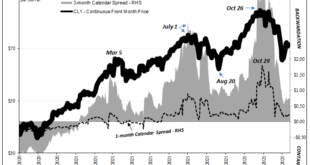

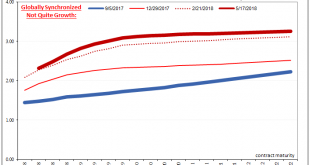

That was fast. Just yesterday I said watch out for when the oil curve flips from backwardation to contango. When it does, that’s not a good sign. Generally speaking, it means something has changed with regard to future expectations, at least one of demand, supply, or also money/liquidity. Contango is a projected imbalance which leaves the global system facing realistic prospects of being overwhelmed with too much oil. Back during 2014’s crude crash, Economists and...

Read More »Testing The Supply Chain Inflation Hypothesis The Real Money Way

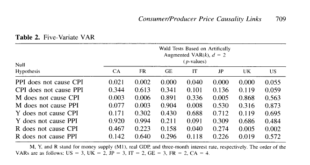

Basic intuition says this is a no-brainer. Producer prices rise, businesses then pass along these higher input costs to their customers in the form of consumer price “inflation” so as to preserve profits. This is the supply chain hypothesis. Statistically, we’d therefore expect the PPI to lead the CPI. And this was expected for much of Economics’ history, taken for granted as one of those self-evident truths (kind of like the Inflation Fairy). After the dreadful...

Read More »The FOMC Chases The US Unemployment Rate Regardless of China’s Huge Mess

In certain quarters, “scientific” quarters, the Chinese haven’t just done a fantastic job managing their own outbreak of COVID-19, the Communist government has produced a pandemic response model for the entire world to envy. After all, according to the WHO’s most recent data (up to December 15, 2021), only 5,697 of the nation’s citizens have died of (with?) corona since the whole thing began. Outside the WHO and partisan political circles, of course, no one believes...

Read More »Trying To Project The Goods Trade Cycle

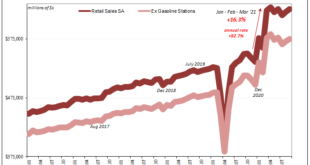

One quick note on yesterday’s retail sales estimates in the US for the month of November 2021. The increase for them was less than had been expected, but these were hardly awful by any rational measure. Instead, they seemed to further indicate only what we had proposed upon release of the October estimates: Christmas shopping came a bit early for more shoppers than otherwise. Not terribly dramatic by any means, yet noticeable. Even the “real” series adjusted for,...

Read More »Weekly Market Pulse: Has Inflation Peaked?

The headlines last Friday were ominous: Inflation Hits Highest Level in Nearly 40 Years Inflation is Painfully High… Groceries and Christmas Presents Are Going To Cost More Inflation is Soaring.. America’s Inflation Burst This morning on Face The Nation, Mohamed El-Erian, former Harvard endowment manager, former bond king apprentice, economist and the man who seems to have a permanent presence on CNBC, had this to say: The characterization of inflation as transitory...

Read More »A Global JOLT(s) In July

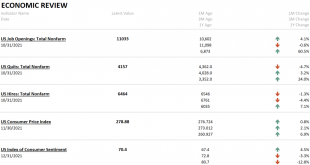

The Bureau Labor Statistics reported today another huge month for Job Openings (JO). According to their methodology (which I still believe is flawed, but that’s not our focus this time), the level for October 2021 (JOLTS updates are for one month further back than payrolls) was a blistering 11.03 million. It wasn’t a record high, though, as that was set back in July. Yes, the number remains upward in the stratosphere, but it has been in the same general area of it...

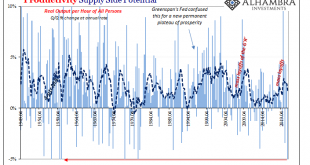

Read More »The Productive Use Of Awful Q3 Productivity Estimates Highlights Even More ‘Growth Scare’ Potential

What was it that old Iowa cornfield movie said? If you build it, he will come. Well, this isn’t quite that, rather something more along the lines of: if you reopen it, some will come back to work. Not nearly as snappy, far less likely to sell anyone movie tickets, yet this other tagline might contribute much to our understanding of “growth scare” and its affect on the US labor market. This topic deserves a much deeper dive than I am going to give it (for now). What...

Read More »Weekly Market Pulse: Discounting The Future

The economic news recently has been better than expected and in most cases just pretty darn good. That isn’t true on a global basis as Europe continues to experience a pretty sluggish recovery from COVID. And China is busy shooting itself in the foot as Xi pursues the re-Maoing of Chinese society, damn the economic costs. But here in the US, the rebound from the Q3 slowdown is in full bloom. Just last week we had pending home sales, ADP employment, both ISM reports,...

Read More »This Is A Big One (no, it’s not clickbait)

Stop me if you’ve heard this before: dollar up for reasons no one can explain; yield curve flattening dramatically resisting the BOND ROUT!!! everyone has said is inevitable; a very hawkish Fed increasingly certain about inflation risks; then, the eurodollar curve inverts which blasts Jay Powell’s dreamland in favor of the proper interpretation, deflation, of those first two. Twenty-eighteen, right? Yes. And also today. Quirky and kinky, it doesn’t seem like a lot,...

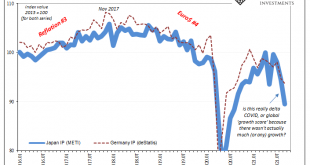

Read More »The ‘Growth Scare’ Keeps Growing Out Of The Macro (Money) Illusion

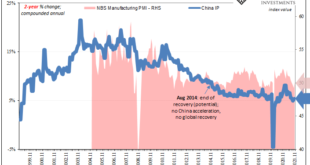

When Japan’s Ministry of Trade, Economy, and Industry (METI) reported earlier in November that Japanese Industrial Production (IP) had plunged again during the month of September 2021, it was so easy to just dismiss the decline as a product of delta COVID. According to these figures, industrial output fell an unsightly 5.4%…from August 2021, meaning month-over-month not year-over-year. Altogether, IP in Japan is down just over 10% since June, nearly 11% since...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org