Today we ask, what is wealth? As we start a new year many will be looking at their portfolios and wondering what 2023 will have in store for them. Similar to 2022, we suspect there will be a lot of unknowns. As with anything unforeseen, it’s a good idea to have some insurance. This is why there were record levels of gold buying last year, and we expect the same in the coming months; because people want to protect their wealth with the insurance that gold offers....

Read More »Weekly Market Pulse: Happy Holidays

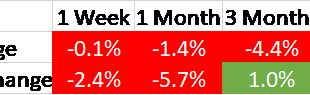

We received a host of economics reports this past week; some good, others not so much. The week started with the Consumer Price Index report coming in better than expected at an increase of just 0.1% from the previous month (7.1% from a year ago), compared with respective estimates of 0.3% and 7.3%. This is great news (and the market responded in kind), as inflation continues to moderate not only here but also in Europe. US import and export prices were also both...

Read More »Weekly Market Pulse: Envy

Legendary investor and Berkshire Hathaway vice-chair Charles Munger recently stated: “The world is not driven by greed. It’s driven by envy.” I think this perfectly encapsulates our current investing era. In a day and age where social media has replaced not only traditional news media but human interaction, where influencers and gamers are top career aspirations for the nation’s youth, where artists (content creators) are paid by the number of followers, likes, and...

Read More »Weekly Market Pulse: Currency Illusion

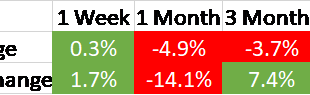

When we think about the challenges facing an investor today, the big problems, the things we worry about that could cause a lot more harm than some interest rate hikes, are mostly outside the United States. China is prominent this weekend because of demonstrations against their zero COVID policies. The Chinese people appear to be pretty well fed up with the endless lockdowns and have finally decided to try and do something about it. Unfortunately, I’m not sure...

Read More »The Bitcoin is ‘as-good-as-gold’ myth is over

When you invest in gold or buy silver coins with GoldCore you are choosing to invest in an asset that has no counterparty risk. Sadly those who have been holding their bitcoin on the crypto exchange FTX, have not experienced the same level of reassurance and service from the exchange’s management. This event is all part of a much wider lesson about which assets really are safe havens. Also how to reduce the level of counterparty risk your investment portfolio is...

Read More »Weekly Market Pulse: Good News, Bad News

One thing I can tell you for certain about last week’s big rally on Thursday and Friday: there were a lot of people who desperately wanted a good excuse to buy stocks. And buy they did after a better-than-expected CPI report Thursday morning, pushing the S&P 500 up nearly 6% on the week with all of that coming on Thursday and Friday. The same could be said of bonds which also had a good week, with the aggregate index up 2.3%. The stock market rally probably says...

Read More »[Video] Gold in 2023 Will Be Driven by Real Rates – Mike Singleton

Gold in 2023 Will Be Driven by Real Rates A Fed pivot is to be expected in 2023, according to today’s guest Mike Singleton. Mike is Senior Analyst at Invictus Research and joins us for the first time, here on GoldCore TV. [embedded content] In his chat with our host Dave Russell, Mike gives us his thoughts on inflation, the US Dollar and what the future holds for gold and silver prices. You’ll hear why Mike thinks that real rates are the key for us to look out for to...

Read More »SPECIAL REPORT: Follow The Money Series – Dawn Of A New Era

With inflation recently hitting a high not seen since 1981, it is now apparent that the factors that drove the disinflation trend of the last four decades are coming to an end. Globalization and demographics, the two big factors that combined to hold down prices and wages for so long, are reversing, and so too is the downtrend in prices, wages, and interest rates. While 1970s levels of inflation seem unlikely, several trends are converging to keep upward pressure on...

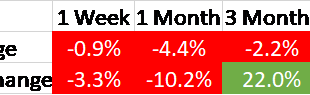

Read More »Weekly Market Pulse: Did Powell Just Blink?

Did Jerome Powell blink last Friday? It was just before the market open Friday and interest rates were jumping higher, as they had all week. The 10-year Treasury yield was up to 4.33%, another 11 basis points higher than the previous close and 32 basis points higher than the previous week’s close. Then, “the article” hit the front page of the WSJ: Fed Set to Raise Rates by 0.75 Point and Debate Size of Future Hikes By Nick Timiraos The article led with this quote:...

Read More »Market Currents: Fed Confusion

The Federal Reserve seems confused about its role in inflation and unemployment. Alhambra’s Steve Brennan and Joe Calhoun discuss it. [embedded content] [embedded content] Tags: Alhambra Research,Bonds,commodities,currencies,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,Real Estate,stocks

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org