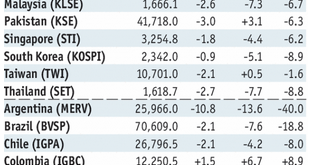

Stock Markets EM FX ended Friday mixed, capping off a mostly softer week. TRY, MXN, and RUB were the top performers and the only ones up against USD, while ARS, CLP, and BRL were the worst. Looking ahead, US jobs data on Friday pose some risks to EM, coming on the heels of a higher than expected 2% y/y rise in PCE. China will also remain on the market’s radar screen, with the first snapshots of June economic activity...

Read More »Emerging Markets: What Changed

Summary PBOC fixed USD/CNY at the highest level since December 14. Bank Indonesia delivered a larger than expected 50 bp to 5.25%. Bulgarian Prime Minister Boyko Borissov survived a second no-confidence vote this year. Turkish President Recep Tayyip Erdogan was re-elected but with sweeping new powers. Saudi Arabia, Kuwait, and UAE are reportedly in talks to help stabilize Bahrain. The South African Reserve Bank...

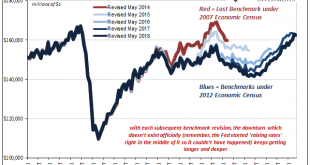

Read More »Revisiting The Revised Revisions

I missed durable goods last month for scheduling reasons, which was a shame given that May is the month each year for benchmark revisions to the series. Since new estimates under the latest revisions were released today, it seems an appropriate time to revisit the topic of data bias, and why that matters. What happens with durable goods (or any data for that matter, the process is largely the same) is that the Census...

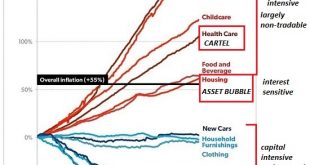

Read More »Make Capital Cheap and Labor Costly, and Guess What Happens?

Employment expands in the Protected cartel-dominated sectors, and declines in every sector exposed to globalization, domestic competition and cheap capital. If you want to understand why the global economy is failing the many while enriching the few, start with the basics: capital, labor and resources. What happens when central banks drop interest rates to near-zero? Capital becomes dirt-cheap. It becomes ludicrously...

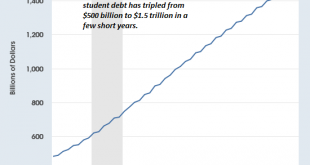

Read More »Dear High School Graduates: the Status Quo “Solutions” Enrich the Few at Your Expense

You deserve a realistic account of the economy you’re joining. Dear high school graduates: please glance at these charts before buying into the conventional life-course being promoted by the status quo. Here’s the summary: the status quo is pressuring you to accept its “solutions”: borrow mega-bucks to attend college, then buy a decaying bungalow or hastily constructed stucco box for $800,000 in a “desirable” city, pay...

Read More »Emerging Markets: Preview of the Week Ahead

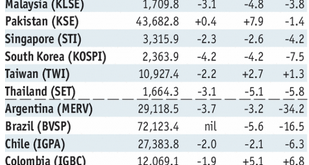

Stock Markets EM FX ended Friday mixed, and capped off a mixed week overall as the dollar’s broad-based rally was sidetracked. EM may start the week on an upbeat after PBOC cut reserve requirements over the weekend. Best EM performers last week were ARS, MXN, and TRY while the worst were THB, IDR, and BRL. Stock Markets Emerging Markets, June 20 - Click to enlarge Indonesia Indonesia reports May trade Monday....

Read More »Emerging Markets: What Changed

Summary Nor Shamsiah Mohd Yunus was named the new Governor of Malaysia’s central bank. Moody’s cut the outlook on Pakistan’s B3 rating to negative from stable. National Bank of Hungary tiled more hawkish. Israeli Prime Minister Benjamin Netanyahu’s wife was charged with misusing public funds. MSCI added Saudi Arabia and Argentina to its Emerging Markets index Brazil’s government its split on the inflation target for...

Read More »Bi-Weekly Economic Review (VIDEO)

[embedded content] Information and opinions about the economy and markets from Alhambra Investments CEO Joe Calhoun. Related posts: Bi-Weekly Economic Review: Bi-Weekly Economic Review – VIDEO Bi-Weekly Economic Review – VIDEO Weekly SNB Intervention Update: SNB Resumes Interventions Cookie policy Privacy Policy Bi-Weekly Economic Review: Oil,...

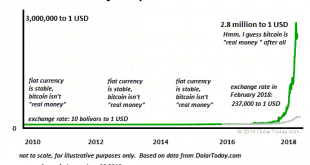

Read More »Gresham’s Law and Bitcoin

Rather suddenly, the state issued fiat currency bolivar lost 99% of its purchasing power. Gresham’s law holds that “bad money drives out good money,” meaning that given a choice of currencies (broadly speaking, “money” that serves as a store of value and a means of exchange), people use depreciating “bad” to buy goods and services and hoard “good” money that is appreciating or holding its value. As this dynamic plays...

Read More »Bi-Weekly Economic Review:

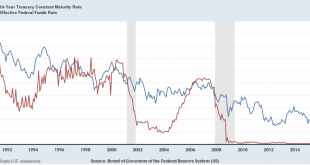

Is the rate hiking cycle almost done? Not the question on everyone’s minds right now so a good time to ask it, I think. A couple of items caught my attention recently that made me at least think about the possibility. There has been for some time now a large short position held by speculators in the futures market for Treasuries. Speculators have been making large and consistent bets that Treasury prices would fall....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org