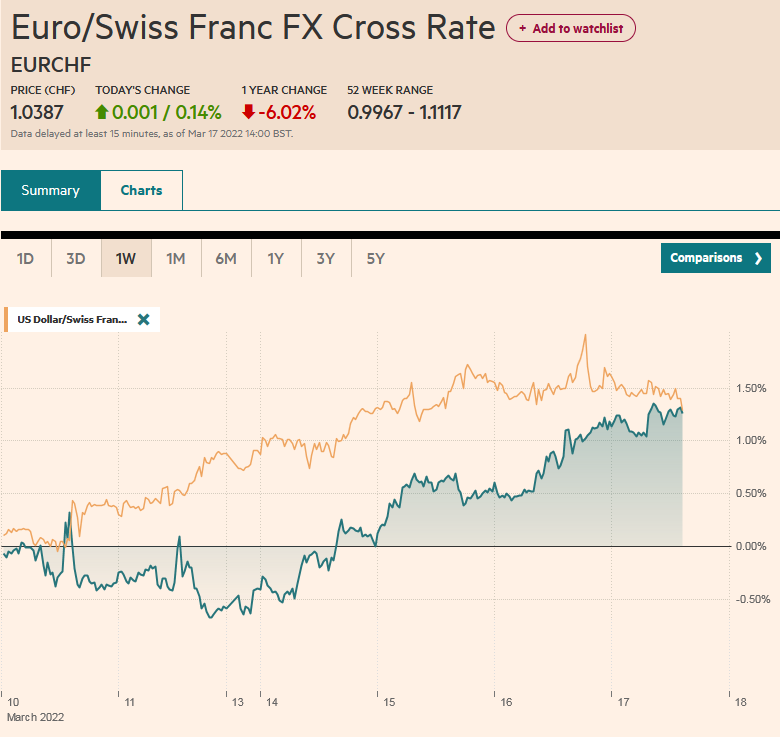

Swiss Franc The Euro has risen by 0.14% to 1.0387 EUR/CHF and USD/CHF, March 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The markets continue to digest the implications of yesterday’s Fed move and Beijing’s signals of more economic supportive efforts as the Bank of England’s move awaited. The US 5–10-year curve is straddling inversion and the 2-10 curve has flattened as the Fed moves from one horn of the dilemma (behind the inflation curve) to the other horn (recession fears). Asia Pacific equities extended yesterday’s surge. The Hang Seng led the charge with a 6.7% gain. Taiwan’s benchmark rose 3% and the Nikkei gained 2.5%. Europe’s Stoxx 600 is posting small gains and US futures are paring

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Bank of England, Brazil, China, Currency Movement, Featured, Federal Reserve, Japan, newsletter, Riksbank, Russia, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.14% to 1.0387 |

EUR/CHF and USD/CHF, March 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX Rates

Overview: The markets continue to digest the implications of yesterday’s Fed move and Beijing’s signals of more economic supportive efforts as the Bank of England’s move awaited. The US 5–10-year curve is straddling inversion and the 2-10 curve has flattened as the Fed moves from one horn of the dilemma (behind the inflation curve) to the other horn (recession fears). Asia Pacific equities extended yesterday’s surge. The Hang Seng led the charge with a 6.7% gain. Taiwan’s benchmark rose 3% and the Nikkei gained 2.5%. Europe’s Stoxx 600 is posting small gains and US futures are paring yesterday’s late gains. The US 10-year yield is near 2.11% after poking briefly above 2.2% yesterday. European bond yields are mostly 2-3 bp lower. The Hong Kong Monetary Authority and Saudi Arabia hiked 25 bp too as their currency pegs required. The dollar initially rallied on the Fed statement but unwound the gains during the Chair Powell’s press conference. It is lower against most currencies today. The Australian dollar is the strongest of the majors, helped by better-than-expected jobs report. The emerging market currencies are led today by the South Korean won, whose gains appeared to be fueled by strong demand for its bonds today. Gold traded below $1900 yesterday before recovering. That recovery is being extended today and the yellow metal is near $1944. There may be potential toward $1962 in the next day or two. April WTI appears to have forged a base around $93-$94 and is trying to test $100. US natgas is firm after yesterday’s 4% gain. Europe’s natgas benchmark is recouping half of yesterday’s 6.7% decline. Iron ore eased after jumping 8.5% yesterday. Copper is extending yesterday’s gains and is up about 1.4%. May wheat is consolidating after falling near 7.5% yesterday.

Asia Pacific

China has underscored the shift from structural reforms to growth, which many market observers had already detected. However, investors now need to see the proof of the pudding, so to speak, which is to say policy adjustments. It could happen with the setting of the loan prime rates on Monday in Beijing, but more observers are talking about a cut in reserve requirements in the coming weeks.

Australia employment rose 77.4k, more than twice the median forecast in Bloomberg’s survey. The details were even stronger. Full-time positions rose by nearly 122k last month after a revised 6.1k decline in January (originally it fell by 17k). The unemployment rate fell to 4.0% from 4.2%, even though the participation rate rose to 66.4% from 66.2%. Australia’s short-term bond yields rose 3-4 bp as the data brought forward an RBA rate hike. The odds of a move at the end of Q2 has increased.

The BOJ meeting concludes tomorrow and standing pat will underscore the growing divergence with the US and others’ monetary policy. The fiscal year end is approaching, and Japanese purchases/sales of foreign bonds and stocks remains subdued, but foreign investors for the second week have been significant sellers of Japanese stocks and buyers of Japanese bonds.

The dollar rose slightly through JPY119.10 yesterday and is consolidating below that today. The JPY118.60, which we targeted last week, now offers support. Note that the upper Bollinger Band comes in today near JPY118.70. The Australian dollar jumped 1.35% yesterday, its largest rise since early November 2020. It is extending the gains today and is approaching the (61.8%) retracement objective of the decline since it reached $0.7440 earlier this month. That retracement objective is near $0.7335. and above there, last week’s high near $0.7375 may draw attention. Recall that the greenback gapped higher against the Chinese yuan on Monday and Tuesday. It filled Tuesday’s gap yesterday and entered Monday’s gap today without filling it. The bottom of the gap is just below CNY6.34. The PBOC set the dollar’s reference rate at CNY6.3406. The median projection in Bloomberg’s survey was for CNY6.3360.

Europe

The Bank of England is awaited. The swaps market has about a 1-in-4 chance that it delivers a 50 bp move today, with odds-on favorite scenario of a 25 bp move. The BOE is likely to raise its inflation outlook, and this will serve to underscore the policy path. Today’s move will be the third hike in a row and will bring the base rate up to where it was before the pandemic struck. A 25 bp increase will bring the base rate to 0.75%. When it reaches 1.0% (May), the BOE has said it could (but not will) reduce its balance sheet more actively by selling securities rather than just passively through not re-investing maturing proceeds.

The Governor of Sweden’s Riksbank indicated that its first rate hike will likely be delivered before the second half of 2024, which it had previously anticipated. Ingves warned that inflation was too high. Using fixed mortgage rates, the underlying inflation stood at 4.3% in February, and the core underlying rate, which excludes energy is at 3.4%. The next Riksbank meeting is late next month, but the focus of the first hike is now in September.

The US says that the sanctions on Russia do not prohibit Moscow from servicing its dollar debt until May. Russia, trying to conserve its hard currency reserves that it has access to, has also made this more difficult and many expect a default in Q2. Separately, note that India, which abstained in the UN vote condemning the Russian invasion, appears to be exercising an option in an earlier agreement to buy more Russian oil. Russian oil is trading, as one would imagine, as a deep discount, and Russia covers shipping and insurance costs. The White House press secretary indicated that India’s purchases are not violating US sanctions.

The euro reached a five-day high in early European turnover today, slightly above $1.1065. Last week’s high was near $1.1120. Ahead of that is the 20-day moving average around $1.1095. Recall that in response to the Fed’s statement yesterday, the euro recorded session lows by $1.0950 before recovering to new session highs. We suspect the high for the day may have been approached, with initial support now pegged in the $1.1000-$1.1020 band. When the euro was on its lows yesterday, sterling dipped below $1.3050 and then reversed higher to rally a cent. Those gains were extended today to $1.3190. Sterling also looks poised for a buy the rumor sell the fact type of trading like the dollar did yesterday in response to the Fed. Initial support is seen near $1.3150 and then $1.3100.

America

The dollar typically rallies ahead of the first Fed hike in recent cycles and then weakens as tightening phase progresses. Research from the Bank of International Settlements finds an average decline of a little more than 4%. Part of the reason may stem from the Fed’s inability to achieve the proverbial “soft-landing” to bring down inflation without inducing a recession. Many are skeptical that a soft-landing can be achieved now, in part because the Fed waited too long to halt the asset purchases. And despite the drama when “transitory” was jettisoned from Fed-speak about inflation, the Fed’s new forecasts show that is still the median case. The PCE deflator stood at 6.1% in January, and the median Fed forecast sees it at 4.3% at the end of this year and 2.7% next year, and 2.3% in 2024. Moreover, many observers are also finding it hard to reckon the Fed’s tightening pace and slower GDP with the median dot seeing unemployment at 3.5% this year and next.

The Fed meeting probably reduces the focus on today’s high-frequency data, which includes industrial production, housing starts and permits, weekly jobless claims and the March Philadelphia Fed survey. Note that after yesterday’s retail sales data, the Atlanta Fed’s GDPNow tracker increased its Q1 estimate to 1.2% from 0.5% (from March 8). For many, like ourselves, that see the odds high of a recession, we do not see the contraction as imminent, but perhaps beginning late this year or, more likely a 2023 story.

Canada’s February CPI reported yesterday was stronger than expected at 5.7% (median forecast was for 5.55) after 5.1% in January. The average of the underlying measures also rose. The Bank of Canada meets next on April 13. The swaps market is pricing in almost a 68% chance of a 50 bp move. The balance sheet could begin shrinking in May.

As widely anticipated Brazil’s central bank hiked the Selic Rate by 100 bp to 11.75%. It has now hiked rates 975 bp over the past 12 months. Inflation is running above 10%. Petrobras lifted diesel prices by 25% and this warns of more upside inflation risk. Still, a survey by the central bank found expectations for inflation to fall back to 6.45% at the end of this year and 3.7% next year. Mexico and Chile also expected to hike rates later this month (March 24 and March 29 respectively).

The US dollar peaked on Tuesday near CAD1.2870 before reversing lower. It continued to give back its recent gains yesterday, falling to CAD1.2675. It continues to trade heavily and approached CAD1.2650 in the European morning. There is an option for about $325 mln at CAD1.2635 that expires today. The low from earlier this month was set near CAD1.2585 and the 200-day moving average is found slightly above CAD1.2600. The greenback’s high for the month was set on March 8 against the Mexican peso a little below MXN21.47. It slipped below MXN20.60 yesterday and is in a tight range in near there today. The month’s low was recorded close to MXN20.39, a little below the 200-day moving average (~MXN20.42). The US dollar was turned back earlier this week after approaching BRL5.17. It looks poised to rechallenge the BRL5.00 area.

Tags: #USD,Bank of England,Brazil,China,Currency Movement,Featured,Federal Reserve,Japan,newsletter,Riksbank,Russia