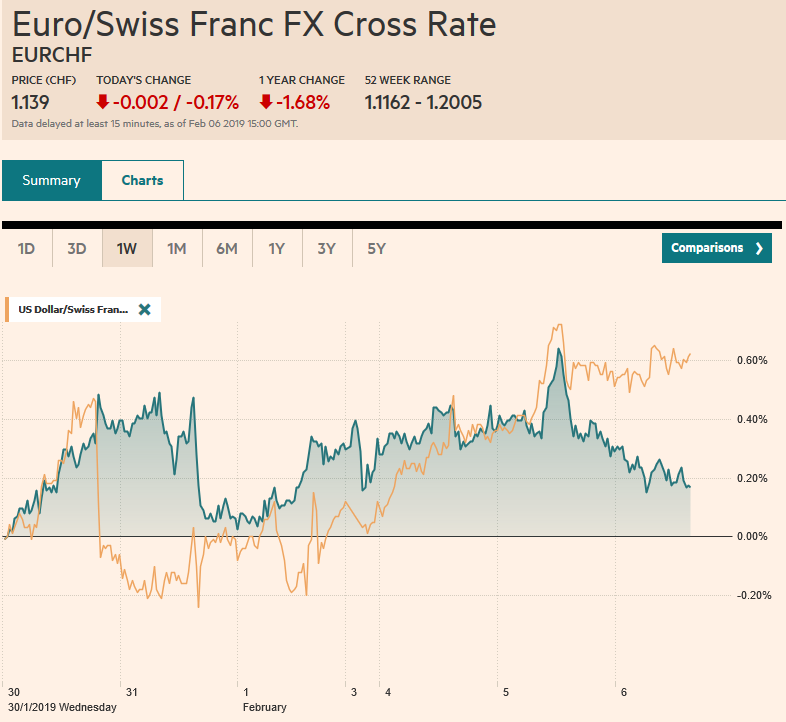

Swiss Franc The Euro has fallen by 0.17% at 1.139 EUR/CHF and USD/CHF, February 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The rally in equities is threatening to pause today, even though the few markets open in Asia edged higher. Europe’s Dow Jones Stoxx 600, which has advanced in eight of the past ten sessions and six in a row, is seeing some profit-taking pressures. US shares are also trading heavier in Europe. The S&P 500 has a five-day rally in tow but looks poised for some backing and filling action. Benchmark 10-year yields are mostly lower, with the notable exception of Italy, which could be a little concession ahead of the bond sale and/or

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, CAD, EUR, EUR/CHF, Featured, FX Daily, GBP, JPY, MXN, newsletter, SPY, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.17% at 1.139 |

EUR/CHF and USD/CHF, February 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

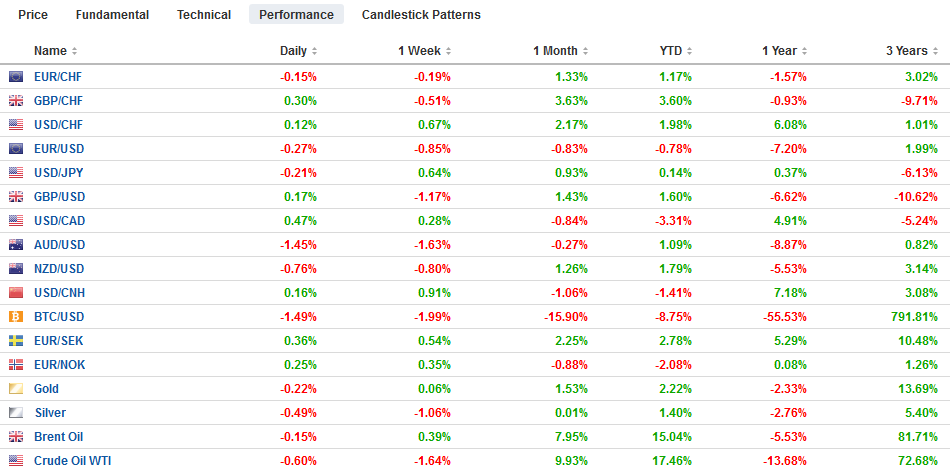

FX RatesOverview: The rally in equities is threatening to pause today, even though the few markets open in Asia edged higher. Europe’s Dow Jones Stoxx 600, which has advanced in eight of the past ten sessions and six in a row, is seeing some profit-taking pressures. US shares are also trading heavier in Europe. The S&P 500 has a five-day rally in tow but looks poised for some backing and filling action. Benchmark 10-year yields are mostly lower, with the notable exception of Italy, which could be a little concession ahead of the bond sale and/or concern that a new long-term loan facility by the ECB is not imminent. The US dollar is stronger than most major and emerging market currencies, underpinned by a less hawkish comment from the Governor of the Reserve Bank of Australia and a large drop in German factory orders. Meanwhile, oil prices are heavier as the pullback from the recent highs continues, while force majeure in by Vale is lifting iron ore prices. |

FX Performance, February 06 |

Asia Pacific

After disappointing the market yesterday by not seeming to recognize the economic headwinds, the Reserve Bank of Australia Governor Lowe delivered the message investors wanted to hear. He acknowledged the foreign and domestic risks and confirmed that policy has shifted from a tightening bias to a more neutral setting. The market is pricing in almost a 50% chance of a cut by the end of the year. Australian rates fell sharply on Lowe’s comments. The two-year yield shed nine basis points to almost 1.70%, and the 10-year yield fell six basis points to 2.18%, the lowest in a month. The Australian dollar was sent reeling. Near $0.7135, the Aussie is off about 1.4%, the most in more than a year.

With many markets still on the New Year holiday and the light news stream from Japan, the focus is on developing Asia. Indonesia surprised with stronger than expected Q4 GDP (5.18%). The rupiah is one of the emerging market currencies to gain against the dollar today. India’s central bank meets tomorrow, and while many expect a neutral stance, there is a risk of a cut in rates as inflation is at an 18-month low, and the domestic impulses are weak. It may not be the base case, but of the central banks meeting this week (Thailand and Philippines), it is where the risk of a surprise seems greatest.

Unable to build momentum above JPY110, the dollar has slipped lower and is threatening to end a three-day advance. It has traded on both sides of yesterday’s range already and a close below yesterday’s low, just below JPY109.80 would weaken the technical tone. Initial support is now pegged near JPY109.40. Note that there are $2.2 bln in options struck between JPY109.50-JPY109.65 that expire today. There are $530 mln in options at JPY110 that will also be cut today. If dollar-yen is primarily a range-bound creature, then we must assume that we have found the upper end and now may fish for the lower end. The JPY108.00 area is the obvious guess, and the low from the end of January was JPY108.50. North American dealers may want to join the party that has pushed the Australian dollar down a cent, but caution is advised. The intraday technical indicators are trying to turn higher late in the European morning. The sell-off appears to have exhausted itself a little below $0.7125. There is a large A$1.1 bln $0.7150 option that expires today and the push below there, a low probability event 24-hours ago, likely spurred related sales. It should now offer resistance.

Europe

Leaving aside German banks, both the national champions and Landesbanks, there are two major economic concerns. The first is domestic and relates to the changes in the auto sector. The second is the global slowdown. The unexpectedly sharp 1.6% drop in December factory orders suggests that the headwinds from the auto sector are easing. However, foreign orders, and non-EMU orders, in particular, slumped. The drop was the largest in six months, but follows the upward revision in November from -1.0% to -0.2%. Even if the worst is past, it will take several months for Germany to work out of the elevated inventories weak order dynamics.

A common pattern is playing itself out again as ECB officials take their case to the press, which is happy to be used in this way. This time, first came reports from close sources that played up the need for a new long-term refinancing loan facility by the ECB. Italian bonds rallied on ideas that Italian banks are among the chief beneficiaries. Now the response is given. The ECB, we are told, is no hurry to offer a new TLTRO. It would seem straightforward. The doves offered the first line, and ht hawks pushed back. However, the Machiavellian tactics may sometime see a false flag, as it a hawk putting the dove’s case out there almost a fait accompli, forcing the hawks to make a stand. In any event, it is true that the technical considerations favor a Q2 decision, not Q1. And in the meantime, the strategic ambiguity can still lend support to the market.

The combination of disappointing economic data and fear that officials will back into a no-deal divorce has seen sterling pare last month’s gains. The UK’s Telegraph reports that if the House of Commons approves Prime Minister’s deal, an eight-week delay may be sought. Market participants have long expected a delay, but the length of it has been subject to much debate and little conclusion. A Parliament vote is expected next week. However, in this game of brinkmanship, mid-February is not close enough. There is more time to play before urgency is strong enough to allow rationality to prevail.

The euro has been pushed below $1.14 for the first time in eight sessions. It is testing an important chart area near $1.1375. The intraday technical suggest this area may hold and that North American dealers may try to squeeze their European colleagues by taking the euro back above $1.1410-$1.1420. Expiring options don’t kick in until $1.1440 (~955 mln euros). Sterling fell to $1.2925 in Asia and retested it in Europe, and it too is poised to recover in the North American morning. However, Brexit is deterring short-term participants expressing ideas of a dollar pullback in sterling. Instead, many seem to be legging in and of the euro-sterling cross. The euro has been trending higher for the past two weeks but is bit heavier today.

America

The markets did not seem to respond to President Trump’s State of the Union address. The main focus remains on trade and prospects for another government shutdown. While Mnuchin and Lighthizer will go to China next week to extend the trade talks, a Trump-Xi meeting apparently is not a done deal, or that is the way it is being spun now. Gamesmanship seems to require holding out a commitment for future meetings on progress at the current one. There seem to be two broad issues. The first is the extent of the structural reform China offers. A Bloomberg report notes that China has offered to talk about more issues than it was previously. The second is verification and enforcement. The Trump Administration has been critical of past trade agreement conflict resolution mechanisms.

While Canada reports building permits (December) and January IVEY and the US reports the November trade balance, the main interest lies with two Fed officials speaking today: Powell and Quarles. But they take place too late to impact today’s activity. Asia will get the first chance to respond.

The S&P 500 has gained 16.7% since the lows after Christmas and has a five-day streak coming into today. Provided the 2700 area remains intact, many will look for 2800, the early December high, though the earnings outlook has not improved. US interest rates are broadly lower than one might expect if the unwinding of the Fed’s balance sheet was causing stress on the private sector by forcing it to bear more of the burden of a rising US deficit.

The Canadian dollar appears to be being dragged down by the other dollar-bloc currencies and the risk-off mood. Oil prices are also lower. The US dollar has been carving out a base in recent days near CAD1.3070-CAD1.3100. It is now testing CAD1.3200. The next target if this can be overcome is in the CAD1.3240-CAD1.3265 area. Meanwhile, against the peso, the dollar remains in well-worn ranges (~MXN19.00-MXN19.20).

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,Featured,FX Daily,MXN,newsletter,SPY,USD/CHF