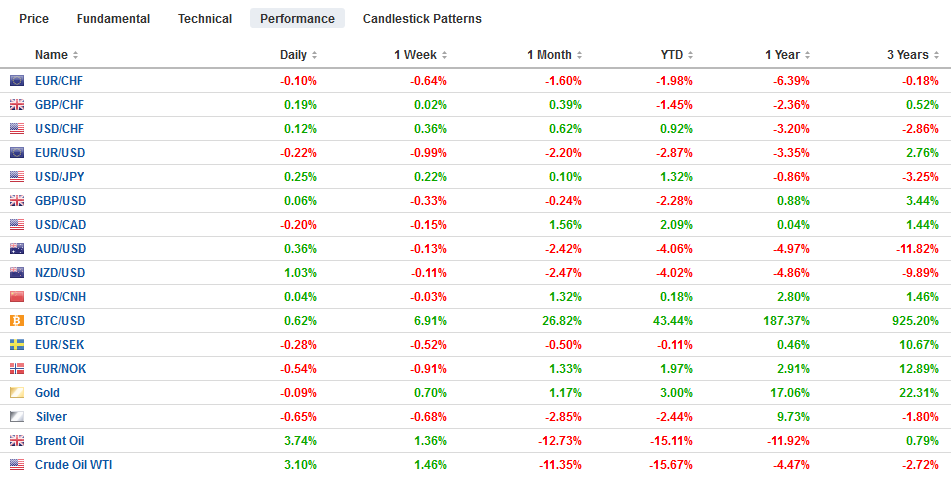

Swiss Franc The Euro has fallen by 0.08% to 1.064 EUR/CHF and USD/CHF, February 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors appear to be increasingly looking past the latest coronavirus from China as new afflictions slow. Despite the soggy close of US equities yesterday, Asia Pacific bourses are nearly all higher, led by more than 1% gains in Singapore and Thailand. The Dow Jones Stoxx 600 is at new record highs, led by consumer discretionary and materials sectors. US shares are also trading higher. Safe haven flows into bonds continues to unwind. Benchmark yields are mostly higher, led by the 10 bp jump in New Zealand’s 10-year yield following a hawkish hold by the Reserve Bank. European

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, China, Currency Movement, EUR/CHF, Eurozone Industrial Production, Featured, Federal Reserve, newsletter, Philippines, RBNZ, Riksbank, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.08% to 1.064 |

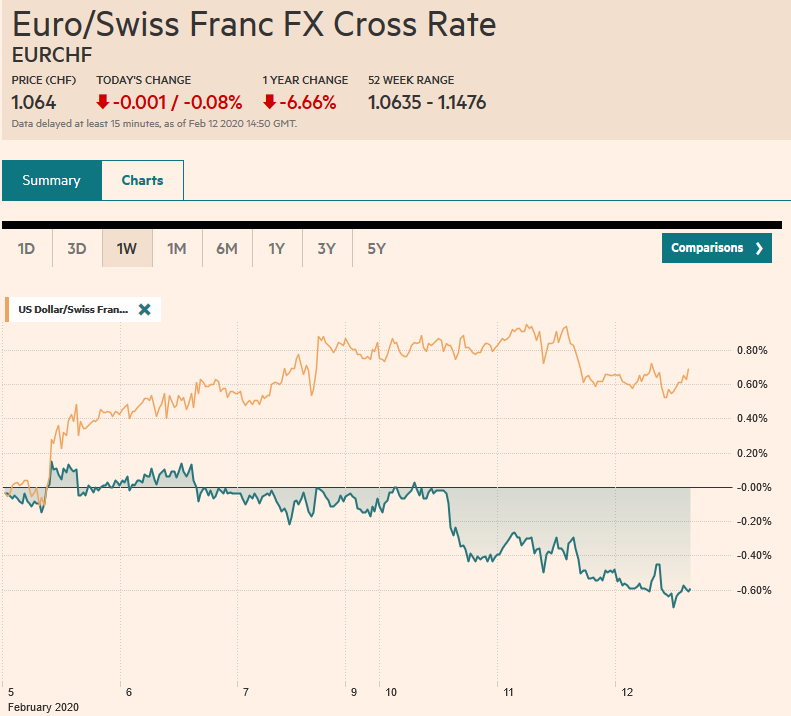

EUR/CHF and USD/CHF, February 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Investors appear to be increasingly looking past the latest coronavirus from China as new afflictions slow. Despite the soggy close of US equities yesterday, Asia Pacific bourses are nearly all higher, led by more than 1% gains in Singapore and Thailand. The Dow Jones Stoxx 600 is at new record highs, led by consumer discretionary and materials sectors. US shares are also trading higher. Safe haven flows into bonds continues to unwind. Benchmark yields are mostly higher, led by the 10 bp jump in New Zealand’s 10-year yield following a hawkish hold by the Reserve Bank. European yields are 1-2 bp higher, but Italian and Spanish bonds, are being treated as risk-assets, with yields slipping a little. The 10-year Greek bond yield fell below 1% for the first time. The dollar is seeing last week’s gains consolidated or pared. The yen is underperforming as the dollar seeks a foothold above JPY110.00. Gold is lower for the second session. It ended a four-day, roughly $19 rally yesterday and is lower again today. It is off about $7 since Monday’s close. Oil prices are stabilizing, and the March WTI contract is at a new three-day high just below $51 a barrel. |

FX Performance, February 12 |

Asia Pacific

The Reserve Bank of New Zealand delivered a hawkish hold. Like many investors, it is looking past the coronavirus, which it anticipates is a short-run disruption (six weeks?).The central bank suggested fiscal rather than monetary policy will be drawn on to respond to the fallout. It dropped its reference to lower rates this year, and the market followed. The RBNZ raised the interest rate path from 0.9% to 1.0%. The New Zealand dollar rallied over 1% for its first back-to-back gain in a month and the largest advance in almost two and a half months.

Beijing is nearly doubling local governments’ quota to issue debt. Many had begun tapping this year’s quota last year as Beijing unrolled efforts to support the economy. On top of the previously approved CNY1 trillion, local governments were granted authority to borrow another nearly CNY850 bln, almost a third of which is regarded as “special” debt earmarked for local infrastructure and rail. Beijing sees growth as more important than ever, and Reuters reported that China’s Xi is concerned that efforts to contain the virus may have gone too far in some areas and is threatening the economy.

Previously we noted that the US push for “cost-plus-50%,” under which nations with US bases should cover the cost and pay an additional 50% went over like a lead zeppelin. South Korea was so outraged that it began what appears to be a low-level military cooperation agreement with China. Yesterday, the tension between the US and the Philippines reached a breaking point, literally. The Philippines has formally notified the US that it is ending the Visiting Forces Agreement that allows US troops to train in the country, and exempts participants from visa and passport controls. That said, it is not clear how much the Philippines President and US critic Duterte is using the agreement as a bargaining chip. However, it must be more simply renewing the visa for former Philippines national chief of police, which was canceled in January. US presence in the Philippines helps combat local rebels and is a sign of force to vis-a-vis China and its territorial claims in the region. At the same time, the proposed budget unveiled by the White House earlier this week may be dead-on-arrival as they typically are, but the cuts in foreign aid illustrate no concrete alternative to China’s Belt Road Initiative, for which coronavirus is a tragic short-run disruption.

The dollar is straddling the JPY110 level, the upper end of this year’s range. There are chunky options for almost $1.4 bln at JPY110 and JPY110.05. Support is seen near JPY109.75 and JPY109.50. The Australian dollar has been aided by the risk-appetite, and perhaps, by the New Zealand dollar. The Aussie, which set multi-year lows around $0.6060 earlier this week, is now probing near $0.6750, where an option for A$795 mln will roll off today. The dollar is edging higher against the Chinese yuan after two days of declines. It is trading near CNY6.97 after finishing last week a little above CNY7.0.

Europe

That the EU rebuffed UK Chancellor of the Exchequer’s suggestion that regulation equivalency should be recognized for years at a time was not really news. The two are still playing and have yet to get serious and, perhaps it is like the decay of options or how Hemingway described the two ways of he went bankrupt, slowly at first then suddenly. The real news yesterday was the signal from Kudlow, Trump’s economic adviser, that the administration was reversing itself and will negotiate a trade accord with the EU before the UK. Although Trump encouraged Brexit and promised a quick trade deal, UK nationalism has clashed with US nationalism (e.g., Huawei and a digital tax).

Sweden’s Riksbank stood pat today as widely anticipated. It is the only central bank that experimented with negative rates that has managed to bring the repo rate back to zero. It does not seem in a hurry to raise rates again. In its updated forecasts, it tweaked its growth forecast higher while shaving its outlook for underlying inflation (CPIF, which uses fixed-rate mortgages). When rates were hiked in December, there were two dissents. This time, none. The krona edged higher against the euro to reach its best level in a little more than a month. The euro finished last month near SEK10.67 and is now near SEK10.50.

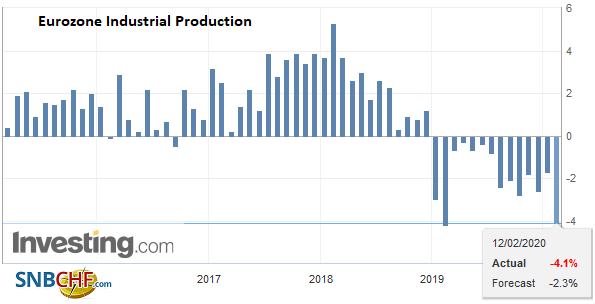

EurozoneEurostat confirmed what individual countries have already reported, namely that industrial output collapsed at the end of last year. It fell 2.1% in December, and the November gain of 0.2% was revised away. t is the largest drop in nearly four years. Meanwhile, two ECB Executive Board members (Schnabel and Lane) defended negative rates as a policy tool. Lastly, Ireland’s central bank revised up its growth projection to 6.1% from 5% for last year and 4.8% from 4.3% for this year. Efforts to form a government following the nearly three-way last weekend continues. Fianna Fail reiterated its pledge not to invite Sinn Fein into the government. The euro is in about a quarter-cent range above $1.09, which it had briefly traded below yesterday. There are options for 1.3 bln euros struck between $1.09 and $1.0910 that expire today. A close above $1.0935 is needed to stabilize the tone. North American participants have appeared to have been more aggressive in selling the euro recently. Last year’s low, set October 1, was near $1.0880. Sterling is pushing higher for the third consecutive session, but it has not traded above $1.30 since February 6. The intraday technicals are getting stretched, and the $1.30 area may be difficult to sustain a push above today. |

Eurozone Industrial Production YoY, December 2019(see more posts on Eurozone Industrial Production, ) Source: Investing.com - Click to enlarge |

United States

Federal Reserve Chair Powell did not break new ground in yesterday’s testimony, but that alone contained information for investors. The market pulled back from its aggressive Fed view. The implied yield of the December fed funds futures contract rose by 3.5 bp and another 1.5 bp today. That brings the yield rise this month to 12.5 bp to 1.265%. That means the market continues to discount a little more cut fully discounted. The debate is not about whether the Fed will cut, but whether there will be one or two cuts. The fed funds futures strip has a quarter-point cut fully discounted by the end of Q3, after which the hurdle is high to move ahead of the national election. Separately, the Fed’s third 14-day repo operation was oversubscribed. Banks wanted almost twice the $30 bln the Fed had offered. ($52.65 bln). While a nuanced understanding of what is happening may be elusive, that is taking place is worrisome and raises questions about the Fed’s exit strategy.

The economic calendar for North America is light ahead of tomorrow’s US CPI and Mexico’s central bank meeting. Powell appears before Congress for the second day. The questions may differ, but the answers will remain the same. Philadelphia Fed President Harker shares his economic assessment today, but his views are well known, and he is seen as a centrist. Mexico is widely expected to deliver a 25 bp rate cut tomorrow.

We have been looking for the US dollar to begin unwinding some recent gains against the Canadian dollar. The greenback settled near CAD1.3320 on Monday, its highest close since last October. It retreated yesterday, and follow-through selling today has brought to about CAD1.3265. The daily technical indicators topping and suggest a further US dollar weakness is likely. Look for around CAD1.3185 as a first target and then CAD1.3100. The US dollar is trading slightly lower against the Mexican peso. Its losses this week have been minor, but it is the third consecutive session that the greenback has lost ground. Resistance now looks pegged around MXN18.70 as it works its way toward MXN18.50.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,China,Currency Movement,EUR/CHF,Eurozone Industrial Production,Featured,federal-reserve,newsletter,Philippines,RBNZ,Riksbank,USD/CHF