- Click to enlarge 1. As soon as it was clear that the ECB was not easing today, the euro began to recover, after making a marginal new low for the year (just above $1.11). 2. Draghi made it clear that easing was going to be delivered in September and on several fronts including rates (with mitigating measures like tiering) and new asset purchases (not decided on instruments, which plays into speculation of equity...

Read More »FX Daily, July 26: Markets Consolidate as the Dollar Index Extends its Advance for the Sixth Consecutive Session

Swiss Franc The Euro has risen by 0.13% at 1.1056 EUR/CHF and USD/CHF, July 26(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors are happy for the weekend. Between the ECB, Brexit, and next week’s FOMC, BOJ, and BOE meetings, the markets are mostly in a consolidative mode ahead of the weekend. The first look at Q2 US GDP is the last important data...

Read More »FX Daily, July 25: ECB Takes Center Stage

Swiss Franc The Euro has risen by 0.71% at 1.1045 EUR/CHF and USD/CHF, July 25(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The euro remains stuck in its trough below $1.1150 ahead of the ECB meeting. The US dollar is firmer against most of the major currencies. The yen continues to resist the draw of the greenback. Most emerging market currencies are...

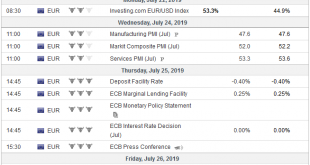

Read More »FX Daily, July 24: Poor PMI Weighs on Euro Ahead of ECB

Swiss Franc The Euro has fallen by 0.17% at 1.0966 EUR/CHF and USD/CHF, July 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Disappointing flash PMI pushed an already offered euro lower ahead of tomorrow’s ECB meeting. European bonds rallied and equities, amid a rash of earnings, is trying to extend the advance for a fourth consecutive session. Italian and...

Read More »FX Daily, July 23: Debt Deal Help Lifts the Dollar

Swiss Franc The Euro has fallen by 0.32% at 1.097 EUR/CHF and USD/CHF, July 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The gains in US equities and the apparent US budget agreement has underpinned equities today and the US dollar. Asia Pacific equities recouped yesterday’s losses, and Europe’s Dow Jones Stoxx is posting gains for the third consecutive...

Read More »FX Daily, July 22: Greenback is Mostly Firmer to Start New Week, while the Euro is Pinned near $1.12

Swiss Franc The Euro has fallen by 0.03% at 1.1007 EUR/CHF and USD/CHF, July 22(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: What promises to be an eventful two weeks has begun quietly. The ECB, Fed, BOJ, and BOE will meet over the next fortnight. The central banks of Turkey and Russia meet this week and are expected to cut rates. The UK will have a new...

Read More »FX Weekly Preview: Highlights in the Week Ahead

Three events that will capture the market’s attention next week: The consequences of the Japanese election, the first look at US Q1 GDP, and the ECB meeting. The central banks of Turkey and Russia also meet. Both are expected to cut interest rates, following rate cuts in the middle of last week by South Korea, Indonesia, and South Africa. Japan goes to the polls on July 21 to elect the upper chamber of the Diet. There...

Read More »The ECB is preparing for delivery

After Draghi’s shift in Sintra, we still see the ECB rate cuts as a starter and a first step before the implementation of a broader policy package.We expect the European Central Bank (ECB) to prepare markets for the delivery of fresh monetary stimulus following Mario Draghi’s unequivocal signal in Sintra. An adjustment to forward guidance is the most natural path for the ECB to take, by signalling that policy rates will remain at present levels “or lower”, paving the way for a 10 bp deposit...

Read More »FX Weekly Preview: What to Watch if Fed and ECB are Committed to Easing

There is little doubt after the Federal Reserve Chairman Powell’s testimony last week and the FOMC minutes that a rate cut will be delivered at the end of the month. Similarly, after comments by several ECB officials and the record of their recent meetin.g confirms it too is prepared to adjust policy. The timing of the ECB’s move is more debatable, an adjustment at the July 25 meeting appears to have increased. While a...

Read More »FX Daily, July 11: Powell Spurs Equity and Bond Market Rally, While the Greenback Falls Out of Favor

Swiss Franc The Euro has fallen by 0.06% at 1.1123 EUR/CHF and USD/CHF, July 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Fed’s Powell confirmed a Fed rate cut at the end of this month by warning that uncertainties since the June FOMC had “dimmed the outlook” and that muted price pressures may be more persistent. It ignited an equity and bond market rally...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org