On his blog, JP Koning reports that [b]oth the Christmas bump and the sawtooth pattern arising from monthly payrolls are less noticeable than previous years. But these patterns remain more apparent for Canadian dollars than U.S. dollars. Not because Canadians like cash more than Americans. We don’t, and are probably further along the path towards digital payments then they are. Rather, the percentage of U.S. dollars held overseas is much larger than Canadian dollars, so domestic usage of...

Read More »Cash Holdings Have Become Less Cyclical

On his blog, JP Koning reports that [b]oth the Christmas bump and the sawtooth pattern arising from monthly payrolls are less noticeable than previous years. But these patterns remain more apparent for Canadian dollars than U.S. dollars. Not because Canadians like cash more than Americans. We don’t, and are probably further along the path towards digital payments then they are. Rather, the percentage of U.S. dollars held overseas is much larger than Canadian dollars, so domestic usage of...

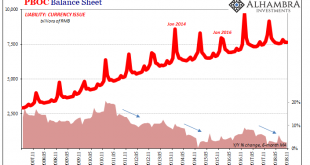

Read More »China’s Eurodollar Story Reaches Its Final Chapters

Imagine yourself as a rural Chinese farmer. Even the term “farmer” makes it sound better than it really is. This is a life out of the 19th century, subsistence at best the daily struggle just to survive. Flourishing is a dream. Only, you can see just on the other side of the hill the bright reflective lights of one of China’s many glittering modern cities. Not only are you reminded of the stark difference between what...

Read More »More Unmixed Signals

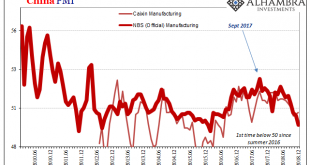

China’s National Bureau of Statistics (NBS) reports that the country’s official manufacturing PMI in December 2018 dropped below 50 for the first time since the summer of 2016. Many if not most associate a number in the 40’s with contraction. While that may or not be the case, what’s more important is the quite well-established direction. Coming in at 49.4 in December, it’s down in a straight line from 51.3 in August....

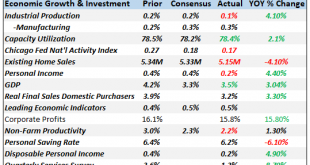

Read More »Monthly Macro Monitor – November 2018

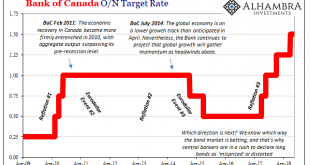

Is the Fed’s monetary tightening about over? Maybe, maybe not but there does seem to be some disagreement between Jerome Powell and his Vice Chair, Richard Clarida. Powell said just a little over a month ago that the Fed Funds rate was still “a long way from neutral” and that the Fed may ultimately need to go past neutral. Clarida last week said the FF rate was close to neutral and that future hikes should be “data...

Read More »The Direction Is (Globally) Clear

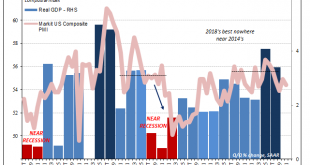

It is definitely one period that they got wrong. Still, IHS Markit’s Composite PMI for the US economy has been one of the better forward-looking indicators around. Tying to real GDP, this blend of manufacturing and services sentiment has predicted the general economic trend in the United States pretty closely. The latter half of 2015 was the big exception. For November 2015, the composite index jumped to 56.1 from 55.0...

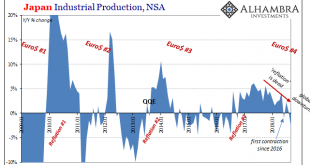

Read More »China Now Japan; China and Japan

Trade war stuff didn’t really hit the tape until several months into 2018. There were some noises about it back in January, but there was also a prominent liquidation in global markets in the same month. If the world’s economy hit a wall in that particular month, which is the more likely candidate for blame? We see it register in so many places. Canada, Europe, Brazil, etc. It does seem as if someone flipped a switch...

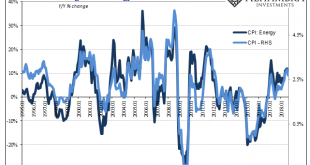

Read More »Downslope CPI

Cushing, OK, delivered what it could for the CPI. The contribution to the inflation rate from oil prices was again substantial in August 2018. The energy component of the index gained 10.3% year-over-year, compared to 11.9% in July. It was the fourth straight month of double digit gains. Yet, the CPI headline retreated a little further than expected. After reaching the highest since December 2011 the month before,...

Read More »‘Mispriced’ Bonds Are Everywhere

The US yield curve isn’t the only one on the precipice. There are any number of them that are getting attention for all the wrong reasons. At least those rationalizations provided by mainstream Economists and the central bankers they parrot. As noted yesterday, the UST 2s10s is now the most requested data out of FRED. It’s not just that the UST curve is askew, it’s more important given how many of them are. Look to our...

Read More »Why Am I Fighting for the Gold Standard?

Life is good. They could not have imagined what we have now, back in the dark ages. So I have never understood why people prep for a return to the dark ages. The only thing I can think of is that they don’t really picture what life is like. 14 hours a day of back-breaking labor to eke out a subsistence living. Subject to the risks of rain, sun, and insects. Prepping makes no sense to me. I don’t know if I would choose...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org