Gold Price Falls on Selling of Gold Futures Equal to 3 Million Ounces in 30 Minutes

Gold Price Falls on Selling of Gold Futures Equal to 3 Million Ounces in 30 Minutes

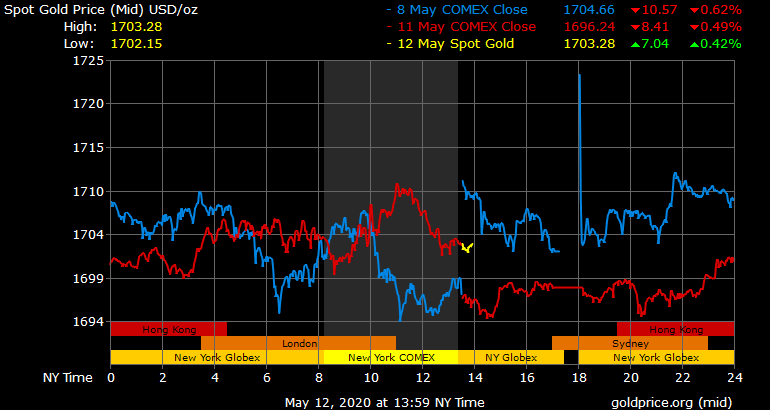

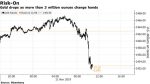

◆ Gold price falls to a three-month low as concentrated selling of COMEX gold futures contracts equal to over 3 million ounces are sold in 30 minutes◆ 33,596 contracts were aggressively sold in the 30 minutes between 10:00 and 10:30 a.m. New York time which is more than triple the 100-day average for that time of day

Largest Gold Nugget in Britain Found in River in Scotland – “Experts” Concerned About a Scottish Gold Rush

Largest Gold Nugget in Britain Found in River in Scotland – “Experts” Concerned About a Scottish Gold Rush

The largest gold nugget in Britain has been found in a Scottish river, as experts reveal that members of the public are taking up hunting after watching YouTube clips. The diver, who wishes to remain anonymous, discovered the £80,000 “doughnut-shaped” nugget using a method called “sniping”, in which a prospector uses a snorkel and hand tools to scan the riverbed for treasures.

Gold Surges To Test $1,600/oz, Oil Over $70, Stocks Fall on Risks of World War In Middle East

Gold Surges To Test $1,600/oz, Oil Over $70, Stocks Fall on Risks of World War In Middle East

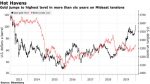

◆ Gold has surged to test $1,600 per ounce, up 4% so far in 2020 and building on the stellar near 18.9% gain in 2019 ◆ Gold is testing it’s highest levels since 2013 as investors diversify into gold; Goldman, Citi and other gold analysts are advocating gold bullion as important hedge in crisis ◆ Oil prices have surged with Brent crude reaching $70 per barrel; concern over oil supplies from Iran, Iraq and other nations as U.S. State Department warns of attacks on Saudi oil facilities

Gold’s New Bull Market and Why $7,000 Per Ounce Is “Logical” (Part I)

Gold’s New Bull Market and Why $7,000 Per Ounce Is “Logical” (Part I)

◆ Gold could rise to more than $7,000 an ounce according to respected MoneyWeek contributor and fund manager Charlie Morris (Part I today and Part II tomorrow). A year ago, in my occasional free newsletter, Atlas Pulse, I upgraded gold – which was trading at $1,239 an ounce at that point – to “bull market” status for the first time since 2012.

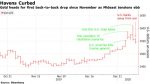

Gold Steadies After Falls As U.S., Iran Stepping Back From the Brink

Gold Steadies After Falls As U.S., Iran Stepping Back From the Brink

◆ Haven demand ebbs as stocks climb with easing Mideast tensions◆ Palladium retreats from fresh record but holds near $2,100. ◆ There’s still very strong demand for gold “due to a host of financial, geopolitical and monetary risks,” said Mark O’Byrne, research director at GoldCore

“Smart Move” By Prudent Investors Is To Diversify Into Gold

“Smart Move” By Prudent Investors Is To Diversify Into Gold

With no opportunity cost to holding a zero-yield asset such as gold, investors increasingly are adding it to their portfolios as a hedge. ◆ Gold retains its intrinsic value, something no paper currency has managed to do over history. ◆ Gold is insurance. Insurance isn’t supposed to make you rich; it’s supposed to keep you from being poor.

Gold Surges To New Record Highs in Euros at €1,581/oz and $1,726/oz in Dollars

Gold Surges To New Record Highs in Euros at €1,581/oz and $1,726/oz in Dollars

Gold prices surged to new all time record highs in euros and other digital fiat currencies today due to concerns about the outlook for risk assets and currencies in an era of unprecedented economic and monetary risk.

Gold Will Reach $3,000/oz: “Fed Can’t Print Gold” and Is “Ultimate Store Of Value” – Bank of America

Gold Will Reach $3,000/oz: “Fed Can’t Print Gold” and Is “Ultimate Store Of Value” – Bank of America

Gold in USD – 3 Days Gold prices are 0.7% higher today after falling just 0.3% yesterday as traders sought refuge in safe haven gold as oil prices collapsed lower again. Oil slumped to nearly $15 a barrel, its lowest since 1999 as the economic fallout from government lockdowns and the shutting down of entire economies impacts risk assets and commodities dependent on economic growth.