See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. The Fundamental Price has Deteriorated, but… Let us look at the only true picture of supply and demand in the gold and silver markets, i.e., the basis. After peaking at the end of April, our model of the fundamental price of gold came down to the level it reached last November. ,300. Which is below the level it inhabited since Q2 2017. We will look at an updated picture of the supply and demand picture. But first, here is the chart of the prices of gold and silver. Gold and Silver Price(see more posts on gold price, silver price, )Gold and silver priced in USD - Click to enlarge Gold:Silver Ratio Next, this is a

Topics:

Keith Weiner considers the following as important: 6) Gold and Austrian Economics, Chart Update, dollar price, Featured, Gold and its price, gold basis, Gold co-basis, gold price, gold silver ratio, newsletter, Precious Metals, silver basis, Silver co-basis, silver price

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

The Fundamental Price has Deteriorated, but…Let us look at the only true picture of supply and demand in the gold and silver markets, i.e., the basis. After peaking at the end of April, our model of the fundamental price of gold came down to the level it reached last November. $1,300. Which is below the level it inhabited since Q2 2017. We will look at an updated picture of the supply and demand picture. But first, here is the chart of the prices of gold and silver. |

Gold and Silver Price(see more posts on gold price, silver price, ) |

Gold:Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It rose this week. |

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

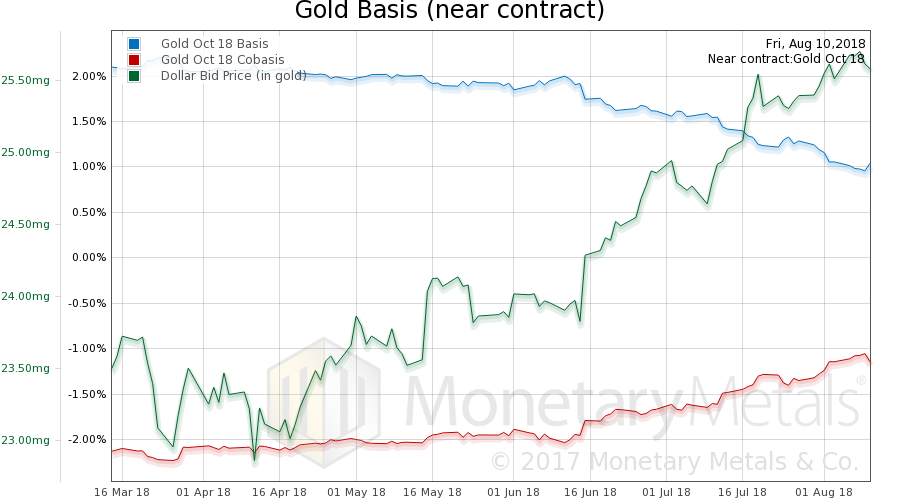

Gold Basis and Gold Co-basisHere is the gold graph showing gold basis, co-basis and the price of the dollar in terms of gold price. The price barely moved. And the basis (abundance) and co-basis (scarcity) barely moved too. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

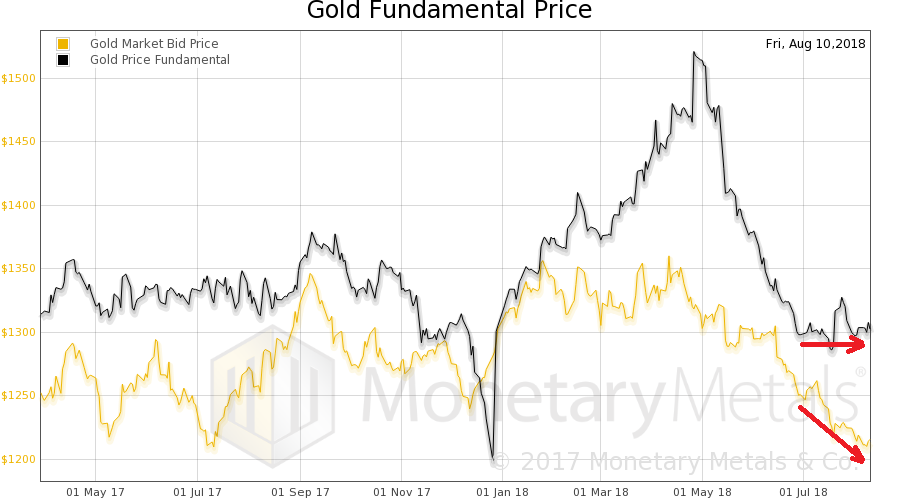

Gold Fundamental PriceAnd the Monetary Metals Gold Fundamental Price also barely moved, down $1 last week to $1,303. However, this is notable. Let’s look at an updated chart of the fundamental gold price, going back to April 2017. The red arrows show the trend since the end of June. The market price has moved down about fifty bucks, in contrast to the fundamental price which has moved sideways. Obviously, this does not mean that the market price cannot go lower. And there is no guarantee that the fundamentals will hold. However, it suggests that traders now ought to be thinking of buying gold. Apart from the contrarian angle, that the price has moved down a lot — about $150 since mid-April — this is the reality of where supply of metal intersects demand of metal. Or, rather, it would be the intersection point if it weren’t for those pesky leveraged speculators who can pull the price away from this intersection. As they are now. |

Gold Fundamental Price |

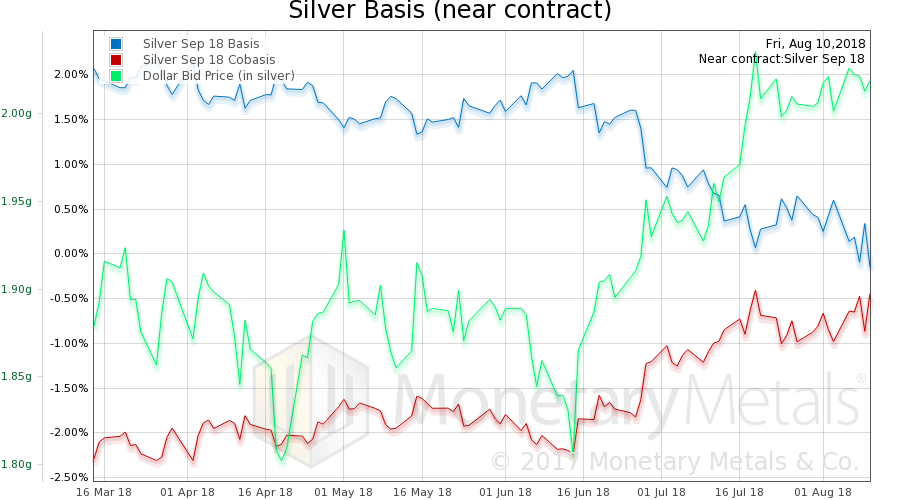

Silver Basis and Co-basisNow let’s look at silver. Although the September silver contract shows a falling basis and rising co-basis, the silver basis continuous didn’t move much. However, the market price of silver dropped this week. The Monetary Metals Silver Fundamental Price fell 29 cents, from $16.52 to $16.23, and it has been in a downtrend since the third week of May. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

Charts by: Monetary Metals

Chart captions by PT

Tags: Chart Update,dollar price,Featured,gold basis,Gold co-basis,gold price,gold silver ratio,newsletter,Precious Metals,silver basis,Silver co-basis,silver price