What central banks do – and how their policies diverge from one another – will continue to drive financial markets in 2016, impacting fixed income markets and creating opportunities for equity investors in places where policy is easing, according to the 2016 Investment Outlook from Credit Suisse’s Private Bank. The Federal Reserve seems almost certain to raise interest rates for the first time since 2006 in December – and, Credit Suisse believes it will raise them three more times in 2016....

Read More »US Equities: Will Volatility Persist?

It’s no secret that one of the best ways to be successful when investing in capital markets is to buy when everyone else is selling. But that doesn’t make it any easier, especially when market turbulence is coming from several sources at once. Already on edge as a result of China’s surprise devaluation in August and a potential rate hike by the Federal Reserve, investors have had to figure out how to navigate financial markets amid high levels of both volatility and uncertainty. Watch an...

Read More »The markets’ pole star is fading

Published: 11th November 2015 Download issue: Since 2009, major central banks such as the US Federal Reserve, the European Central Bank (ECB), the Bank of Japan (BoJ) and others have largely determined the trends in the major asset classes of both emerging and developed countries: equities, sovereign and corporate bonds, and currencies. Investors found their guiding light in the central banks. Markets are once again likely to find themselves under their influence in 2016, but without as...

Read More »Digging through the Rubble of the Rout

A selloff as violent as the one global equities markets experienced this past Monday can have effects that mirror a real-life earthquake. Once the earth stops moving, shell-shocked investors have to figure out what caused all the shaking and whether aftershocks are coming. They also have to determine whether anything valuable is hiding in the debris. To the first point, it’s quite clear that trouble in China was the catalyst for the rout. It all started on Friday, August 21, when...

Read More »A Revenue Recession Points to More M&A Ahead

As the second-quarter earnings season draws to a close in the United States, with 89 percent of companies in the S&P 500 having announced quarterly results, there’s both good and bad news to report. Sugar first: Seventy-four percent of companies beat consensus estimates, slightly better than the 10-year average of 70 percent. The outlook for the future is getting rosier, too. The consensus forecast for 12-month forward earnings growth is now 7.2 percent, up from 5.2 percent at the...

Read More »Bad for China, Good for European Stocks

For the three months leading into August, the Chinese government had kept the yuan-dollar exchange rate fixed in a tight range around 6.115 yuan to the dollar. Yet the yuan’s spot price consistently traded about 1.4 percent weaker than the fix. Investors, in other words, sensed a devaluation coming. In mid-August, Chinese officials proved them right by intervening in currency markets for three days in a row, prompting a 3 percent drop in the value of the yuan. An 8 percent decline in...

Read More »Swiss National Bank: Composition of Reserves and Investment Strategy

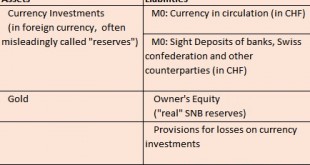

We regularly publish the SNB asset structure by currency, rating & duration and the investment strategy. They shall be a template for the tactical asset allocation along these dimensions for other conservative asset managers – CHF holdings certainly excluded because the SNB nearly exclusively buys foreign assets. The SNB balance sheet looks as follows: In this post we will concentrate on the assets side, investment strategy and composition of “FX reserves”.See more on liabilities...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org