attempting to instigate class warfare”, and was “written by Communist sympathisers”. ‘Demonising bankers’ is an interesting accusation and one that doesn’t have to come from an anti-communist perspective. In the 70-odd years since the film’s release there has been a growing level of evidence for bankers (and banks) to absolutely be demonised. There are some important lessons to be learnt from the film’s protagonist George Bailey. For us the main takeaway for cautious investors and savers is in reference to trusting banks and deposit companies with your hard earned cash. It is a lesson on how exposing your wealth to various counterparties is exposing it to an incalculable level of risk. Furthermore it should be a lesson on the importance of having savings and learning how best to protect them. “The money’s not here” A famous scene early on in the film sees James Stewart’s George Bailey confront a mob of customers who are demanding their money back from his Bailey Building and Loan community bank. It is implied that there is an larger economic crisis going on and Bailey’s savers are panicking about the security of their assets. Bailey tells them that they can’t have their money for at least two months. …you’re thinking of this place all wrong. Whilst Bailey’s bank is unlikely to operate using a fractional reserve system the lesson for depositors today is the same. At a simple level our banking structure and finances are deeply interwoven so when a bank, big or small, fails, lots of people will feel the pain. Viewers should pay attention to this quick lesson in economic fragility. It’s a Wonderful Life shows that the economy at both a national and international level can seemingly change from a healthy position to a dangerous and costly one based on the sort of collective, self-fulfilling beliefs that John Maynard Keynes called “animal spirits”. For those of you who have seen the scene of Bailey trying to prevent a run on his bank you will recall how similar his customers’ lack of understanding as to how a bank works is similar to the majority of those who use the banking system we have today. As we saw with the Northern Rock crisis depositors are convinced their money is sitting there in the safe. And, they are sure it is still ‘their’ money (it isn’t). Additionally they fail to question how the banks are able to distribute so much money, such as for mortgages or car loans. |

|

| Are the banks and their failures something we should be worried about?

Today a bank run looks quite different to the one we see in It’s A Wonderful Life. The sign of a bank run is usually indicated by a long line of people queuing at an item (as per Northern Rock). But, the fear is the same. The fear and threat of too much leverage in the system is still very real. The fear that one big loss could take down an entire bank and wipe out the life savings of many—is arguably even scarier than it was back in 1948. Bank failures today are far more serious than Depression-era failures. This is because so many banks are national and international entities, so intertwined with one another. The collapse of Washington Mutual in 2008, triggered by deposit withdrawals, was the largest failure in U.S. banking history. This year marked ten years since both the start of the financial crisis and the first bank run in the UK in 140 years. The Bank of England, UK government and regulators rushed to salvage what they could. It made little difference, the financial system was terminal. Afterwards then Bank of England Governor, Mervyn King, reflected:

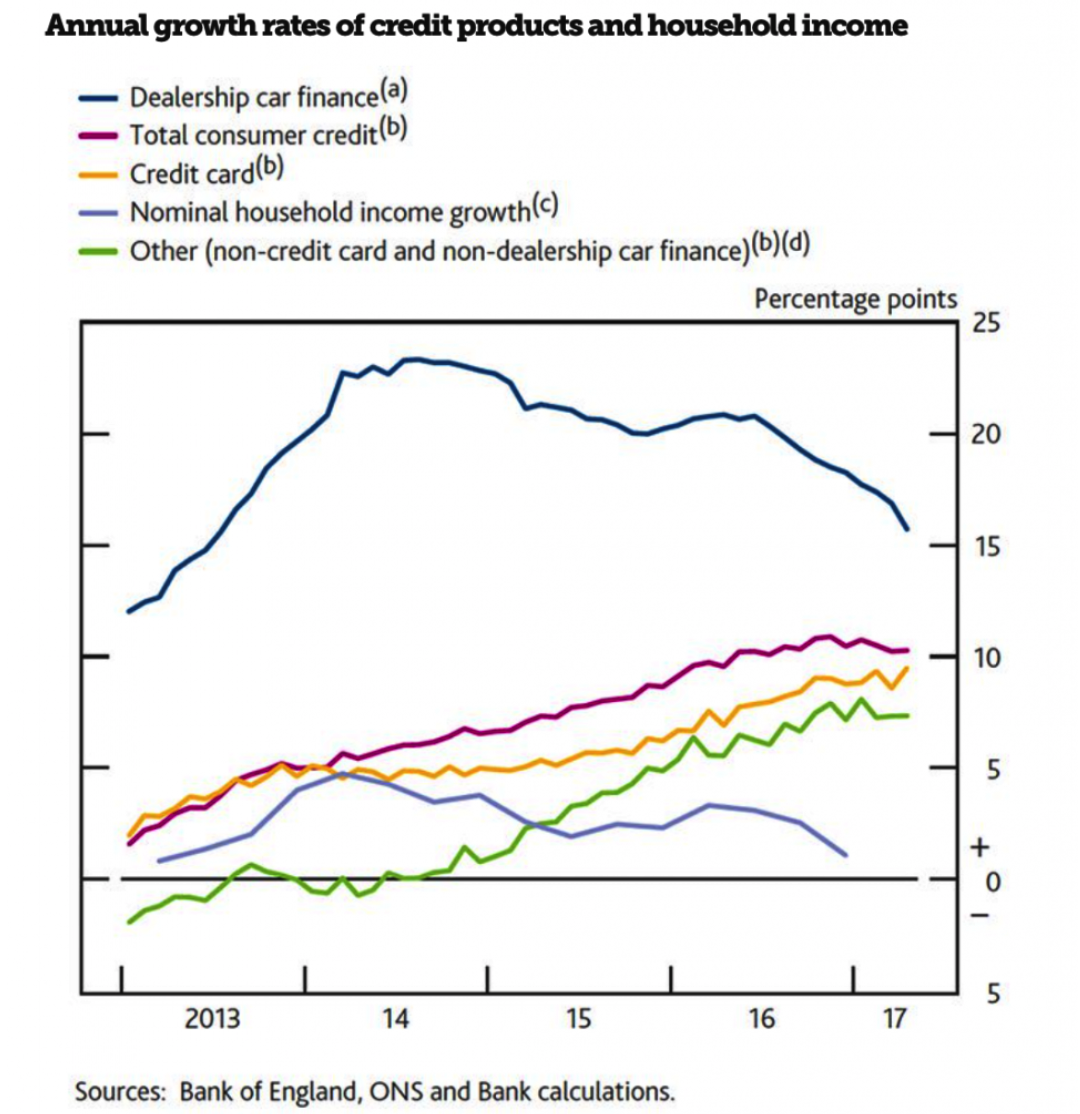

In a major critique of the stress tests carried out on UK banks Kevin Dowd, a professor of finance and economics at Durham University writes, “The stress tests are about as useful as a cancer test that cannot detect cancer. They seek to demonstrate a financial resilience on the part of UK banks that simply isn’t there…Our banking system is an accident waiting to happen..“It is disturbing that 10 years on from Northern Rock, the best measures of leverage – those based on market values – indicate that UK banks are even more leveraged than they were then,” Savers more exposed than ever Savers are exposed to the huge leverage in the system partly thanks to the huge pensions and debt time bombs that are just looking for a spark to light their short fuse. Currently in the UK savers are exposed to a £1 trillion debt time bomb hanging over the country. We are nearing the end of the timebomb’s long fuse and it looks set to explode in the coming months. It is made up of two major components.

Why is this? It’s because we apparently didn’t learn from the massive man made crisis that was the 2008 financial crisis. The ‘we’ is referring to UK individuals who are holding over £1.5 trillion of household debt. It refers to the pension fund managers who are ignoring the fact they hold more liabilities than assets. It refers to banks and mortgage and loan providers who give loans to people who are already indebted and who will struggle to pay the debt back. It refers to a compliant media who do not have ask hard questions about irresponsible lending practices and cheer lead property bubbles due to getting significant revenues from the banking and property sectors. And, ultimately the ‘we’ is the government who peddled such terrible monetary policy that it has brought us as close to nuclear financial disaster as we have been since 2008. |

Annual Growth Rates of Credit Products and Household Income, 2012 - 2017 |

| Risks from all sides for savers

Sadly it is not just struggling borrowers and pensioners who are exposing savers to increased risks and expense. 10 million savers here in the UK have been royally screwed over by a government announcement that they will be taxed on their savings. Buried deep in the 2017 Autumn budget is a a £1.8billion stealth tax raid, discovered by Royal London who explain:

Even if you don’t have one of the affected financial products you are still being screwed over by the banks. Interest rates in the UK have been increased to 0.5% in recent months. One would naturally expect to feel the benefit of this should they have savings. However, research by the Daily Mail’s money arm found that ‘hardly any savers in popular easy-access accounts or in easy-access cash Isas with Barclays, NatWest, RBS, Lloyds, HSBC, Halifax and Santander have benefited from the full rise.’ Many will experience just a sixth of the rate hike seen last month. What with the tax liability, inflation and negative real rates of interest it is of little question that savers are exposed to risks. The ECB doesn’t care too much about this though and is looking to use individuals’ savings to help prop up the banking system thanks to unprotected deposits and bank bail-ins. So it seems there is little savers can do rather than look out for number one. It’s a Wonderful Life or It’s a Horrible Mess? With best wishes I do hope you really do wake up to think that It’s a Wonderful Life. But beyond the Christmas cosiness of your own home it really is seemingly a Horrible Mess. According to the PNC’s calculations the true cost of the Twelve Days of Christmas basket climbed by 0.7% when (US) inflation-adjusted. The main culprits were the Pear Tree, the Lords-a-leaping and the Five Gold Rings. Of those three it was the Gold Rings which saw the biggest increase in price this last year thanks to gold climbing by over 11% in the last twelve months. This is something to take advantage of and to ensure that yours can be a Wonderful Life and not one of the holiday kind. Savers and prudent spenders can do very little about the current mess of things. All we can do is protect our own finances. This isn’t something to be done by rushing to the bank when things go wrong in the hope that you’ll be able to withdraw all of your money by some miracle. The level of debt in the financial system in the UK and most western countries is completely unsustainable. For the majority of savers this means personal finances and savings held in deposit accounts are at risk from banks’ over-leveraging. This in turn puts them at risk of bail-ins. Bank bail-ins and negative rates seem increasingly inevitable. Make sure your savings are not exposed to these risks by diversifying into counterparty risk free gold and silver coins and bars for insured delivery and secure storage. |

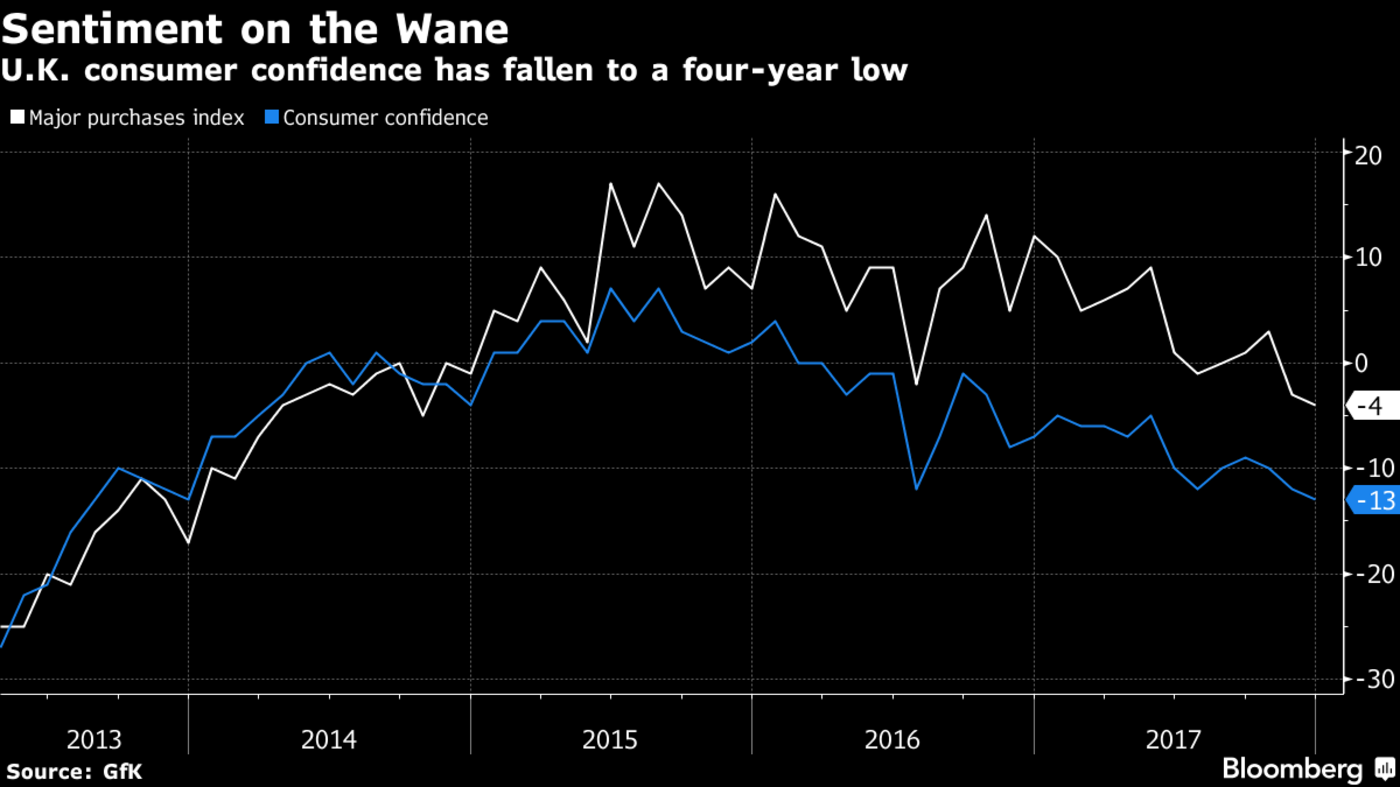

U.K. Consumer Confidence, 2013 - 2017(see more posts on U.K. GfK Consumer Confidence, ) |

Tags: Featured,newsletter,Weekly Market Update