Swiss Franc The Euro has risen by 0.41% to 1.1566 CHF. EUR/CHF and USD/CHF, February 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After the dramatic fall in US equities, Asian equities followed suit. The MSCI Asia Pacific Index fell 3.4% following Monday’s slide of 1.7%. European bourses gapped lower and spent most of the morning moving higher, though large gaps...

Read More »Great Graphic: European Equities Lead Move

Summary: European equities peaked earlier and have fallen the furthest. MSCI EM equities faring the best, and as of now, they are still up on the year. MSCI Asia Pacific fell 3.4% today and is now down 0.33% for the year. This Great Graphic was composed on Bloomberg. It shows four stock indices’ performance since the start of the year. It is indexed so that each index started the year at 100. The yellow line...

Read More »FX Daily, February 05: Dollar Consolidates while Equity Rout may be Ebbing

Swiss Franc The Euro has risen by 0.19% to 1.1622 CHF. EUR/CHF and USD/CHF, February 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Asian equity markets were weighed down by losses in the US markets ahead of the weekend. The MSCI Asia Pacific Index was off 1.4% after the 1.0% pre-weekend loss. The Nikkei gapped lower and shed 2.5% and has fallen in eight of the past...

Read More »FX Weekly Preview: Changing Fortunes in the Capital Markets or Long Overdue Correction?

The chief development in the capital markets has been the sharp drop in equities after a significant rally since late last year and the rise in yields. The dollar had fallen alongside the exuberant appetite for risk assets. Anecdotal evidence supports the idea that the greenback was used as a funding currency to purchase those risk assets. The Dollar Index’s first weekly advance since the middle of last December amid...

Read More »FX Daily, November 22: Global Equity Rally Resumes, while Dollar Slips

Swiss Franc The Euro has fallen by 0.32% to 1.1599 CHF. EUR/CHF and USD/CHF, November 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Global equities are on the march. US indices shrugged off their first back-to-back weekly decline in three months to set new record highs yesterday. The MSCI Asia-Pacific followed suit and recorded their highest close. The Dow Jones...

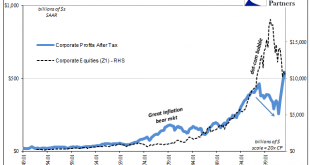

Read More »The Two Parts of Bubbles

What makes a stock bubble is really two parts. Most people might think those two parts are money and mania, but actually money supply plays no direct role. Perceptions about money do, even if mistaken as to what really takes place monetarily from time to time. In fact, for a bubble that would make sense; people are betting in stocks on one monetary view that isn’t real, and therefore prices don’t match what’s really...

Read More »Great Graphic: Small Caps and the Trump Trade

The Russell 2000, which tracks the 2000 smallest companies in the Russell 3000, is threatening to turn positive for the year. It had turned negative in the second half of last week. Many pundits saw its decline and the penetration of the 200-day moving average for the first time in over a year as a sign of an impending down move in the broader equity market. Given valuation, and the number of big name asset managers and...

Read More »FX Daily, August 14: Sigh of Relief Weighs on Yen and Gold, while Lifting Equities and the Dollar

Swiss Franc The Euro has risen by 0.64% to 1.1425 CHF. EUR/CHF and USD/CHF, August 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The lack of new antagonisms over the weekend between the US and North Korea has prompted the markets to react accordingly. Already before the weekend, we detected some signs that at least some market participants had begun looking past...

Read More »FX Daily, July 28: Dollar and Equities Closing Week on Heavy Note

Swiss Franc The franc is off another 0.5% today, to bring its weekly loss to a sharp 2.5%. EUR/CHF and USD/CHF, July 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is mostly lower, though one of the features of recent days has been the dramatic slide of the Swiss franc, and that is continuing today. The euro finished last week near CHF1.1030 and is now...

Read More »Great Graphic: Surprise-S&P 500 Outperforming the Dow Jones Stoxx 600

Many asset managers have been bullish European shares this year. European and emerging market equities are among the favorite plays this year. Surveys of fund managers find that the allocation to US equities is among the lowest in nearly a decade. The case against the US is based on overvaluation and being a crowded trade. Many are concerned about too hawkish of a Federal Reserve (policy mistake) or the lack of tax...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org