Investors have realized Brexit isn’t the end of the world. First, because they think it won’t really happen. After all, elites can fix elections, buy politicians, and control public policy… surely, they can fix this! A letter in the Financial Times reminds us that Swedish voters cast their ballots against nuclear power in 1980. The government just ignored them, doubling nuclear power generation over the next 36...

Read More »Money confuses and blurs economic relations

Money, generally accepted medium of exchange, acts as a veil that confuse and blurs economic relations. This is especially true when it comes to intertemporal considerations. Whilst probably the most important institution in a free market, money can be highly destructive when politicized. Why? Because politics is about power and distribution of real wealth. And since money affect almost every single transaction,...

Read More »The Coming End of the “Third Way” System

The Best Thing About the EU is J.C. Juncker’s Alcoholism We recently discussed the post-Brexit landscape with a friend (in fact, our editor), who bemoaned that “the EU is led by a drunkard”. Our immediate reaction to this was to exclaim: “That’s the best thing about the EU!” Why do we think so? It makes this overpaid, useless bureaucrat human. Not only that, it clearly raises his entertainment value. As our regular...

Read More »In Gold We Trust, 2016

The 10th Anniversary Edition of the “In Gold We Trust” Report As every year at the end of June, our good friends Ronald Stoeferle and Mark Valek, the managers of the Incrementum funds, have released the In Gold We Trust report, one of the most comprehensive and most widely read gold reports in the world. The report can be downloaded further below. The report celebrates its 10th anniversary this year. As always, a...

Read More »Vive la Revolution! Brexit and a Dying Order

A Dying Order Last Thursday, the Brits said auf Wiedersehen and au revoir to the European Union. On Friday, the Dow sold off 611 points – a roughly 3.5% slump. What’s going on? In Europe and the U.S., the masses are getting restless. Mr. Guy Wroble of Denver, Colorado, explained why in a short letter to the Financial Times: The old liberal world order is dying because the cost-benefit ratio for the average person in...

Read More »Rule Britannia

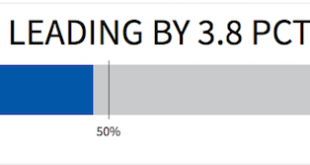

A Glorious Day What a glorious day for Britain and anyone among you who continues to believe in the ideas of liberty, freedom, and sovereign democratic rule. The British people have cast their vote and I have never ever felt so relieved about having been wrong. Against all expectations, the leave camp somehow managed to push the referendum across the center line, with 51.9% of voters counted electing to leave the...

Read More »The EU Begins to Splinter, a new Tsunami for Kuroda

Dark Social Mood Tsunami Washes Ashore Early this morning one might have been forgiven for thinking that Japan had probably just been hit by another tsunami. The Nikkei was down 1,300 points, the yen briefly soared above par. Gold had intermittently gained 100 smackers – if memory serves, the biggest nominal intra-day gain ever recorded (with the possible exception of one or two days in early 1980). Here is a...

Read More »Towards Freedom: Will The UK Write History?

Summary: Every freedom loving person on the planet has their eyes fixed on this referendum. A clear majority voting for Brexit and therefore for more decentralization, would show that the British realized they can break free from their self-imposed nonage, and reclaim individual liberty. Mutating Promises We are less than one week away from the EU referendum, the moment when the British people will be called upon...

Read More »The Fed Doomsday Device

Summary: Debt is just the flip side of credit. As debt goes bad, credit disappears. And then the system that created so much credit-money will go into reverse, destroying the nation’s money supply. The money supply (actually, the supply of ready credit) will shrink – suddenly and dramatically. And what should have been a minor, routine pullback in the economy will become a catastrophic panic. Bezzle BALTIMORE – ...

Read More »Janet Yellen’s $200-Trillion Debt Problem

Summary More than $10 trillion of government bonds now trade at negative yields. And another $10 trillion or so worth of U.S. stocks trade well above their long-term average valuations. And there’s more than $200 trillion of debt in the world. All of this sits on the Fed’s financial applecart. Does Janet Yellen dare upset it? Blame “Brexit” BALTIMORE – The U.S. stock market broke its losing streak on Thursday [and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org