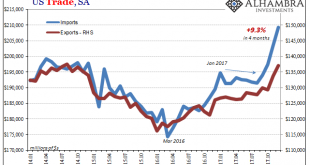

US imports rocketed higher once again in December, according to just-released estimates from the Census Bureau. Since August 2017, the US economy has been adding foreign goods at an impressive pace. Year-over-year (SA), imports are up just 10.4% (only 9% unadjusted) but 9.3% was in just those last four months. For most of 2017, imports were flat and even lower. The question is, obviously, what has changed? Did the boom...

Read More »Central Bank Transparency, Or Doing Deliberate Dollar Deals With The Devil

The advent of open and transparent central banks is a relatively new one. For most of their history, these quasi-government institutions operated in secret and they liked it that way. As late as October 1993, for example, Alan Greenspan was testifying before Congress intentionally trying to cloud the issue as to whether verbatim transcripts of FOMC meetings actually existed. Representative Toby Roth (R-WI) quizzed the...

Read More »FX Daily, January 18: Currencies Consolidate After Chop Fest

Swiss Franc The Euro has fallen by 0.20% to 1.174 CHF. EUR/CHF and USD/CHF, January 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar rallied in the North American afternoon yesterday and the timing coincided with the release of the Fed’s Beige Book that saw several districts report wage and price pressures. The US 10-year yield moved toward toward 2.60%,...

Read More »China and US Treasuries

The US Treasury market was consolidating yesterday’s 7.5 basis point jump in 10-year yields when Bloomberg’s headline hit. The claim was that Chinese officials are “wary of Treasuries”. Yields rose quickly to test 2.60% and the dollar moved lower. It is difficult to determine the significance of the claim as the Bloomberg story does not quote anyone. The “people familiar with the matter” who are cited are not...

Read More »FX Daily, January 16: Dollar Given a Reprieve

Swiss Franc The Euro has risen by 0.19% to 1.1783 CHF. EUR/CHF and USD/CHF, January 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After extending its recent slide yesterday, which the US markets were on holiday, the dollar is firmer against all the major currencies and most of the emerging market currencies. There does not seem to be macroeconomic developments...

Read More »FX Daily, January 11: Capital Markets Calmer, Greenback Consolidates

Swiss Franc The Euro has risen by 0.45% to 1.1735 CHF. EUR/CHF and USD/CHF, January 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates As market participants were just getting their sea legs back after the start of the year, it was hit by a one-two punch of ideas that BOJ policy was turning less accommodative and that Chinese officials were wary of adding to their Treasury...

Read More »FX Daily, January 09: Dollar Correction Extended

Swiss Franc The Euro has risen by 0.31% to 1.1725 CHF. EUR/CHF and USD/CHF, January 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar’s upside correction that began before the weekend has been extended in Asia and Europe today. The main exception is the Japanese yen. The yen’s modest gains have been registered despite the firmness in US rates and continued...

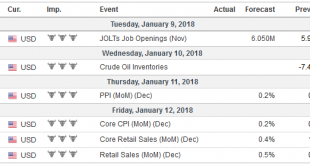

Read More »FX Weekly Preview: Accommodative Officials and Synchronized Upturn Drive Markets

The investment climate is being shaped by two powerful forces. First is the very accommodative policy stance. This includes the United States, where despite delivering the fifth rate hike in the cycle, adjusted by headline CPI, remains negative. The balance sheet has begun being reduced, financial conditions in the US are easier now than a year ago. The ECB’s bond purchase program, which has been cut in half to 30 bln...

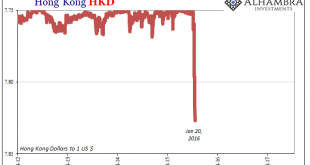

Read More »Industrial production: The Chinese Appear To Be Rushed

While the Western world was off for Christmas and New Year’s, the Chinese appeared to have taken advantage of what was a pretty clear buildup of “dollars” in Hong Kong. Going back to early November, HKD had resumed its downward trend indicative of (strained) funding moving again in that direction (if it was more normal funding, HKD wouldn’t move let alone as much as it has). China’s currency, however, was curiously...

Read More »FX Daily, January 03: Dollar Stabilizes, but Sees Little Recovery

Swiss Franc The Euro has risen by 0.37% to 1.1755 CHF. EUR/CHF and USD/CHF, January 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is stabilizing but the tone remains fragile. The euro, which has advanced for five consecutive sessions coming into today is slightly lower. The euro had stalled yesterday as it approached last year’s high set in September...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org