Our institutional failure reminds me of the phantom legions of Rome’s final days. The mainstream media and its well-paid army of “authorities” / pundits would have us believe the decline in our collective trust in our institutions is the result of fake news, i.e. false narratives and data presented as factual. If only we could rid ourselves of fake news, all would be well, as our institutions are working just fine....

Read More »Bi-Weekly Economic Review – (VIDEO)

[embedded content] Economic thoughts and analysis from Alhambra Investments CEO Joe Calhoun. Related posts: Bi-Weekly Economic Review (VIDEO) Bi-Weekly Economic Review Bi-Weekly Economic Review Bi-Weekly Economic Review: Oil, Interest Rates & Economic Growth Bi-Weekly Economic Review Bi-Weekly Economic Review: As Good As It Gets? Bi-Weekly...

Read More »Buybacks Get All The Macro Hate, But What About Dividends?

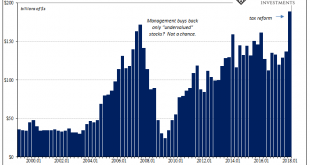

When it comes to the stock market and the corporate cash flow condition, our attention is usually drawn to stock repurchases. With good reason. These controversial uses of scarce internal funds are traditionally argued along the lines of management teams identifying and correcting undervalued shares. History shows, conclusively, that hasn’t really been true. Last year’s tax reform law was meant ideally to spur...

Read More »Will AI “Change the World” Or Simply Boost Profits?

The real battle isn’t between a cartoonish vision or a dystopian nightmare–it’s between decentralized ownership and control of these technologies and centralized ownership and control. The hype about artificial intelligence (AI) and its cousins Big Data and Machine Learning is ubiquitous, and largely unexamined. AI is going to change the world by freeing humankind from most of its labors, etc. etc. etc. Let’s start by...

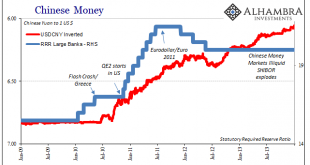

Read More »China’s Seven Years Disinflation

In early 2011, Chinese consumer prices were soaring. Despite an official government mandate for 3% CPI growth, the country’s main price measure started out the year close to 5% and by June was moving toward 7%. It seemed fitting for the time, no matter how uncomfortable it made PBOC officials. China was going to be growing rapidly even if the rest of the world couldn’t. Back then, Western Economists were concerned...

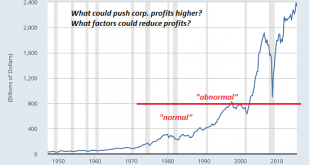

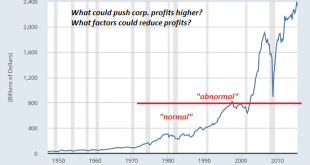

Read More »We Are All Hostages of Corporate Profits

We’re in the endgame of financialization and globalization, and it won’t be pretty for all the hostages of corporate profits. Though you won’t read about it in the mainstream corporate media, the nation is now hostage to outsized corporate profits. The economy and society at large are now totally dependent on soaring corporate profits and the speculative bubbles they fuel, and this renders us all hostages: “Make a move...

Read More »The USA Is Now a 3rd World Nation

I know it hurts, but the reality is painfully obvious: the USA is now a 3rd World nation. Dividing the Earth’s nations into 1st, 2nd and 3rd world has fallen out of favor;apparently it offended sensibilities. It has been replaced by the politically correct developed and developing nations, a terminology which suggests all developing nations are on the pathway to developed-nation status. What’s been lost in jettisoning...

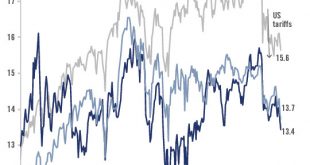

Read More »House View, July 2018

Pictet Wealth Management’s latest positioning across asset classes and investment themes. Asset Allocation On a tactical, rolling three-to-six-month basis, we are tilting away from a bullish to a neutral stance on developed-market equities as trade and political frictions are rising. That said, we remain more upbeat on their prospects after the summer. Recent sell-offs have vindicated our cautiousness regarding...

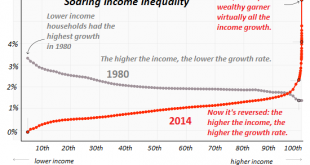

Read More »The Gathering Storm

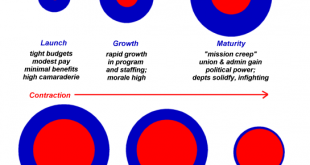

July 4th is an appropriate day to borrow Winston Churchill’s the gathering storm to describe the existential crisis that will envelope America within the next decade. There is no single cause of the gathering storm; in complex systems, dynamics feed back into one another, and the sum of destabilizing disorder is greater than a simple sum of its parts. Causal factors can be roughly broken into two categories: systemic...

Read More »US Vs China – Is It ‘Art Of The Deal’ Or Economic Warfare?

While monetary tightening remains the main risk for global stock markets, the threat of a trade war continues to dominate the headlines… THE DONALD’S DEALMAKING The question raised by Donald Trump’s trade agenda with China remains, in essence, extremely simple. It is whether The Donald is engaged in a typical ‘Art of the Deal’ negotiation, where he can suddenly turn on a dime and declare a ‘win’, or whether he is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org