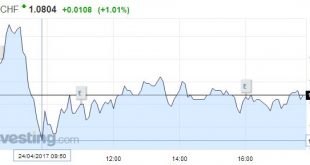

Swiss Franc EUR/CHF - Euro Swiss Franc, April 24(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The results of the first round of the French election spurred a dramatic response in the capital markets. Our thesisthat there is no populist-nationalist wave sweeping the world is supported by the previous results in Austria, the Netherlands, and now France. The AfD in Germany is wilting in the polls, and...

Read More »Credit Suisse Yearbook 2017: Low Interest Rates Hit Returns on Equities

The risk premiums on equities are unlikely to be as high in the future as they have been. This is the conclusion reached by the 2017 Yearbook published by Credit Suisse. In order to make statements regarding future market developments, it is worth taking a look at the past. Therefore, in the latest...

Read More »Great Graphic: Emerging Market Stocks

Summary: MSCI Emerging Market Index is up 12.25% here in Q1. The index is approaching long-standing technical objectives. Look for profit-taking ahead of quarter-end as fund managers rebalance. This Great Graphic from Bloomberg is a weekly bar chart of MSCI Emerging Market equity index. In H2 15 and H1 16, it carved out a head and shoulders bottom that we identify on the chart. We also drew in the neckline...

Read More »FX Daily, February 27: Asia Stumbles, Europe Recovers, Waiting for Trump

Swiss Franc EUR/CHF - Euro Swiss Franc, February 27(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The late recovery in US equities before the weekend did little good for Asian markets. Nearly all the Asian equity markets moved lower, led by the 1.0% decline in Japan’s Topix. It was the third successive loss for the Topix, which is the long losing streak of the year so far. The MSCI Asia Pacific Index...

Read More »FX Daily, February 20: Marking Time on Monday

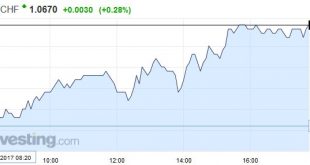

Swiss Franc EUR/CHF - Euro Swiss Franc, February 20(see more posts on EUR/CHF, ) - Click to enlarge FX Rates US markets are closed for the Presidents’ Day holiday, but it hasn’t prevented its pre-weekend gains giving a bullish tone to global equities. The S&P 500 and NASDAQ recovered from early weakness to close at new record levels before the weekend. Global equity markets are following suit today. The...

Read More »FX Daily, November 10: US Dollar, Equities, and Commodities Firmer as Reflation Trade Takes Hold

Comment on GBP and CHF by Matt Vassallo My articles About meMy booksFollow on: Swiss Franc EUR/CHF - Euro Swiss Franc, November 10(see more posts on EUR/CHF, ). - Click to enlarge GBP/CHF rates spiked by almost two cents during Wednesday’s trading, providing those clients holding Sterling with some of the best rates they’ve seen in the past few weeks. This move came following confirmation that Donald...

Read More »Emerging Equities Outshine Developed Markets

In the years before the 2008 financial crisis, investors flocked to equities in fast-growing emerging economies. But when the crisis put the brakes on global growth, that attraction to emerging markets proved a fickle one, and investors sought safe haven in less risky investments. In late 2016, however, the pendulum is swinging back again, with investors citing several reasons for renewed confidence in emerging market equities. Among the most surprising? Their politics are relatively more...

Read More »Growth, Value, and Dividend Aristocrats

There are numerous reasons to be optimistic about global equities in the coming year. Capital is plentiful; central banks in Europe, the United Kingdom, and some Asian economies have an easing bias; and the equity strategists on Credit Suisse’s Global Markets team believe the equity risk premium is higher than warranted. But there are risks, too, including heightened political risk, slowing Chinese growth, and threats to existing business models from technological disruption and Chinese...

Read More »What to Make of the Japanese Market

What’s next for Japanese corporate earnings? Well, that depends. Consider the April-to-June Japanese earnings season, which can be considered a pleasant surprise or a bleak portend based on which numbers you choose to accentuate. Where you stand on Japan depends on where you sit. The quarter was a winner in terms of performance relative to past expectations. Japanese companies beat consensus estimates for both operating and net profits by 11 percent, and twice as many companies beat...

Read More »Optimism for Equities

Global equities have had quite the comeback since the Brexit referendum. After plummeting more than 5 percent in the two trading days following the surprise “Leave” result of the June 23 referendum, the S&P 500 took just ten days to reach a new all-time high. The Euro Stoxx 50 and MSCI All-Country World Index have likewise climbed, with both up more than 10 percent from their post-Brexit troughs. Can the rally continue? Equity strategists on Credit Suisse’s Global Markets team...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org