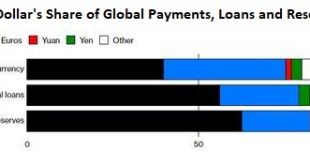

Will bitcoin appear on this chart of global reserve currencies in the future? Could a non-state cryptocurrency like bitcoin become a global reserve currency? I first proposed the idea back in November 2013, long before bitcoin’s rise to $19,000, decline to $3,200, recent ascent to $13,000 and current retrace. The idea is intriguing on a number of levels. In terms of retaining value though thick and thin, the ultimate...

Read More »No, Autos Are Not “Cheaper Now”

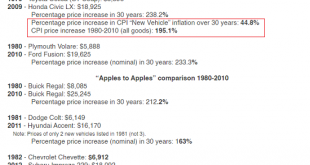

According to the BLS, inflation in the category of “New Vehicles” has been practically non-existent the past 21 years. Longtime readers know I’ve long turned a skeptical gaze at official calculations of inflation, offering real-world analyses such as The Burrito Index: Consumer Prices Have Soared 160% Since 2001 (August 1, 2016) and Burrito Index Update: Burrito Cost Triples, Official Inflation Up 43% from 2001 (May 31,...

Read More »Local Government Is an Engine of Inflation

Insolvency isn’t restricted to private enterprise; governments go broke, too. One reason the economy is so much more precarious than advertised is inflation has pushed households and small businesses to the edge–and one engine of that inflation is local government. This is not to dump on local government, which is facing essentially unlimited demands from the public for more services while mandated cost increases in...

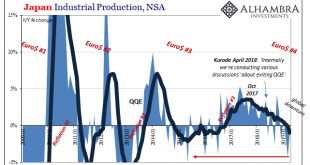

Read More »Japan’s Bellwether On Nasty #4

One reason why Japanese bond yields are approaching records like their German counterparts is the global economy indicated in Japan’s economic accounts. As in Germany, Japan is an outward facing system. It relies on the concept of global growth for marginal changes. Therefore, if the global economy is coming up short, we’d see it in Japan first and maybe best. I wrote in April last year how Japanese Industrial...

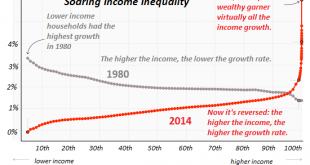

Read More »The Human Cost of “Recovery”: We’re Burning Out

The asymmetries are piling up and we’re cracking under the weight. Judging by the record-high stock market and the record-low unemployment rate, the “recovery” has reached new heights of prosperity. Academics and think-tankers viewing the global economy from 40,000 feet are brimming with policies to bring the remaining laggards into the booming economy. You can imagine them rubbing their hands with glee as they quote...

Read More »The Lessons of Rome: Our Neofeudal Oligarchy

Our society has a legal structure of self-rule and ownership of capital, but in reality it is a Neofeudal Oligarchy. The Inheritance of Rome: Illuminating the Dark Ages 400-1000 is not an easy, breezy read; its length and detail are daunting. The effort is well worth it, as the book helps us understand how the power structures of societies change over time in ways that may be largely invisible to those living through...

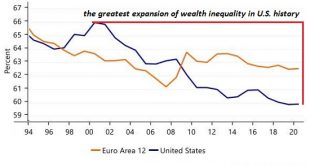

Read More »The Fed’s Casino Is Giving Away Free Gambling Chips (But Only to the Super-Rich)

The rest of us eat our losses, either all at once or in bitter bites as we trudge through the financial wasteland left after bubbles burst. The news that the Federal Reserve Casino is giving away free gambling chips triggered a frenzied rush that trampled the bears, including poor Yogi: There’s just one catch to the giveaway: you have to be rich, and if you want more than a token free gambling chip, you need to be...

Read More »Dear Central Bankers: Prepare to be Swept Away in the Next Wave of Populism

The political moment when the “losers” connect their discontent and decline with central bankers is approaching. The Ruling Elites’ Chattering Classes still haven’t absorbed the key lesson of the 2016 U.S. presidential election: the percentage of the populace that’s becoming wealthier and more financially secure in the bloated, corrupt, self-serving Imperial status quo is declining and the percentage of the populace...

Read More »China looks to new policies to boost infrastructure spending

To stabilise growth, the Chinese government will likely put more focus on infrastructure investment. A new policy announced recently could give a further boost to this sector. Activity data in May point to continued weakness in Chinese economic momentum, with growth in both fixed-asset investment and industrial production slowing last month. The only positive news came from retail sales, where growth picked up after the...

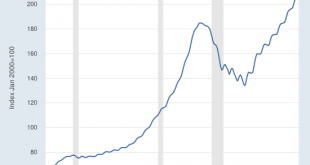

Read More »How Much of Your “Wealth” Is Hostage to Bubbles and Impossible Promises?

All asset “wealth” in credit-asset bubble dependent economies is contingent and ephemeral. A funny thing happens to “wealth” in a bubble economy: it only remains “wealth” if the owner sells at the top of the bubble and invests the proceeds in an asset which isn’t losing purchasing power. Transferring “wealth” to another asset bubble that is also deflating doesn’t preserve the “wealth” from evaporation. All the ironclad...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org