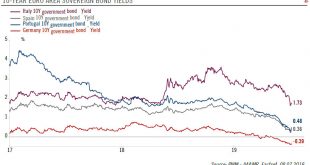

Prospects of more ECB easing has contributed to an across-the-board rally in euro sovereign bonds yields and could help limit volatility in peripheral bonds.Since Mario Draghi in June signalled the European Central Bank’s (ECB) readiness to embark on more easing should the euro area economy fail to regain speed, euro sovereign bonds yields have fallen across the board, with the 10-year Bund yield briefly moving below -0.4% (the same level as the deposit rate) in intraday trading on July 4.We...

Read More »The ECB moves to keep euro bond yields down

Prospects of more ECB easing has contributed to an across-the-board rally in euro sovereign bonds yields and could help limit volatility in peripheral bonds. Since Mario Draghi in June signalled the European Central Bank’s (ECB) readiness to embark on more easing should the euro area economy fail to regain speed, euro sovereign bonds yields have fallen across the board, with the 10-year Bund yield briefly moving below...

Read More »FX Weekly Preview: In Bizzaro Beauty Contest, the US is Still the Least Ugly

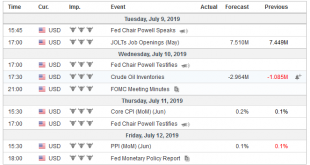

Our hypothesis that the market had reached peak dovishness toward the Fed remains intact after the employment data. Job growth was the strongest since January. The participation rate and the unemployment rate ticked up. Average hourly earnings edged 0.2% higher, and, with revisions, maintained a 3.1% year-over-year pace, which is a bit disappointing. United States The jobs report trumps the PMI/ISM data and suggests...

Read More »FX Daily, July 03: Yields Extend Decline

Swiss Franc The Euro has fallen by 0.05% at 1.112 EUR/CHF and USD/CHF, July 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Interest rates are lurching lower. The US 10-year yield is at new two-year lows, but the driver is European bonds where peripheral yields are 6-7 bp lower, though Italy’s benchmark is off 12 bp, while core yields are down 2-3 bp to new...

Read More »FX Daily, June 19: Still Patient?

Swiss Franc The Euro has fallen by 0.21% at 1.1169 EUR/CHF and USD/CHF, June 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Risk-taking was bolstered by the dramatic shift in Draghi’s rhetoric less than two weeks after the ECB meeting and a Trump’s tweet announcing that there was going to be an “extended” meeting between him and Xi at the G20 meeting and that...

Read More »FX Daily, June 18: Draghi Ends Calm Ahead of FOMC, Sending the Euro and Yields Down

Swiss Franc The Euro has fallen by 0.08% at 1.1196 EUR/CHF and USD/CHF, June 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: ECB President Draghi underscoring the likely need for more stimulus broke the subdued tone as market participants took a “wait and see” stance ahead of tomorrow’s FOMC decision. Draghi’s comments sent the euro through $1.12 for the first...

Read More »FX Daily, June 6: US Tariff Threats on Mexico Compete with ECB for Attention

Swiss Franc The Euro has risen by 0.18% at 1.1178 EUR/CHF and USD/CHF, June 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The implications of President Trump’s assessment that there has not been “nearly enough” progress in negotiations with Mexico that would avert the tariff on June 10 competing for investors’ attention, which had been squarely today’s ECB...

Read More »FX Daily, June 04: Nervous Calm Settles Over Markets

Swiss Franc The Euro has risen by 0.13% at 1.117 EUR/CHF and USD/CHF, June 04(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are stabilizing today after taking a body blow of broadening the use of US tariffs (in migration dispute with Mexico), threatening the ratification of NAFTA 2.0, and still escalating hostile rhetoric between...

Read More »FX Weekly Preview: Curiouser and Curiouser

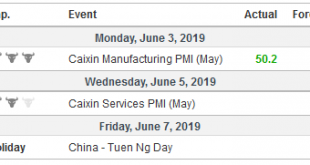

The first week of June features the Reserve Bank of Australia meeting, an ECB meeting, and the US employment data. The RBA is expected to deliver its first rate cut in three years. The market appears to have discounted not only a second cut in H2 but has priced nearly half of a third cut as well. A soft inflation reading after the seasonal bump in April and disappointing survey data, with Brexit and trade tensions,...

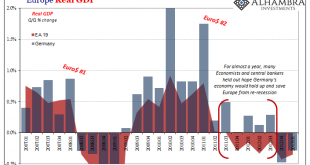

Read More »What’s Germany’s GDP Without Factories

It was a startling statement for the time. Mario Draghi had only been on the job as President of the European Central Bank for a few months by then, taking over for the hapless Jean Claude-Trichet who was unceremoniously retired at the end of October 2011 amidst “unexpected” chaos and turmoil. It was Trichet who contributed much to the tumult, having idiotically raised rates (twice) during 2011 even as warning signs of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org