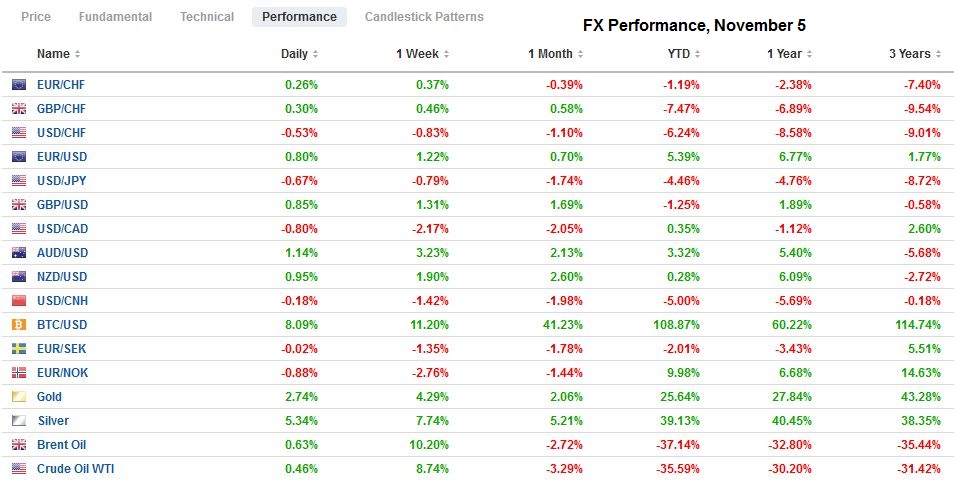

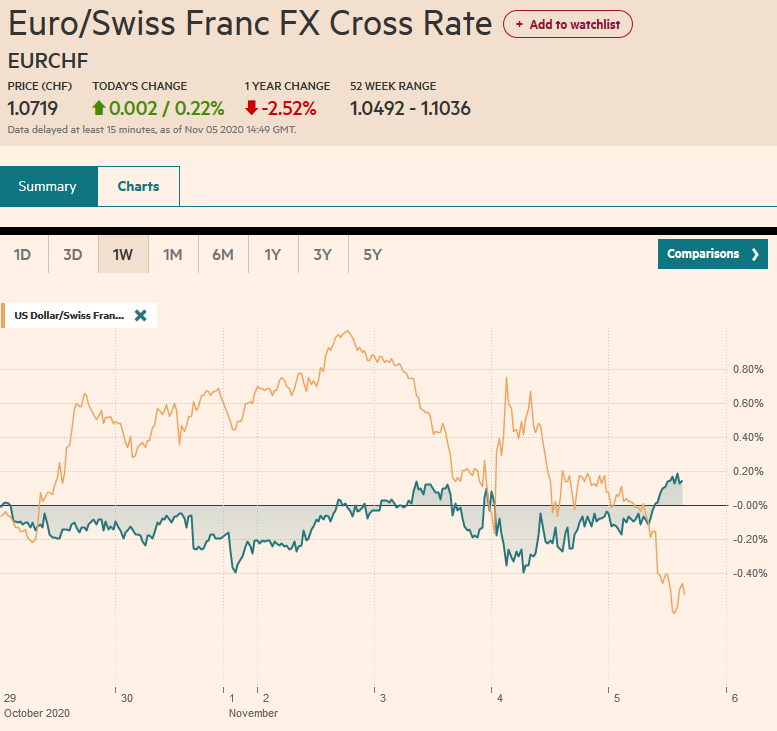

Swiss Franc The Euro has risen by 0.22% to 1.0719 EUR/CHF and USD/CHF, November 5(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The markets did not wait for the final vote count and took stocks and bonds higher while pushing the greenback lower. While it appears Biden will be the next US President, investors seemed to like the fact that his agenda will be checked by a Senate that may remain in Republican hands. Stocks are on a tear. Led by more than a 3% advance in Hong Kong and a nearly 2.5% in South Korea, the MSCI Asia Pacific Index rose to its best level since March 2018 today. Europe’s Dow Jones Stoxx 600 is up almost 1% to bring this week’s rally to more than 6.5%. US shares are extending their

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Australia, Bank of England, China, Currency Movement, EUR/CHF, Featured, FOMC, newsletter, Norway, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.22% to 1.0719 |

EUR/CHF and USD/CHF, November 5(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The markets did not wait for the final vote count and took stocks and bonds higher while pushing the greenback lower. While it appears Biden will be the next US President, investors seemed to like the fact that his agenda will be checked by a Senate that may remain in Republican hands. Stocks are on a tear. Led by more than a 3% advance in Hong Kong and a nearly 2.5% in South Korea, the MSCI Asia Pacific Index rose to its best level since March 2018 today. Europe’s Dow Jones Stoxx 600 is up almost 1% to bring this week’s rally to more than 6.5%. US shares are extending their advance as well, and the S&P 500 futures are up around 2%. Bonds have also continued to rally. The US 10-year yield is off two basis points to 0.74%, a 13 bp decline this week. European bond yields are also lower, with the periphery leading the way. The greenback remains heavy. The euro pushed above $1.18. Sterling is firm, trading through $1.30, even after the Bank of England extended its bond purchases by more than expected. The Australian dollar is establishing a hold above $0.7200. The Chinese yuan is at new two-year highs. Most emerging market currencies are higher, and the JP Morgan Emerging Market Currency Index is approaching its 200-day moving average, which it has not traded above this year. It is the first day since October 21 that gold is holding above $1900. It reached almost $1920 in Europe. Oil prices are consolidating after yesterday’s 4% surge. |

FX Performance, November 5 |

Asia Pacific

China’s leader Xi gave a speech at the trade expo in Shanghai earlier today. He seemed to try to reassure the world that the “dual circulation” and the move to block the Ant IPO were no signs of China turning inward. Still, he seemed to clear that China will become less dependent on foreign technology, which is an expression of import substitution. Even the claim that China will import more than $22 trillion of goods over the next decade poised to limited growth in imports. China imported around $2.1 trillion of goods last year (before the pandemic). Some observers have argued that because China runs a trade surplus, it is not doing “its share” to help the world economy. Yet, the net balance may be a poor metric for such a claim. It is the gross imports that provide a source of demand for many countries’ commodities and goods.

Despite escalating trade tensions with China, Australia reported a much larger than expected trade surplus for September. The trade surplus more than doubled from August’s A$2.6 bln to A$5.6. The average monthly surplus is running about A$1.5 bln more than a year ago. Exports were stronger than expected, rising 4% on the month after a 4% decline in August. Imports tumbled 6%, The median forecast in the Bloomberg survey anticipated a 1% decline, while the August series was revised to show a 1% gain instead of 2%. About half the decline in merchandise imports is accounted for by the ASEAN countries and the other half from the EU.

The US dollar is consolidating in the lower end of yesterday’s range against the yen and is in a narrow JPY104.20-JPY104.55 range today. The JPY104 level, which has been successfully tested in September and October. A break, which we expect even if not quite yet, would likely herald a new trading range. The lower yields do the greenback little favor in the eyes of many institutional investors in Tokyo. Attempts to rally the dollar may be stymied by options struck at JPY105. One for nearly $965 mln expires today, and a $1 bln option there expires tomorrow. The Australian dollar has shrugged off the RBA rate cut and extended QE announced earlier this week. The Australian dollar had recovered from the dip below $0.7000 on Monday to $0.7220 yesterday. It has held below yesterday’s highs so far today, but the next target is near $0.7250. Meanwhile, the Chinese yuan is at new two-year highs. The greenback has spiked to almost CNY6.75 yesterday but reversed to nearly CNY6.65 and today has fallen to almost CNY6.6265. The PBOC set the dollar’s reference rate at CNY6.6895, slightly higher than the market anticipated.

EuropeThe Bank of England announced that it would boost its Gilt purchases by GBP150 bln. This is more than the market expected (~GBP100 bln). However, it did not cut rates, which had also been a possibility. It left is corporate bond purchases at GBP20 bln. The new purchases will begin in January. The BOE also warned that the economy may contract 2% here in Q4. The decision was unanimous. It comes ahead of Chancellor of the Exchequer Sunak presentation to Parliament of the new wage support effort and extension of the furlough program. Meanwhile, two weeks of intensified trade talks with the EU have not resulted in a breakthrough. Next week is now seen as the last week of talks, but… German factory orders were weaker than expected in September, suggesting that Europe’s largest economy may have entered its new social restrictions with fading economic momentum. This has also been evident in the PMI. Factory orders rose by 0.5%, a quarter of the gain economists projected, while the August series was revised to show a 4.9% gain instead of 4.5%. Demand from other eurozone members fell sharply, while non-eurozone and domestic demand firmed. Germany reports September industrial output figures tomorrow, and economists expect them to fare better, flattered by the German auto sector’s recovery. |

Eurozone Retail Sales YoY, September 2020(see more posts on Eurozone Retail Sales, ) Source: investing.com - Click to enlarge |

Norway’s Norges Bank kept rates steady at zero. It recognizes that the economy is in a “deep downturn” but did not change its outlook from September. It expects no change in rates for the next couple of years. Separately, Sweden reported its economy expanded by 4.3% in Q3, after an 8.6% contraction in Q2. Economists in the Bloomberg survey had expected a 5% quarterly growth.

The euro’s recovery from the test on $1.16 yesterday continues and the single currency poked above $1.18 in the European morning for the first time since October 27. The $1.18-area is the middle of the four-cent range that has confined the euro since late July. There is a 1.6 bln euro option there that expires tomorrow. The next important chart point is near $1.1865. Just as the Australian dollar rallied after the RBA’s move, so too has sterling strengthened after the BOE’s announcement. Sterling is trading within yesterday’s range (~$1.2915-$1.3140) but is making new session highs (~$1.3060) in late morning turnover. The euro posted a potential key reversal higher against sterling yesterday and resurfaced above GBP0.9000 after falling to around GBP:0.8945, a two-month low. Follow-through buying today has lifted the euro to almost GBP0.9070 before consolidating.

America

Sometimes the FOMC meeting is riveting. Today is not one of them. There appears to be little for the Fed to do and not much to say. If anything, the high-frequency data has been more resilient than expected, but the recovery remains uneven, incomplete, and fragile. Fed officials see the economy requiring ongoing monetary support and in need of more fiscal assistance. The anticipation of large fiscal stimulus had weighed on the curve’s long-end, and now the market is judging it is somewhat less likely. Although yield curve control seems less likely at this juncture than it did a few months ago, the Fed is understood to be discussing shifting its $80 bln a month Treasury buying toward the longer-end. It is difficult to envision Chair Powell being hawkish. The softer than expected ADP private-sector employment estimate (465k vs. 643k expected) may hint at a potential weak national figure, though the two do not line up well on a monthly basis. Note too that the Treasury Department announced a record $122 bln refunding for next week.

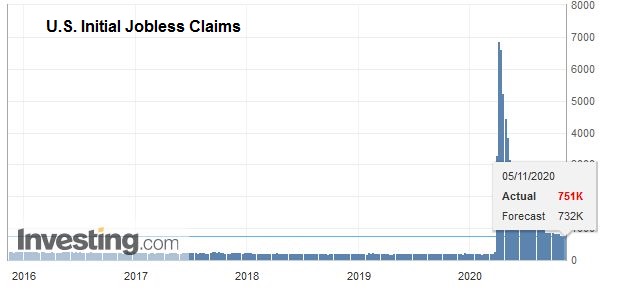

| Before hearing from the Fed, investors will see weekly initial jobless claims. Most look for continued gradual improvement, and the median forecast in the Bloomberg survey is that 725k Americans filed for initial jobless benefits in the last week of October. The risk is for some disappointment, it would seem. The US also reports Q3 productivity and unit labor costs figures, which are derived from Q3 GDP. Canada has a light schedule ahead of tomorrow’s employment data. Mexico reports domestic vehicle sales and consumer confidence, which are not market movers. Note that next week, Banxico meets (November 12). |

U.S. Initial Jobless Claims, November 5, 2020(see more posts on U.S. Initial Jobless Claims, ) Source: investing.com - Click to enlarge |

The US dollar is pinned near its recent lows against the Canadian dollar near CAD.1.3100. It had spiked to CAD1.3080 on October 21 but has not settled below CAD1.3100 since early September. A convincing break of CAD1.3080 would target the September 1 low just below CAD1.3000. The low for the year was set in early January near CAD1.2955. The greenback is slumping against the Mexican peso, and near MXN20.70, it has returned to levels not seen since March. Recall that in yesterday’s spike, the greenback reached almost MXN22.00 but reversed and closed below Monday’s low for a big reversal that may have washed out stale positions. A Biden presidency is expected to improve relations with both Canada and Mexico.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Australia,Bank of England,China,Currency Movement,EUR/CHF,Featured,FOMC,newsletter,Norway,USD/CHF