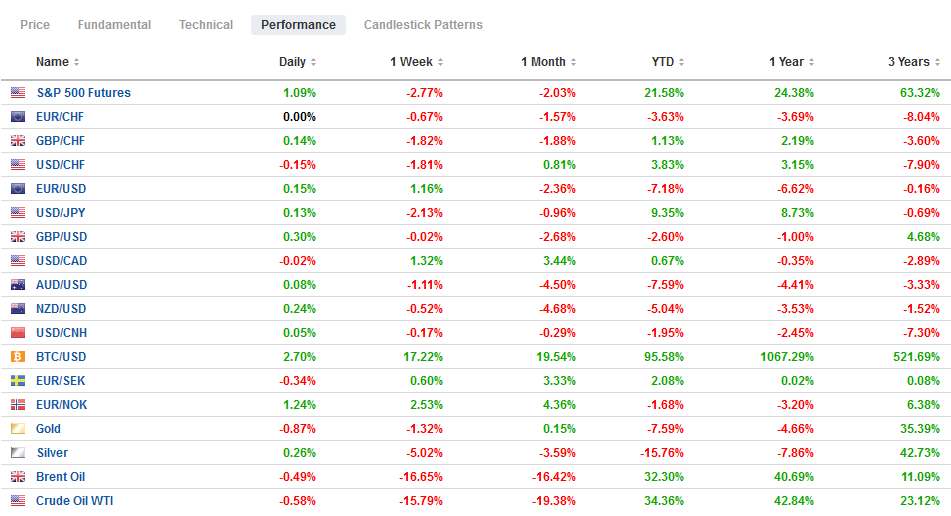

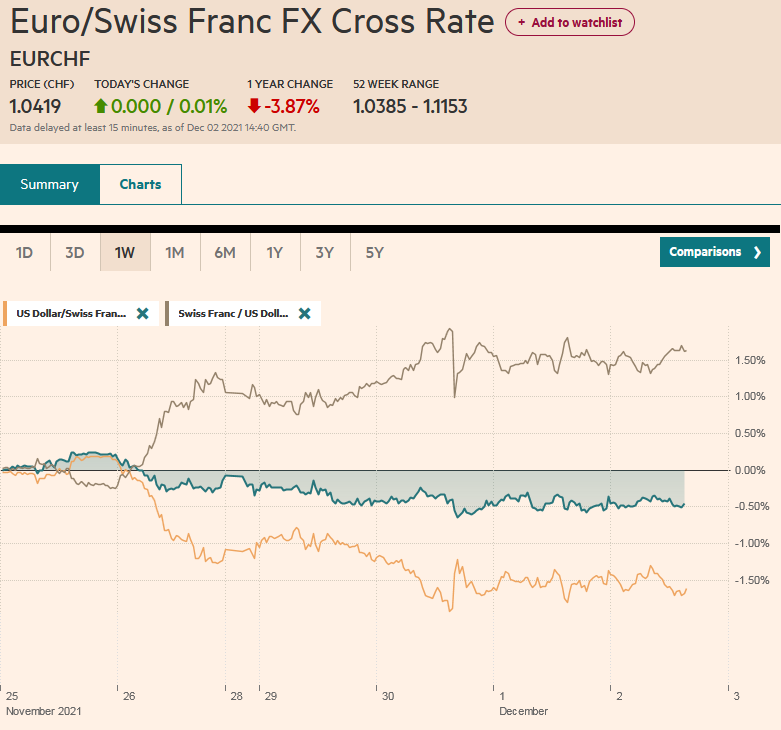

Swiss Franc The Euro has risen by 0.09% to 1.0587 EUR/CHF and USD/CHF, December 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The downside reversal in US stocks yesterday seemed to accelerate after the first case of the Omicron variant was found in the US. In itself, it should not be surprising, but perhaps, what was especially disheartening is that the person had been fully vaccinated. The S&P 500 traded on both sides of Tuesday’s range and closed below it low, a bearish signal. The Nasdaq settled on its lows and looks equally ugly. That said, there has been no follow-through selling, and both are trading higher. The US 30-year yield recorded a marginal new 11-month low, and the 2-10 year curve flattened

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, China, Currency Movement, EMU, Featured, Mexico, newsletter, South Korea, U.K., USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.09% to 1.0587 |

EUR/CHF and USD/CHF, December 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The downside reversal in US stocks yesterday seemed to accelerate after the first case of the Omicron variant was found in the US. In itself, it should not be surprising, but perhaps, what was especially disheartening is that the person had been fully vaccinated. The S&P 500 traded on both sides of Tuesday’s range and closed below it low, a bearish signal. The Nasdaq settled on its lows and looks equally ugly. That said, there has been no follow-through selling, and both are trading higher. The US 30-year yield recorded a marginal new 11-month low, and the 2-10 year curve flattened a little further. Apple’s warning about demand rippled through its supply chain and also weighed equities. Asia Pacific markets were mixed, with Japan and Australia lower among the large bourses. South Korea’s Kospi stood out. It rallied more than 1.5% after Wednesday’s 2%+ advance that snapped a six-day slide. Europe’s Stoxx 600 is off around 1.0%. Most sectors but energy are lower, and the information technology sector has been particularly hard hit (~-3%). The 10-year US Treasury yield is up four basis points to almost 1.44%. European yields are mostly 2-3 bp lower, and the periphery is outperforming the core. The dollar is softer against the major currencies but the yen and Norwegian krone. It has squeezed back above JPY113. The liquid and freely accessible emerging market currencies are trading higher, led by the South African rand and the Mexican peso. Turkey’s President Erdogan replaced the finance minister, which has offset the positive impact of yesterday’s direct intervention to support the beleaguered lira. Gold has been sold to below $1770 to its lowest level since November 3 after trading above $1800 as recently as Tuesday. It is recovering in the European morning. Oil has steadied ahead of OPEC+ decision on next month’s output, but it is still at the lower end of the last couple of day’s ranges. Warmer weather is said to be weighing on natural gas prices. Iron ore prices fell 3% in Singapore, while copper prices are steady after losing a little more than 2% over the past couple of sessions. The CRB Index has a four-day slide in tow coming into today, which is its longest losing streak in three months. |

FX Performance, December 02 |

Asia Pacific

Regional tensions remain elevated. China has struck out at the World Tennis Association for suspending tournaments in the mainland and Hong Kong over the treatment of Peng Shuai. It has also pushed back against comments from Japan’s former Prime Minister Abe over Taiwan. However, there was one positive note that may be obscured by these developments. Yesterday, both Russia and China supported the UN decision to not accept the Taliban’s credentials to represent Afghanistan, at least for now.

Australia’s trade surplus fell for the second consecutive month in October. At A$11.2 bln, the October surplus is still more than 70% above the October 2020 surplus and more than 2.6x the October 2019 surplus. The value of exports fell by 3.3% (seasonally adjusted), nearly twice the pace expected. Metal ores and mineral exports slumped by 23%. The drop in iron ore prices took a toll and offset the increase in the value of coal, coke, metals, and grains. Imports fell by about 3%, led by machinery and industrial equipment. Imports were also held back weaker consumption tied to the lockdown in several states.

South Korea’s November CPI rose by 0.4%. The median forecast (Bloomberg survey) was for a 0.2% decline. This translated into a year-over-year rate of 3.7%, up from 3.2% in October and well above the 3.1% anticipated. The monthly rise reflected higher food and energy prices, without which the (core) CPI eased to 2.3% from 2.8%. The central bank does not meet until mid-January, and it will see the December CPI print before it. It has raised rates twice this year (August and November). The swaps market has almost two hikes discounted in the first half of next year.

The dollar has firmed back above JPY113.00, where a $1 bln option expires tomorrow. Tuesday’s low near JPY112.50 is holding, while the greenback is holding below yesterday’s high (~JPY113.65). In fact, the dollar has been recording lower highs against the yen since last Wednesday’s peak near JPY115.50. The Australian dollar is in a tight range above yesterday’s low (~$0.7095). It has held below $0.7020. Recall the week’s low, which is the low for the year, was slightly below $0.7065. The price action is uninspiring, and a significant low may not be in place. Meanwhile, the US dollar is (slightly) firmer against the Chinese yuan for the second consecutive session and resurfaced above CNY6.37. The PBOC set the dollar’s reference rate at CNY6.3719, while the market (Bloomberg survey) was at CNY6.3712. The greenback settled last week slightly lower than CNY6.3935. It has not traded above CNY6.39 this week.

Europe

The eurozone reported the October unemployment rate slipped to 7.3% from 7.4%. It stood at 8.1% at the end of last year and 7.4% at the end of 2019. Separately, the eurozone reported a 5.4% jump in October producer prices, which lifted the year-over-year rate to 21.9% from 16.1% in September. The increase was more than economists expected but does not appear to have much market impact. Tomorrow the final November PMI readings will be released. The preliminary estimate showed the first increase since the July peak at 60.2 (55.8 in November vs. 54.2 in October).

The Financial Times reports that the US displeasure over Brexit and the UK attempt to remake the Northern Ireland Protocol may be behind the slow progress toward a US-UK trade deal and the lifting of the Trump-era steel and aluminum tariffs on the UK. Recall that the EU, Canada, Mexico, and a few other countries have negotiated the lifting of the tariffs. However, the UK is not alone. The tariffs are still in place on Japan’s steel and aluminum exports to the US. Separately, the UK won rare approval from the EU for increasing the fishing licenses.

The euro is trading inside yesterday’s range, which was inside Tuesday’s range. Tuesday’s range (~$1.1235-$1.1385) is the key. As long as it is in that range, it is hard to get excited about it. The $1.1380 area corresponds to the (38.2%) retracement of the leg lower that began in late October. It has not closed above the 20-day moving average (now around $1.1365) in a month. Sterling is also inside yesterday’s range, which was inside Tuesday’s range (~$1.3195-$1.3370). Resistance at the upper end of the range looks stronger than support, but that said, a chunky option for about GBP850 mln at $1.33 expires today.

America

Ahead of tomorrow’s US (and Canada) employment report, weekly jobless claims will be reported, and a bounce is expected after the sharp fall (-71k to 199k) in the week of the Veteran’s Day holiday. Several Fed officials speak today, but the general sense is that a consensus toward faster tapering is forming. That said, the manufacturing PMI disappointed yesterday (its fourth consecutive monthly decline). While the ISM remained firmed, prices paid eased. Note that the manufacturing PMI stands at 58.3 after finishing 2020 at 57.1. The manufacturing ISM ended last year at 60.5 and is at 61.1 in November.

However, the decline in US auto sales was the real disappointment yesterday. The market expected the second consecutive increase, but auto sales slipped to a 12.86 mln unit pace (seasonally adjusted annual rate). November 2021 sales were 17.3% lower than a year ago. Separately, we note that the funding for the US federal government ends tomorrow, and Congress has yet to pass a continuing resolution, a stop-gap measure. This increases the risk of a government shutdown.

Canada and Mexico have light economic calendars today. In Mexico, the Senate is expected to vote on AMLO’s nomination of the central bank head, Deputy Finance Minister Victoria Rodriquez Ceja, today. Although the US dollar is softer against the Canadian dollar, it remains near CAD1.28. It peaked Tuesday, a little above CAD1.2835. Support is seen in the CAD1.2700-CAD1.2720 area. The narrowing of the short-end interest rate differential and higher volatility in the equity market appears to be the main drivers. The dramatic downside reversal of US stocks yesterday also saw the greenback reverse higher against the Mexican peso after Mexico reported a record worker remittances (around 4% of GDP this year). However, the greenback has been turned back from around MXN21.50. Around MXN21.34, it is still well above yesterday’s lows, a little below MXN21.12.

Tags: #USD,Brexit,China,Currency Movement,EMU,Featured,Mexico,newsletter,South Korea,U.K.