Summary:

All the policies that worked in the Boost Phase no longer work.

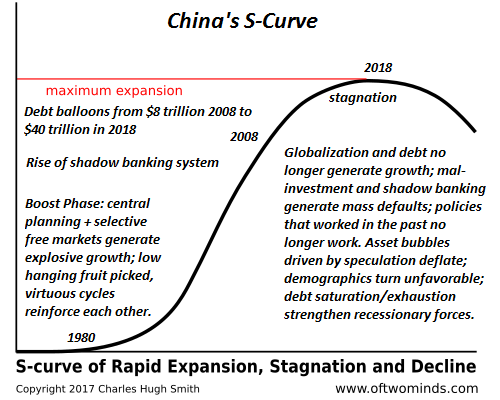

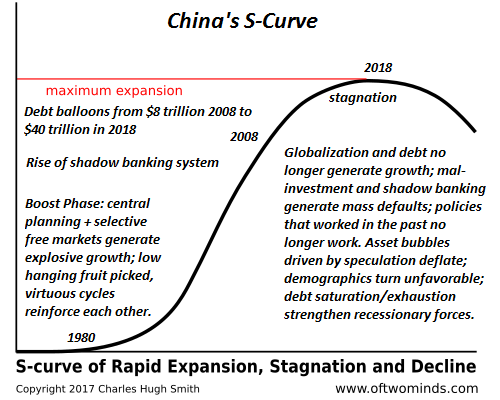

Natural and human systems tend to go through stages of expansion, stagnation and decline that follow what’s known as the S-Curve. The dynamic isn’t difficult to understand: an unfilled ecological niche is suddenly open due to a new adaptation; a bacteria evolves to exploit a new host, etc. Expansion is rapid until the niche is fully occupied, and then growth matures and stagnates; the low-hanging fruit has all been picked, and it’s much more costly to reach what little is left.

Human economies starved of capital, credit, access to markets and freedom are akin to unexploited ecological niches. Lacking capital, credit and the freedom to innovate,

Topics:

Charles Hugh Smith considers the following as important:

5) Global Macro,

Featured,

newsletter,

The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

All the policies that worked in the Boost Phase no longer work.

Natural and human systems tend to go through stages of expansion, stagnation and decline that follow what’s known as the S-Curve. The dynamic isn’t difficult to understand: an unfilled ecological niche is suddenly open due to a new adaptation; a bacteria evolves to exploit a new host, etc. Expansion is rapid until the niche is fully occupied, and then growth matures and stagnates; the low-hanging fruit has all been picked, and it’s much more costly to reach what little is left.

Human economies starved of capital, credit, access to markets and freedom are akin to unexploited ecological niches. Lacking capital, credit and the freedom to innovate, experiment and advance, economies wallow in a self-reinforcing stagnation.

Should capital, credit, access to markets and freedom become available, the economic expansion can be breath-taking. This is the basic script of postwar Japan and the Asian Tiger economies: economies with either minimal or war-damaged infrastructure, limited capital/credit and stifling status quo power structures that limited the freedom of the populace to access markets and innovations were suddenly open to credit, markets and innovation.

This territory of opportunity was quickly exploited in the Boost Phase: all the low-hanging fruit could finally be picked.

In the Boost Phase, policies that open the economy to credit and innovation generate virtuous cycles of expanding credit, markets, capital, employment and development. In the Boost Phase, everyone’s a genius; everyone joining the land rush can get a piece of the action.

In this expansive phase, everyone extrapolates this rapid growth into the future, as if the Boost Phase can last essentially forever. Thus all sorts of pundits predicted that Japan’s late-bubble GDP of 1989 would soon surpass the GDP of the U.S.

A year later, Japan’s bubble burst and it has wallowed in stagnation since. The policies of the Boost Phase all work because any loosening of limits works wonders in economies with an abundance of low-hanging fruit. But once the easy fruit’s been picked, those policies no longer have the same efficacy. In fact, policies that worked wonders are now active impediments, as they were designed for an era that has passed: all the low-hanging fruit is long gone.

We cling to whatever seems to have worked so gloriously in the past, long after the virtuous cycles have turned into self-defeating cycles that only deepen the stagnation and rot. Japan’s core policies remain fixed in 1955, or 1965 if one wants to be generous. Other than Softbank, no major Japanese corporations have emerged since 1955. The central state / central planning model of state agencies coordinating the expansion of exports with major corporations is now crippling Japan; that model worked wonders from 1955 to 1989 and then its internal limits became apparent.

The heavy cost of corruption that was offset by growth in the boost phase becomes destructive in the stagnation phase. Stripped of growth, the economy is sapped by institutionalized corruption: bribes, sweetheart deals, poor quality being ignored, accounting fraud–all become embedded and institutionalized, to the detriment of organic growth.

As a result of one disastrous policy after another–The Great Leap Forward, The Cultural Revolution–China’s 1989 economy was mired in 1949. Once the leadership enabled modest reforms that opened access to credit and markets, and the central planning machinery started building infrastructure at a scale unseen in world history, China’s Boost Phase took off.

But just as trees don’t grow to the moon, no Boost Phase lasts beyond the depletion of the low-hanging fruit. Rational investments in infrastructure and housing inevitably give way to speculative gambles, the classic recipe for mal-investment and excessive leverage that guarantee a collapse of the resulting credit and asset bubbles.

China entered 2008 with $8 billion in officially counted debt; 10 years later that debt is $40 trillion, plus unknown trillions more in the shadow banking system which expanded the options for risky speculation and massive expansions of credit.

Like all the other stagnating economies, China’s “solution” to stagnation was to expand debt-funded speculation and “investments” with little to no actual return.

The high water mark of China’s financialization orgy was 2018. From now on, adding debt simply adds more drag on the underlying economy, as income is diverted to service speculative debt and defaults start hollowing out both the official banking system and the shadow banking system.

All the policies that worked in the Boost Phase no longer work. the policy tool chest is empty, and so China’s leadership is doing more of what’s failed: burying bad debt off the visible balance sheets, re-issuing new loans to pay off defaulted debt, and all the usual tricks of a failed banking/credit system.

Japan has papered over its systemic rot and decline for 30 years by using a financial Perpetual Motion Machine: the state borrows and spends trillions by selling bonds to the central bank, which in effect prints “free money” for the state to burn propping up a sclerotic, corrupt, failed status quo.

| If that’s policy makers’ idea of success, they are delusional. Credit/asset bubbles all deflate, and central bank buying of assets only gives the lie to the illusion of stability and market liquidity.

Simply put, there is no indication China’s leadership has any plan to manage the inevitable stagnation and decline of China’s economy that is now painfully obvious to anyone with the slightest willingness to look beneath the flimsy propaganda of official statistics. They are not alone, of course; every other major economy is equally bereft of policies and equally dependent on bogus statistics and debt to paper over the decline. |

China's S-curve, February 2019 - Click to enlarge |

My new book is The Adventures of the Consulting Philosopher: The Disappearance of Drake. For more, please visit the

book's website.

Tags:

Featured,

newsletter