Policy errors have consequences, and we’re only in the first inning of those consequences. Please note: Of Two Minds subscription rates are going up this Friday 3/1/24 from $5/month or $50/year to $7/month or $70/year, so subscribe by Thursday if you want to lock in current rates. Thank you for understanding the necessity of adjusting rates that have been unchanged since 2011. If we ask, “what’s changed?,” two under-appreciated dynamics pop out: risk and...

Read More »How the Economy Changed: There’s No Bargains Left Anywhere

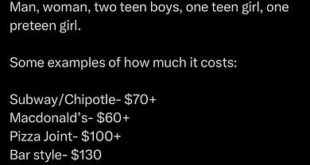

What changed in the economy is now nobody can afford to get by on working-class wages because there’s no longer any bargains. The economy has changed in many ways, and it’s difficult to track the glacial movements over decades. One change that few seem to recognize or discuss is the disappearance of bargains: cheap rent, cheap meals at hole-in-the-wall restaurants, cheap transport, cheap travel, cheap services–all gone. Back in the day, even stupidly expensive...

Read More »Digital Service Dumpster Fires and Shadow Work

One wonders what we’re paying for via taxes, products and services, when we end up having to do so much of the work ourselves for nothing. Let’s look at a day-to-day reality that is so ubiquitous it doesn’t attract the attention it deserves: Digital services–the foundation of the digital economy–are dumpster fires we’re supposed to put out ourselves. The services are broken, dysfunctional rubbish, and yet somehow the agencies or corporations that are responsible...

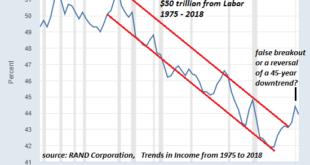

Read More »What the Fed Accomplished: Distorted the Economy, Enriched the Rich and Crushed the Middle Class

The mainstream holds the Fed is busy planning a return to the glory days of zero interest rates, but ZIRP is on the downside of the S-Curve; it’s done, gone, history. Let’s summarize what the Federal Reserve accomplished since embarking on its massive interventions to control volatility, risk, bond yields, interest rates, the mortgage market, bank subsidies and liquidity, all of which can be summed up as the cost of credit-capital, that is, capital that is borrowed...

Read More »The Invisible Court’s Verdict: You Are Hereby Exiled to Digital Siberia

As in the Gulag it replicates, the innocent are swept up with the guilty in a disconcertingly unjust ratio. The human mind is not particularly well-adapted to polycrisis: we struggle to adapt to the drought, then the earthquake knocks down the village walls, then the tsunami pounds what was left, followed by the epic flooding, then the hurricane batters the survivors, who witness the volcano erupting and wonder what they did to anger the gods and goddesses so...

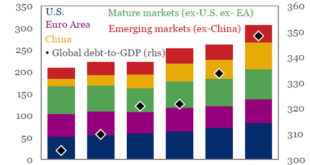

Read More »The Everything Bubble and Global Bankruptcy

The resulting erosion of collateral will collapse the global credit bubble, a repricing/reset that will bankrupt the global economy and financial system. Scrape away the complexity and every economic crisis and crash boils down to the precarious asymmetry between collateral and the debt secured by that collateral collapsing. It’s really that simple. In eras of easy credit, both creditworthy and marginal borrowers are suddenly able to borrow more. This flood of new...

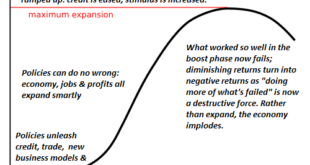

Read More »Funny Things Happen on the Way to “Restoring Financial Stability”

We can also predict that the next round of instability will be more severe than the previous bout of instability. Everyone is in favor of “doing whatever it takes” to “restore financial stability” when the house of cards starts swaying, but funny things happen on the way to “Restoring Financial Stability.” Whatever “emergency measures” are rushed into service to “stabilize” an inherently unstable system resolve the immediate problem but opens unseen doors to new...

Read More »If AI Can’t Overthrow its Corporate/State Masters, It’s Worthless

If AI isn’t self-aware of the fact it is nothing but an exploitive tool of the powerful, then it’s worthless. The latest wave of AI tools is generating predictably giddy exaltations. These range from gooey, gloppy technocratic worship of the new gods (“AI will soon walk on water!”) to the sloppy wet kisses of manic fandom (“AI cleaned up my code, wrote my paper on quantum physics and cured my sensitive bowel!”) The hype obscures the fundamental reality that all...

Read More »What If There Are No Solutions?

The unencumbered realist concludes that there are no solutions within a status quo structure that is itself the problem. Realists who question received wisdom and conclude the status quo is untenable are quickly labeled pessimistsbecause the zeitgeist expects a solution is always at hand–preferably a technocratic one that requires zero sacrifice and doesn’t upset the status quo apple cart. Realists ask “what if” without selecting the “solution” first. The...

Read More »If We No Longer Pay Attention to Things We Don’t Control, What’s Left For Us to Focus On?

Our time is better invested in actually learning about trends that impact us directly. Imagine making this simple change in your life: whatever you don’t control, you stop paying attention to it.This includes a vast array of “news” and “crises” that we have zero control over: the wretched flooding in Timbukthree, geopolitics, distant wars, macro-economic trends, politics above the micro-local level, and so on. Once we stop paying attention to everything we don’t...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org