It was a relatively good weekend in virus-related news; measures of implied volatility continue to trend lower The dollar is trying to build on its recent gains; investors continue to try and gauge just how bad the US economy will get hit The outlook for oil prices remains highly uncertain and volatile Germany signaled that its stance regarding aid to the weaker eurozone countries remains unchanged; the news stream for the UK has turned negative Prime Minister Abe...

Read More »EM Preview for the Week Ahead

EM may get a little support from a potential OPEC+ deal to limit oil. Even if a deal is struck, the impact is likely to be fleeting as the global growth outlook remains terrible. We remain negative on EM for the time being. AMERICAS Mexico reports March CPI Tuesday, which is expected to rise 3.37% y/y vs. 3.70% in February. If so, inflation would move further towards the 3% target. February IP will be reported Wednesday, which is expected to contract -1.2% y/y...

Read More »Dollar Bid as Market Sentiment Worsens

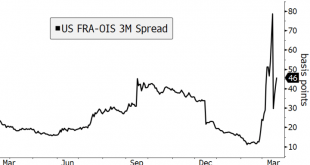

The virus news stream out of Europe has improved a bit The US is already taking about the next relief bill; the Fed continues to roll out measures to address dollar funding issues ADP and ISM manufacturing PMI are the US data highlights Regulators across Europe are asking banks to stop paying dividends; eurozone and UK reported final manufacturing PMIs Japan Q1 Tankan report was released; BOJ tweaked its bond buying program for April RBA minutes were released; Korea...

Read More »Drivers for the Week Ahead

Markets continue to digest the implications of the Fed’s bazooka moment last week The data highlight this week will be March jobs data Friday; key manufacturing sector data will come out earlier in the week On Friday, BOC delivered an emergency 50 bp rate cut to 0.25% and started QE Final eurozone and UK PMI readings for March will be reported; late Friday, Fitch cut UK’s rating by a notch to AA- with negative outlook Japan has a fairly busy data week; RBA minutes...

Read More »ECB Approaching its Bazooka Moment

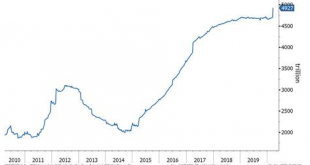

The ECB appears to be moving closer to activating Outright Monetary Transactions (OMT). Despite being part of Draghi’s “whatever it takes” moment, OMT has never been used. If the Fed’s open-ended QE is seen as dollar-negative, then OMT should be seen as euro-negative. ECB Balance Sheet Total Assets, 2010-2019 - Click to enlarge RECENT DEVELOPMENTS At the regularly scheduled March 12 meeting, the ECB delivered a package of easing measures that were in hindsight...

Read More »Drivers for the Week Ahead

Risk sentiment is likely to remain under pressure this week as the impact of the coronavirus continues to spread; demand for dollars remains strong As of this writing, the Senate-led aid bill has stalled; the US economic outlook is getting more dire; Canada is experiencing similar headwinds This is a big data week for the UK; eurozone March flash PMIs will be reported Tuesday; oil prices continue to slide Japan has a heavy data week; RBNZ will start QE; China offers...

Read More »Dollar Firm, Markets Unsettled Despite Aggressive Policy Responses Worldwide

Markets remain unsettled even as policymakers worldwide continue to take aggressive emergency measures; the dollar continues to power higher Fed rolled out another crisis-era program last night; US Senate passed the House virus relief bill by a 90-8 vote ECB held an emergency call last night and announced an additional bond purchase program to the tune of €750 bln that now includes commercial paper SNB kept rates steady at -0.75% as expected; BOJ continues to flood...

Read More »EM Preview for the Week Ahead

Market sentiment is likely to open this week on an upswing after the Fed’s emergency rate cut and expanded QE were announced Sunday afternoon local time. Yet as we have seen time and again this past couple of weeks, added stimulus has had little lasting impact on markets as the virus numbers continue to worsen. Europe is now reporting more daily cases than China did at its peak. We remain negative on EM until the global growth outlook becomes clearer. AMERICAS...

Read More »Dollar Firms, Equities Sink Ahead of ECB Decision as US Fails to Deliver

President Trump spoke to the nation last night and did little to calm markets; reports suggest that the Democrats are working on a bill Fed easing expectations are intensifying The ECB decision will be out at 845 AM ET; over the past 17 ECB decision days, the euro has finished lower in 11 of them Reports suggest the Bank of Japan is “likely to strengthen stimulus” next week; Australia announced details of its AUD17.6 bln stimulus plan The dollar is broadly firmer...

Read More »Dollar Soft as BOE Surprises Ahead of UK Budget

The dollar is stabilizing but remains vulnerable to disappointment as markets await details of US fiscal measures US reports February CPI; Joe Biden moved closer to clinching the Democratic nomination BOE delivered a surprise 50 bp rate cut to 0.25% and initiated a new lending scheme; UK government releases its budget today; UK reported weak data RBA Deputy Governor Debelle laid out the likely path for unconventional policy; China reported disappointing money and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org