As France’s Finance Minister, Christine Lagarde objected strenuously to Ben Bernanke’s second act. Hinted at in August 2010, QE2 was finally unleashed in November to global condemnation. Where “trade wars” fill media pages today, “currency wars” did back then. The Americans were undertaking beggar-thy-neighbor policies to unfairly weaken the dollar. The neighbor everyone though most likely to be sponged off of was Europe. The day after the Fed’s second launch,...

Read More »European Economy: A Time Recession

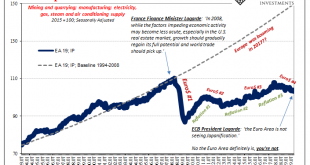

Eurostat confirmed earlier today that Europe has so far avoided recession. At least, it hasn’t experienced what Economists call a cyclical peak. During the third quarter of 2019, Real GDP expanded by a thoroughly unimpressive +0.235% (Q/Q). This was a slight acceleration from a revised +0.185% the quarter before. The real question, though, is whether the business cycle approach means anything in this day and age. I don’t think it does, and that’s a big part of why...

Read More »More Signals Of The Downturn, Globally Synchronized

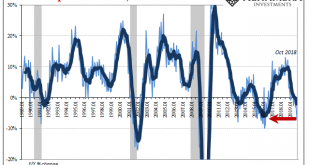

For US importers, October is their month. And it makes perfect sense how it would be. With the Christmas season about to kick into full swing each and every November, the time for retailers to stock up in hearty anticipation is in the weeks beforehand. The goods, a good many future Christmas presents, find themselves in transit from all over the world during the month of October. For the Census Bureau’s trade data, that means this is the month that shines above...

Read More »Monthly Macro Monitor: Market Indicators Review

Is the recession scare over? Can we all come out from under our desks now? The market based economic indicators I follow have improved since my last update two months ago. The 10 year Treasury rate has moved 40 basis points off its low. Real interest rates have moved up as well but not quite as much. The difference is reflected in slightly higher inflation expectations. The yield curve has also steepened as the 10 year Treasury yield rose faster than the 2 year. This...

Read More »Bitcoin Myths, Report 27 Oct

Keith gave a keynote address—the only speaker with an hour to cover his topic—at the Gold and Alternative Investments Conference in Sydney on Saturday. Said topic was the nature of money. “Money is a matter of functions four: a medium, a measure, a standard, a store.” Most of the talk was structured around discussing these functions. Medium is pretty obvious: the dollar is the universal medium of exchange. It is basically frictionless, trading at zero spread (with...

Read More »Dollar (In) Demand

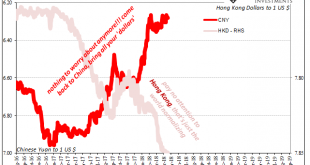

The last time was bad, no getting around it. From the end of 2014 until the first months of 2016, the Chinese economy was in a perilous state. Dramatic weakness had emerged which had seemed impossible to reconcile with conventions about the country. Committed to growth over everything, and I mean everything, China was the one country the world thought it could count on for being immune to the widespread economic sickness. That’s why in early 2016 authorities...

Read More »Warum der Dollar der Welt nicht guttut

Der britische Notenbankchef sagt, der US-Dollar müsse ersetzt werden – durch eine digitale Weltwährung. «Der globale Finanzzyklus ist in Wahrheit ein Dollarzyklus»: Mark Carney, Gouverneur der Bank of England. Foto: Keystone Am diesjährigen Notenbank-Symposium im amerikanischen Jackson Hole ist der Dollar in die Kritik geraten. Mehrere Beiträge entlarvten die Weltwährung als wichtigen Risikofaktor für die Weltwirtschaft. Prominentester Kritiker ist der Gouverneur der...

Read More »Oh Inflation, du Knacknuss!

Monatlicher Erklärungsbedarf: EZB-Vizepräsident Luis de Guindos an einer Pressekonferenz. Foto: Reuters Volkswirtschaften dies- und jenseits des Atlantiks stehen vor demselben Problem. Die Inflation ist tendenziell zu niedrig. Denn die meisten Notenbanken orientieren sich an einem mittelfristigen Zielwert für die optimale Inflationsrate. In der Regel liegt er bei 2%. Da die Teuerung tatsächlich beträchtlich tiefer ausfällt, verkünden die Zentralbanken in den USA, Euroland, Japan und auch...

Read More »Ein Blick in die Dollar-Zukunft

Was passiert mit unserer Weltwährung? Lächelnder Benjamin Franklin auf der 100-Dollar-Note. Foto: iStock Der Kursverlauf des Dollars überrascht wieder einmal viele Währungsanalysten. Sie gingen davon aus, dass die Aufwertung dieses Jahr zu Ende gehen würde. Der Dollar hat sich in den vergangenen zwölf Monaten gegenüber den wichtigsten Währungen um 10% verteuert. Und der Anstieg geht weiter, obwohl US-Zentralbankchef Powell im Januar die Hoffnung auf immer höhere Dollarzinsen zerstörte....

Read More »The Two Faces of Inflation, Report 22 Apr

We have a postscript to last week’s article. We said that rising prices today are not due to the dollar going down. It’s not that the dollar buys less. It’s that producers are forced to include more and more ingredients, which are not only useless to the consumer. But even invisible to the consumer. For example, dairy producers must provide ADA-compliant bathrooms to their employees. The producer may give you less milk...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org