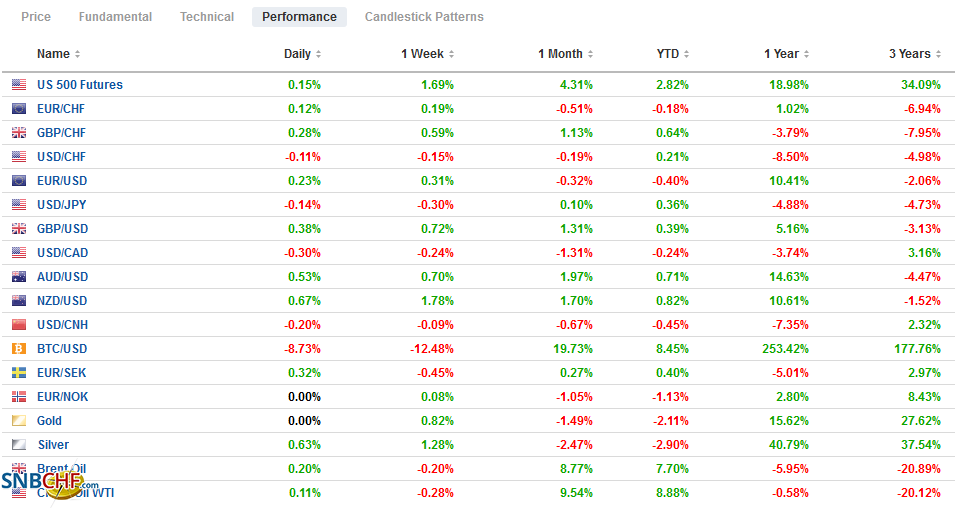

Swiss Franc The Euro has risen by 0.10% to 1.0791 EUR/CHF and USD/CHF, January 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After rallying strongly to start the year, Asia Pacific equities, led by the high-flying Hang Seng, sold-off, led by Tencent. Most markets in the region were off at least 1%. Australia and India escaped the profit-taking due to holidays. Europe’s Dow Jones Stoxx 600 is faring better and looks poised to snap a two-day fall, led by materials, financials, information technology, and consumer staples. US shares are trading a little heavier. The US earnings season picks up today, with Microsoft, J&J, Texas Instruments, AMD, 3M, and GE, among others. The US 10-year yield, which the

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brazil, China, Currency Movement, Featured, Italy, newsletter, South Korea, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.10% to 1.0791 |

EUR/CHF and USD/CHF, January 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

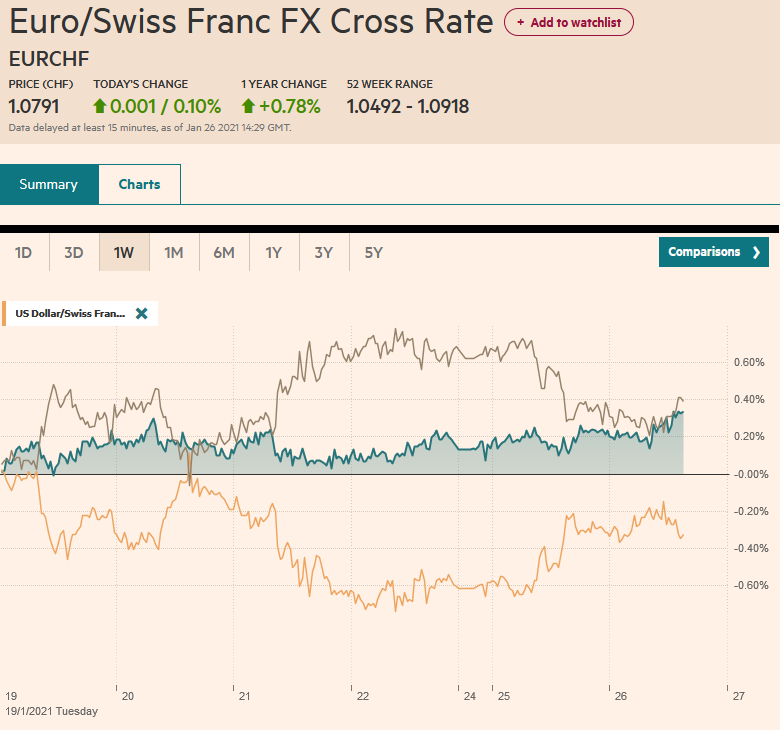

FX RatesOverview: After rallying strongly to start the year, Asia Pacific equities, led by the high-flying Hang Seng, sold-off, led by Tencent. Most markets in the region were off at least 1%. Australia and India escaped the profit-taking due to holidays. Europe’s Dow Jones Stoxx 600 is faring better and looks poised to snap a two-day fall, led by materials, financials, information technology, and consumer staples. US shares are trading a little heavier. The US earnings season picks up today, with Microsoft, J&J, Texas Instruments, AMD, 3M, and GE, among others. The US 10-year yield, which the consensus expected to push above 1.20%, slipped below 1.03% yesterday, its lowest level in nearly three weeks. It is hovering below 1.05% in the European morning. Yesterday’s decline dragged Asia-Pacific yields lower, but core European yields have come back firmer, though Italy’s 10-year yield extended yesterday’s drop despite the seemingly political uncertainty. The dollar is trading higher, with the Scandias and Antipodeans bearing the brunt. The yen, euro, and Canadian dollar are slightly softer. Emerging market currencies are mixed. Even though most of the freely accessible emerging market currencies are lower, the JP Morgan Emerging Market Currency Index is trading to snap a three-day decline. Gold is trading slightly off but remains within the range seen before the weekend (~$1837.50-$1871). March WTI is firm near three-day highs a little above $53 a barrel. |

FX Performance, January 26 |

Asia Pacific

MSCI is dropping more Chinese companies from its China All-Share Index to be in line with US edicts. This entails excluding China National Chemical, China Nuclear Power, China Shipbuilding Industries, among others. This drives homes an element of American soft power, and one in which the Biden administration is in no hurry to change.

China’s President Xi complained about the US without naming it in his speech at the World Economic Forum. While he brandished multilateralism as a cudgel to hit the US, while he was quite unwilling to apply it to China’s behavior in its own neighborhood. It discourages countries from seeking remedy for disputes in international forums and insists on bilateral negotiations where its power can be brought to bear. Xi had nothing to say about its unilateral trade disruptions with Australia, Canada, or in the past, Japan. Separately, reports suggest Germany is considering sending a naval frigate into the region for a series of port-of-calls in South Korea, Australia, and through the disputed waters of the South China Sea.

South Korea reported Q4 20 GDP expanded by 1.1%. While it was slower than Q3 growth of 2.1%, it was better than the 0.9% median estimate in the Bloomberg survey. The year-over-year contraction of 1.4% was also a little less than expected and could be among the least in the OECD. The preliminary data suggests the strength of its exports helped offset the weakness in domestic demand. China is its number one export market (~25%), and the US is the second-largest (~12%). Vietnam is the third-largest South Korean export market (~~8%).

Today may be the fifth consecutive session that the dollar remains below JPY104. The peak last week was near JPY104.10. The dollar is in a narrow range of less than 20 pips today and holding above the 20-day moving average (~JPY103.60). The Australian dollar was sold back toward last week’s low (~$0.7660) during the local holiday. It recouped some ground in late-Asia/early European activity. Initial resistance is now seen near $0.7720. The dollar’s reference rate was set at CNY6.4847 by the PBOC today, a touch firmer than expected. Month-end money market pressures and a draining operation by the central bank saw the overnight repo rate jump 28 bp to 2.77%, the highest since October 2019. Note that the onshore yuan (CNY) continues to trade firmer than the offshore yuan (CNH) for the fourth consecutive session and suggest speculative and foreign demand slackened, which is consistent with our expectation for continued consolidation.

Europe

Facing a likely defeat in the Senate this week, Italy’s Prime Minister will tender his resignation before getting fired. In some ways, one might say an election is due, even though the parliament session extends to the end of May 2023. Since the end of WWII, the average Italian government lasts about 13 months. President Mattarella will offer Conte the first chance to put together a new government with the existing parliament. This is Conte’s gambit, and it is easier to do when resigning than losing a confidence vote. He will likely seek a broader coalition with some independents, centrists, and possibly some stranglers in Berlusconi’s fold. Given the public health crisis and the economic crisis, plus incomplete political reform, and the largest party in parliament, the Five-Star Movement, has seen its popular support collapse. Most, except for the far-right, do not seem to truly desire an election now. The news broke after the European markets closed for the day and Italy’s 10-year benchmark yield eased a little more than 7 bp, and the premium over Germany narrowed by around 3.5 bp. The spread is narrowing by another three basis points today. The euro had recorded the session low (~$1.2115) before the European close yesterday and recovered around a third of a cent afterward, and consolidating in the US afternoon mostly above $1.2140.

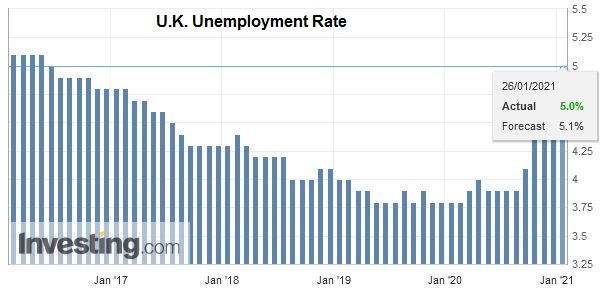

| As calculated by the International Labour Office, the UK’s unemployment rate rose to 5.0% in the three-months through last November (4.9% previously) and is the highest in around four years. The details were not as bad as feared in no small part due to the furlough program’s extension as new social restrictions were imposed. The jobless claims rose by 7k in December, after the November series was revised to 38.1k from 64.3k. The number of people working fell by 88k in the three months through November, which is the smallest decline since July. The furlough program currently ends in April but is expected to be extended. Perhaps it will be announced with the budget in early March. |

U.K. Unemployment Rate, November 2020(see more posts on U.K. Unemployment Rate, ) Source: investing.com - Click to enlarge |

The euro held above $1.2100 in late Asia dealings, where an option for a little more than 725 mln euros will expire later today. The subsequent bounce faltered in front resistance seen near $1.2150. Look for a consolidative North American session. Enthusiasm for the single currency seems limited now, and tomorrow there is an option for a billion euros struck at $1.22 that will be cut. Sterling slipped to a five-day low a little above $1.3600. Resistance is seen in the $1.3660-$1.3680 area. The euro is encountering offers around GBP0.8900, which it has not closed above since January 13.

America

Leaving aside the partisanship, it is best to understand that the $1.9 trillion stimulus proposal by the new Biden administration is a negotiating document. Media and pundits demonstrate a firm grasp of the obvious when they proclaim the bill will not pass in its current form. Of course not, and no one really thought otherwise. The bills face opposition from some moderate Democrats, who would have enhanced clout, and other measures, including the minimum wage hike, would be removed under the terms of reconciliation. Biden, we have argued, is moderate and would naturally be inclined to see politics as the art of the possible rather than an expression of ideological purity. Part of the consideration, too, is that some of the jobless benefits will expire in March, and there does seem to be bipartisan support for an extension and funds for the vaccine rollout. There was a little realistic chance that it was going to be approved before the impeachment trial begins. Meanwhile, two Democratic Senators have indicated they will not support a move to get rid of the filibuster, allowing Republicans greater sway and will likely force more compromise. It will likely dilute part of Biden’s agenda but could also mean more gets done.

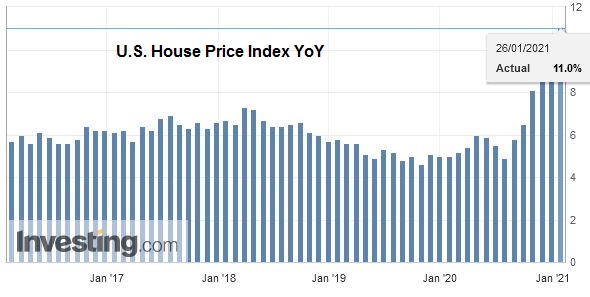

| House prices, the Conference Board’s survey, and the Richmond Fed’s manufacturing survey do not typically have the heft to move the capital markets. Tomorrow’s FOMC meeting, and especially Chair Powell’s press conference, looms large. The US Treasury auctions a record $61 bln five-year notes today. Yesterday’s record sale of two-year notes was well received. The rate was a new record low, and the bid-cover was higher than the recent average. The amount taken by indirect bidders was a five-month high, leaving dealers with the least since last April. |

U.S. House Price Index YoY, November 2020(see more posts on U.S. House Price Index, ) Source: investing.com - Click to enlarge |

There is much talk about closer US-European ties, and it is still early days, but skepticism lingers after the EU struck the investment agreement with China at the end of last year. Other recent moves by Europe send a message to the new US administration that it is not 2016. Now the EU has announced it would downgrade Venezuela’s Guaido from the national assembly head to a “privileged interlocutor.” Perhaps it is the right move, but coordination with the US would have been helpful.

Mexico reports November retail sales today. A recovery of 1.2% is expected after a 1.4% decline in October. The highlight of the week is the Q4 GDP estimate at the end of the week. Mexico’s economy is expected to have grown by 3% after a 12.1% expansion in Q3. That would still leave the economy a little more than 5% smaller for the year. Brazil reports IPCA-15 inflation for this month. A 0.8% increase would lift the year-over-year rate above 4.3% and plays on ideas that the central bank may raise rates as soon as its next meeting in March.

For the third consecutive session, the greenback is making new highs against the Canadian dollar. Recall that the US dollar fell to its lowest level since April 2018 last week (a little below CAD1.26 on January 21) but reversed higher. It has taken out yesterday’s high by a few ticks to rise to almost CAD1.2785. It has not closed above CAD1.28 since late last year. The high this month, so far, is about CAD1.2835. Initial support today may be found near CAD1.2730. Similarly, the US dollar recorded a low against the Mexican peso last week near MXM19.55 and has bounced back strongly. It extended its gain to a new high for the month today, just above MXN20.29. However, the dollar has seen is gains pared in the European morning and is little changed as North American operatives return to their posts. The first level of support may appear near MXN20.00 and then MXN19.92.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brazil,China,Currency Movement,Featured,Italy,newsletter,South Korea