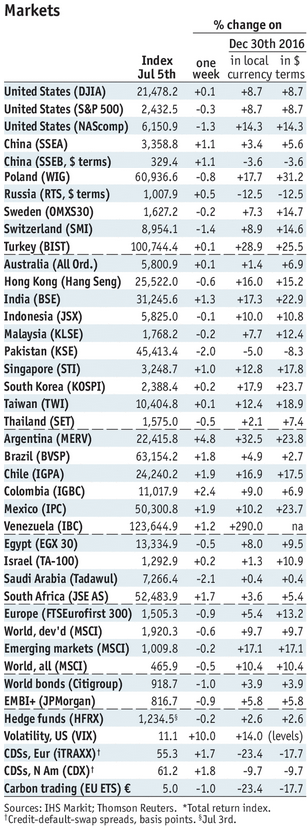

Stock Markets EM FX ended the week on a firm note, helped by softer than expected US data. Indeed, EM FX was up across the board for the entire week and was led by BRL, MXN, and ZAR. The ECB meeting this week will draw some interest, especially after the BOC last week became the second major central bank to hike rates. Stock Markets Emerging Markets, July 05 Source: economist.com - Click to enlarge Hungary National Bank of Hungary meets Tuesday and is expected to keep policy steady. The bank has been loosening policy quarterly via unconventional measures, which it just did at its June meeting. Further easing is possible at the September meeting. CPI rose only 1.9% y/y in June, the lowest since December and

Topics:

Win Thin considers the following as important: emerging markets, Featured, newslettersent, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Stock MarketsEM FX ended the week on a firm note, helped by softer than expected US data. Indeed, EM FX was up across the board for the entire week and was led by BRL, MXN, and ZAR. The ECB meeting this week will draw some interest, especially after the BOC last week became the second major central bank to hike rates. |

Stock Markets Emerging Markets, July 05 Source: economist.com - Click to enlarge |

HungaryNational Bank of Hungary meets Tuesday and is expected to keep policy steady. The bank has been loosening policy quarterly via unconventional measures, which it just did at its June meeting. Further easing is possible at the September meeting. CPI rose only 1.9% y/y in June, the lowest since December and below the 2-4% target range.

MalaysiaMalaysia reports June CPI Wednesday, which is expected to rise 3.8% y/y vs. 3.9% in May. Although the central bank does not have an explicit inflation target, falling price pressures should allow it to keep rates steady into 2018.

South AfricaSouth Africa reports June CPI Wednesday, which is expected to rise 5.2% y/y vs. 5.4% in May. If so, this would be the lowest rate since November 2015 and would remain in the 3-6% target range. SARB then meets Thursday and is expected to keep rates steady at 7.0%. However, we think the weak economy will lead the bank to start an easing cycle in H2 2017. That leaves September 21 and November 23.

PolandPoland reports June industrial and construction output, real retail sales, and PPI Wednesday. Consensus for y/y readings are 3.9%, 9.8%, 6.0%, and 2.1%, respectively. The economy remains robust, but price pressures are falling and so there is no urgency to hike rates. CPI rose only 1.5% y/y in June, the lowest since December and at the bottom of the 1.5-3.5% target range.

TaiwanTaiwan reports June export orders Thursday. Exports and export orders have slowed a bit in recent months and so bears watching. The mainland economy appears to be holding up well, which should be reflected in Taiwan data.

IndonesiaBank Indonesia meets Thursday and is expected to keep rates steady at 4.75%. CPI rose 4.4% y/y in June, above the 4% target but still in the 3-5% target range. While the bank signaled the end of the easing cycle after its last 25 bp cut in October, we think a tightening cycle is still some ways off.

BrazilBrazil reports mid-July IPCA inflation Thursday, which is expected to rise 2.84% y/y vs. 3.52% in mid-June. If so, this is further below the 4.5% target and even below the 3-6% target range. Next COPOM meeting is July 26, and markets are leaning towards another 100 bp cut to 9.25%. Brazil then reports June current account and FDI data Friday.

KoreaKorea reports trade data for the first 20 days of July Friday. This will be the first glimpse of global activity in H2. China appears to be starting off the second half on a firm note, which should help boost regional growth.

|

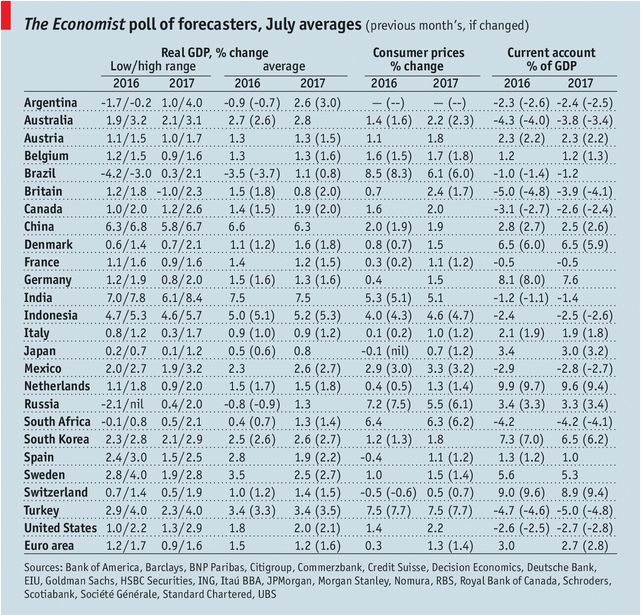

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, July 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newslettersent,win-thin