Meaningless Noise BALTIMORE – The Dow rose 250 points on Friday… putting it back near its all-time high. A “blow-out jobs report” was said to be the inspiration. Oh my… so many dots.. so little time. Friday’s jobs report said that 278,000 Americans found work in June – up from 11,000 in May. This was considered such good news that investors rushed to buy stocks. At least, that was the line taken by the mainstream...

Read More »“It’s Prohibited By Law” – A Problem Emerges For Japan’s “Helicopter Money” Plans

Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that – as we predicted last week – Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed...

Read More »Central Bank Wonderland is Complete and Now Open for Business — The Epocalypse Has Fully Begun

The following article by David Haggith was first published on the Great Recession Blog. Summer vacation is here, and the whole global family has arrived at Central-Bank Wonderland, the upside-down, inside-out world that banksters and their puppet politicians call “recovery.” Everyone is talking about it as wizened traders puzzle over how stocks and bonds soared, hand-in-hand, in face of the following list of economic...

Read More »Germany Sells First Ever Negative-Yielding 10Y Treasury, Corporate Bonds

Negative for 10 Years Overnight, we previewed what was about to be a historic for the eurozone bond auction, when this morning Germany sold its first ever 10Y bonds with a zero coupon. As it turned out the issue was historic in another way as well: with the prevailing 10Y bond trading well in negative yield territory, it was largely expected that today’s bond auction would likewise issue at a negative yield, and...

Read More »Fat People for Trump!

Alphas and Epsilons BALTIMORE – One of the delights of being an American is that it is so easy to feel superior to your fellow countrymen. All you have to do is stand up straight and smile. Or if you really need an ego boost, just go to a local supermarket. Better yet, go to a supermarket with a Trump poster in the parking lot. Trigger warning: In the following ramble, we make fun of democracy, Trump, obesity,...

Read More »Larry Summers Wants to Give You a Free Lunch

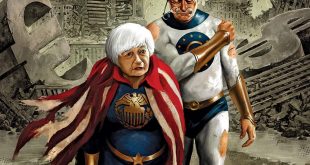

Consequences of Central Bank Policies The existing capital stock continues to be frittered away at the expense of savers and retirees. Nonetheless, central bankers don’t give a doggone about it. This, after all, is one consequence of roughly eight years of near zero interest rate policy. Central planning superheros, leaving a wasteland behind… Image credit: Steve Epting 30 year bond yield Another related...

Read More »European Banks and Europe’s Never-Ending Crisis

Landfall of a “Told You So” Moment… Late last year and early this year, we wrote extensively about the problems we thought were coming down the pike for European banks. Very little attention was paid to the topic at the time, but we felt it was a typical example of a “gray swan” – a problem everybody knows about on some level, but naively thinks won’t erupt if only it is studiously ignored. This actually worked for a...

Read More »Planet Debt

Low Interest Rate Persons She is a low-interest-rate person. She has always been a low-interest-rate person. And I must be honest. I am a low-interest-rate person. If we raise interest rates, and if the dollar starts getting too strong, we’re going to have some very major problems. — Donald Trump BALTIMORE – With startling clarity, the presumptive Republican presidential nominee described himself – and Fed chief...

Read More »Housing Affordability – A Dose of Reality

Restless Peasants First, a few quick words on Brexit. Being the always positive and optimistic person that I am (big grin), I see one very positive outcome of Brexit – it is a revolution without bloodshed. For once, I’m not digressing. Brexit has a lot of parallels with housing affordability in the US. Brexit is a clear illustration of how politicians, policy makers and the establishment have lost touch with the...

Read More »Mooning the Elite

Connecting Dots BALTIMORE – U.S. stocks bounced on Tuesday, with the Dow up 269 points [and even further on Wednesday, ed.]. Was that all there was? Is the “Brexit” scare over? We don’t know… but we’re going to take a pause today. Instead of trying to connect the new dots, we’re going to take a look at the old dots we’ve already strung together. We’ve been connecting the dots every day (except weekends) for the last...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org