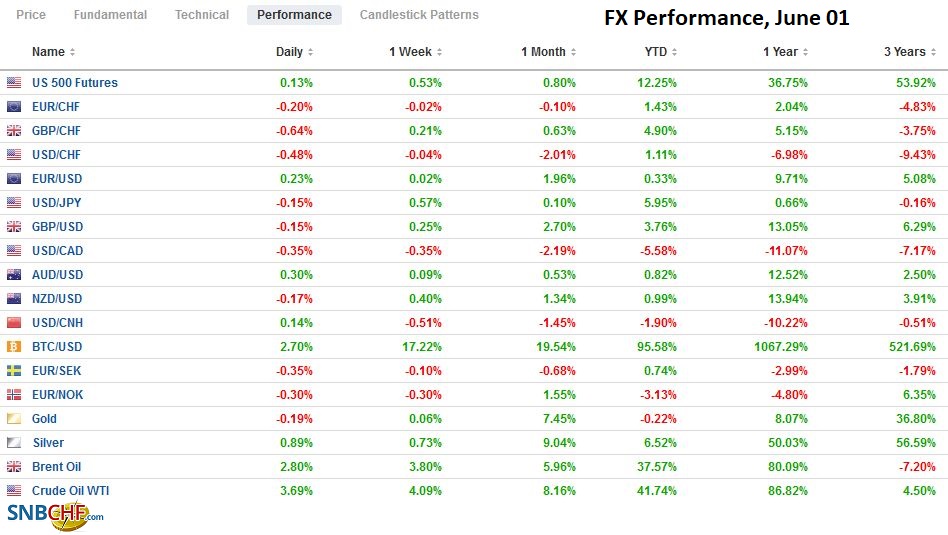

Swiss Franc The Euro has risen by 0.15% to 1.0948 EUR/CHF and USD/CHF, June 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar fell against most major currencies following the PBOC’s modest move to reduce the upward pressure on the yuan. Follow-through selling was seen earlier today, and sterling reached a new three-year high. However, the dollar found a bid in the European morning, while the Scandi currencies held on to most of their earlier gains. Emerging market currencies were mixed, and the yuan eased. The JP Morgan Emerging Market Currency Index’s four-day advancing streak is at risk. Equity markets have begun the new month on firm-footing. The MSCI Asia Pacific Index rose, led by Hong

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, China, China Caixin Manufacturing PMI, Currency Movement, EMU, EUR/CHF, Eurozone Consumer Price Index, Eurozone Manufacturing PMI, Eurozone Unemployment Rate, Featured, inflation, Japan Manufacturing PMI, newsletter, OECD, PMI, South Korea, Switzerland Gross Domestic Product, Switzerland retail sales, U.K. Manufacturing PMI, U.S. ISM Manufacturing Employment, U.S. Manufacturing PMI, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.15% to 1.0948 |

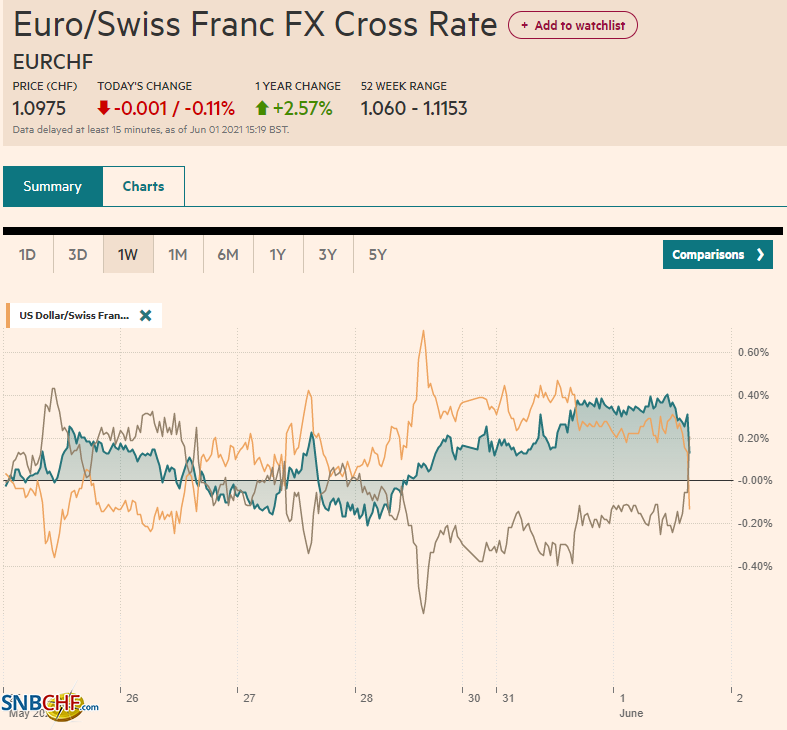

EUR/CHF and USD/CHF, June 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The US dollar fell against most major currencies following the PBOC’s modest move to reduce the upward pressure on the yuan. Follow-through selling was seen earlier today, and sterling reached a new three-year high. However, the dollar found a bid in the European morning, while the Scandi currencies held on to most of their earlier gains. Emerging market currencies were mixed, and the yuan eased. The JP Morgan Emerging Market Currency Index’s four-day advancing streak is at risk. Equity markets have begun the new month on firm-footing. The MSCI Asia Pacific Index rose, led by Hong Kong, Thailand, and New Zealand, to post the third consecutive gain. It has risen 11 of the past 13 sessions. It has rallied from the year’s low in mid-May to the upper end of its three-month trading range. Europe’s Dow Jones Stoxx 600 snapped a seven-day rally yesterday but has come back strongly today to set new record highs. US futures are trading higher. The US 10-year yield is firm near 1.62%, after finishing last week slightly below 1.60%. Most European benchmark yields are slightly firmer. Gold’s gains were extended above $1916, and it saw the best level since January 8 before easing back to little changed levels below $1908. OPEC+ underscored the tightness of markets, and oil prices were lifted to new highs, with oil rallying more than 2% to lift Brent to almost $71 a barrel and the July WTI above $68 a barrel. Other industrial commodities are mixed. Iron ore gained for a third session and is up more than 10% over the run. Steel rebar fell after rising around 6% over the past two sessions. After rising in four of five sessions last week, copper is slightly softer today. |

FX Performance, June 01 |

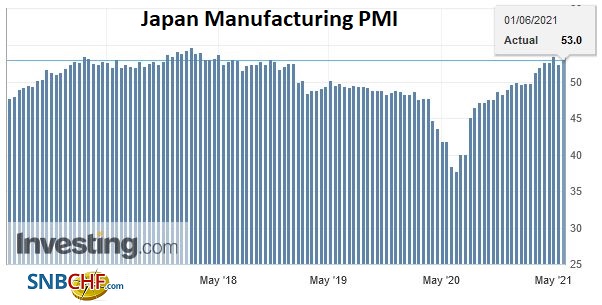

JapanJapan’s final manufacturing PMI suggested the slowing of activity was not as great as initially feared. The 53.0 reading compares with the 52.5 flash estimate and 53.6 in April. Japan also reported a deeper than anticipated contraction in Q1 capital spending. It contracted by 7.8% year-over-year after a 4.8% decline in Q4 20. This risks a downward revision to its GDP estimate (-1.3% quarter-over-quarter). |

Japan Manufacturing PMI, May 2021(see more posts on Japan Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

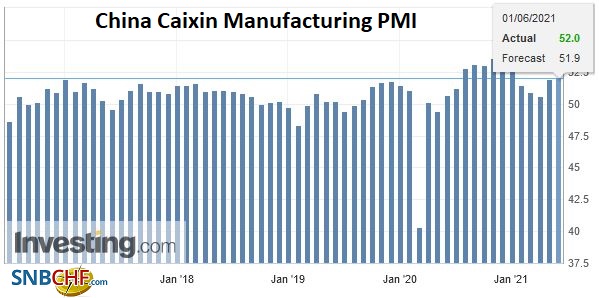

ChinaChina’s Caixin manufacturing PMI edged up to 52.0 from 51.9 in April. The official measures had eased to 51.0 from 51.1. They both told the same story of steady expansion in China’s manufacturing sector. |

China Caixin Manufacturing PMI, May 2021(see more posts on China Caixin Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Asia Pacific

The Reserve Bank of Australia left policy untouched today with a review of its asset purchases and three-year yield target on track for next month. It is focused on the labor market and acknowledged that some signs of a labor shortage were appearing. Separately, the May manufacturing PMI ticked up to 60.4 from the preliminary estimate of 59.9 and 59.7 in April.

South Korea and Taiwan’s May manufacturing PMI eased but remain well in expansion mode. South Korea’s slipped to 53.7 from 54.6. Seoul also reported strong trade figures, with exports accelerating to 45.6% year-over-year in May from 41.2% in April. Imports rose 37.9% from a year ago, after a 33.9% increase in April. Taiwan’s May manufacturing PMI eased to 62.0 from 62.4.

Following the PBOC’s move to increase the reserve requirements for foreign exchange from 5% to 7%, the dollar bounced about 0.35% against the offshore yuan, while the onshore yuan snapped a seven-day advance. It slipped further today. The move comes after the verbal intervention escalated (in terms of frequency) and the dollar’s reference rate, set by the PBOC, began deviating a bit more than usual from market expectations. The unusual move on reserve requirements (the first since 2007) is just a warning shot. Some trigger, in terms of duration of the one-way market, the pace of the move, or perhaps, though unlikely a rather arbitrary line in the sand such as a level, has seen officials climb a few rungs on the escalation ladder. One implication is that if the yuan does not share in the dollar’s devaluation, then the other major currencies may have to be a bigger adjustment.

Beijing took an unexpected and rather bizarre step. In the face of the limited response to allowing families to have two children (2016), the Politburo announced a three-child policy. It was not immediately clear when the policy begins. It could have abolished the birth limits altogether, as some researchers at the PBOC argued. The demographic changes are a slow grind, and it has been evident for years. The recent census report that showed a decline in the working-age population gave impetus to the move. China’s population may begin to shrink by 2025. Yet, the Great Convergence is not just about the eightfold increase in per capita income since 1980 but also in fertility rates. The reason many, if not most high-income countries have experienced a decline in fertility rates is not due to government edict but to the dictates of the market and greater integration of women into the workforce. In China, like America, the high costs of housing and education are also formidable hurdles. Beijing would have only children support four elderly parents, and raise three children. Urbanization, modernity, and legal equality are powerful prophylactics. The risk is that this policy begins a pushback against Chinese women in the workforce and other social discriminations. At the same time, China announced intentions to gradually raise the retirement age from 60 years currently for men and as low as 50 for women.

The dollar rose to about JPY110.20 before the weekend and fell to about JPY109.35 yesterday. It found support ahead of JPY109.30 today and is back near JPY109.60 in the European morning. There is an option that expires today for $325 mln at JPY109.75. US rates still seem to be the key driver.

The Australian dollar had tested May’s low near $0.7675 before the weekend but closed above $0.7700 and held above it yesterday. Today’s gains to almost $0.7770, a four-day high, seemed to exhaust the buying, and consolidation was seen in the European morning.

The US dollar is trading about 0.1% higher against the yuan today. It would be the largest gains since May 19. The PBOC set the dollar’s reference rate at CNY6.3572, sufficiently higher than the median forecast of CNY6.3556, to suggest officials are still expressing displeasure.

EurozoneThere were three data points from the eurozone today. First, the manufacturing PMI was revised to show a small gain in May rather than a small loss of 63.1 from the 62.8 flash report and 62.9 in April. |

Eurozone Manufacturing PMI, May 2021(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

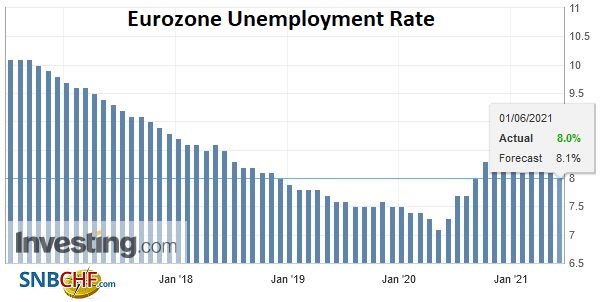

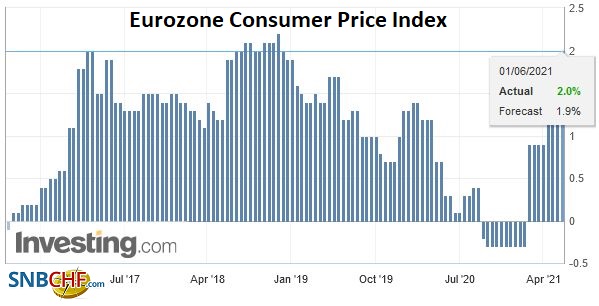

| Second, German and French readings were revised higher while Italy and Spain showed solid gains. Third, the unemployment rate slipped to 8.0% in April from 8.1% in March. Headline CPI rose to 2.0% from 1.6% in April, which reflected a 0.3% month-over-month rise rather than the 0.2% expected. |

Eurozone Unemployment Rate, April 2021(see more posts on Eurozone Unemployment Rate, ) Source: Investing.com - Click to enlarge |

| Fourth, the core rate increased to 0.9%, as expected, from 0.7%. Finally, the vaccine rollout in Europe has accelerated, and the EU plans on lifting restrictions for those who are fully vaccinated as of July 1. |

Eurozone Consumer Price Index (CPI) YoY, May 2021(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

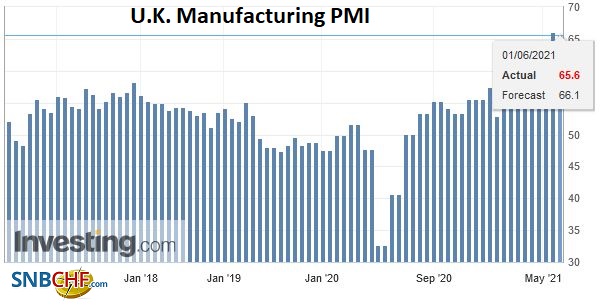

United KingdomThe UK was one of the few countries to see its flash manufacturing PMI revised lower in the final reading. After rising to 60.9 in April from 58.9 in March, the preliminary estimate showed another jump in May to 66.1. However, the final reading put it at a still robust 65.6. Separately, the property tax holiday extension saw house prices accelerate in May to 10.9% from 7.1% in April (Nationwide estimate), a new seven-year high. |

U.K. Manufacturing PMI, May 2021(see more posts on U.K. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Switzerland |

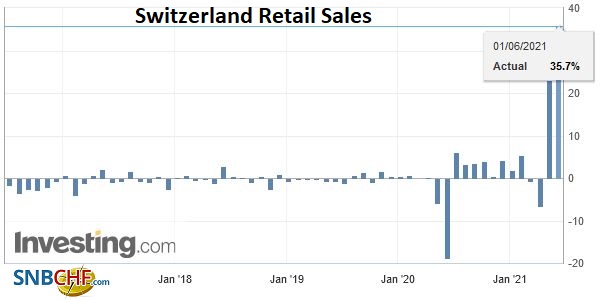

Switzerland Retail Sales YoY, April 2021(see more posts on Switzerland Retail Sales, ) Source: Investing.com - Click to enlarge |

Switzerland Gross Domestic Product (GDP) YoY, Q1 2021(see more posts on Switzerland Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

Germany

Germany is sending a senior diplomatic team to the US to discuss the Nordstream 2 pipeline. Like the previous two administrations, the Biden administration objected to it but has been reluctant to escalate the sanction regime that had been imposed. Meanwhile, Europe is still chaffing under the Trump administration’s steel and aluminum tariffs imposed on national security grounds. Biden has not removed the tariffs. It is as if Trump gave it a negotiating chit that it appears to want something in exchange. Meanwhile, Germany and France have reacted with outrage at the news reports indicating that Danish intelligence had worked with the US to spy on European officials.

Month-end sales saw the euro fall to a two-week low a little below $1.2135 before the weekend when it quickly recovered to back to $1.22. It advanced to about $1.2230 yesterday and marginally extended those gains today to a little above $1.2240. Last week’s high was around $1.2265, and there is an option that expires today at $1.2275 for 1.7 bln euros. There is not much momentum to speak of as the euro has spent most of the Asian session and European morning between $1.2220 and $1.2240. The return of US traders may see an initial attempt to the upside, but we suspect it will be limited.

Sterling managed to close above $1.42 for only the second time in three years yesterday and extended those gains to almost $1.4250 in Asia today. Profit-taking kicked in and send sterling toward $1.4175 in Europe. Support is seen in the $1.4140-$1.4160 area.

United StatesThe OECD updated its economic forecasts and now sees US growth near 6.9% this year. That is up from 6.5% in March and 3.2% in December (before Biden’s $1.9 trillion stimulus package and aggressive vaccination effort). The eurozone is now forecast to expand by 4.3% rather than 3.9%. China’s growth is estimated to be 8.5%, up from 7.8%. Growth projections in the UK were revised to 7.2% from 5.1%. India was a notable exception to the OECD’s optimism. The recovery was marked down to 9.9% from 12.6%. |

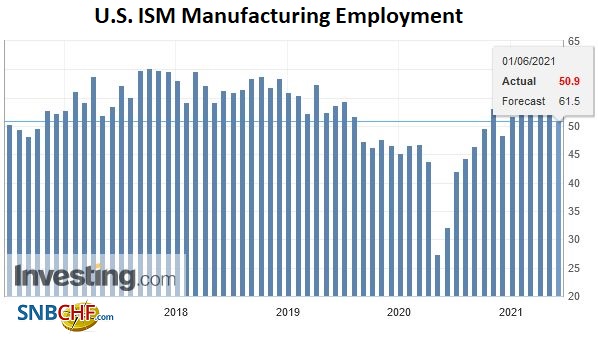

U.S. ISM Manufacturing Employment, May 2021(see more posts on U.S. ISM Manufacturing Employment, ) Source: Investing.com - Click to enlarge |

| The US has a full slate of economic reports today. First, the final manufacturing PMI is due. The flash showed a rise to 61.5 from 60.5. However, it is the manufacturing ISM that may draw more attention. It is projected to rise to 60.9 from 60.7. New orders and employment will be watched closely for obvious reasons, but it may be a decline in prices paid (median forecast in Bloomberg’s survey is for 89.0 after 89.6) that may spur the greatest market reaction. Second, April’s construction spending is expected to have accelerated (0.5% vs. 0.2% in March). Finally, Fed governors Quarles and Brainard speak today at a Politico event and the Economic Club of New York, respectively. |

U.S. Manufacturing PMI, May 2021(see more posts on U.S. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Canada

Canada reports March monthly GDP (1.0% expected after 0.4% in February). This will allow it to estimate Q1 GDP. The median forecast in Bloomberg’s survey is for a 6.8% annualized pace after a 9.6% pace in Q4. Mexico reports April worker remittances, an important source of hard currency coming into the country. Mexico’s Markit PMI rose each month this year through April but remains below 50. The May estimate is due today. The IMEF manufacturing and non-manufacturing indices show the Mexican recovery continues. Brazil reported Q1 GDP (0.9% quarter-over-quarter is anticipated after the 3.2% surge in Q4 20. May’s trade balance (a large surplus even if not as big as the $10.3 bln reported in April) and the manufacturing PMI are also on tap.

The US dollar slipped to a five-day low just ahead of CAD1.2025, where a $350 mln option expires today. The multi-year low was set on May 18, just below CAD1.2020. The CAD1.20 is a significant technical level. Initial resistance is near CAD1.2070.

Although the dollar moved above MXN20.00 in the last two sessions of last week, it failed to close above it once. Support is seen in the MXN19.80-MXN19.82 area. The market may be cautious ahead of the weekend legislative and local elections. Asset managers appear to like Brazil, and the dollar is testing support near BRL5.20. It was briefly below there in January. A convincing break would target BRL5.00.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,China,China Caixin Manufacturing PMI,Currency Movement,EMU,EUR/CHF,Eurozone Consumer Price Index,Eurozone Manufacturing PMI,Eurozone Unemployment Rate,Featured,inflation,Japan Manufacturing PMI,newsletter,OECD,PMI,South Korea,Switzerland Gross Domestic Product,Switzerland Retail Sales,U.K. Manufacturing PMI,U.S. ISM Manufacturing Employment,U.S. Manufacturing PMI,USD/CHF