At this particular juncture eight months into 2018, the only thing that will help is abrupt and serious acceleration. On this side of May 29, it is way past time for it to get real. The global economy either synchronizes in a major, unambiguous breakout or markets retrench even more. That’s been the basis of this thing from Day 1; or, more accurately, Day 3.01. Reflation #3 wasn’t really any different in type from either Reflation #1 or Reflation #2 (though, I have to admit, with the last benchmark GDP revisions I am moving closer to separating Reflation #1 from Reflation #1a with now two negative quarters sitting in 2011; meaning Reflation #3 was really Reflation #4, and consequently this Eurodollar Event #4 may be

Topics:

Jeffrey P. Snider considers the following as important: 5) Global Macro, currencies, Dollar, economy, EuroDollar, Europe, Eurozone Composite PMI, Eurozone Gross Domestic Product, Featured, Federal Reserve/Monetary Policy, GDP, IHS Markit, manufacturing, Markets, newsletter, PMI, Service sector, The United States, U.S. Gross Domestic Product, U.S. Markit Composite PMI, US

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| At this particular juncture eight months into 2018, the only thing that will help is abrupt and serious acceleration. On this side of May 29, it is way past time for it to get real. The global economy either synchronizes in a major, unambiguous breakout or markets retrench even more.

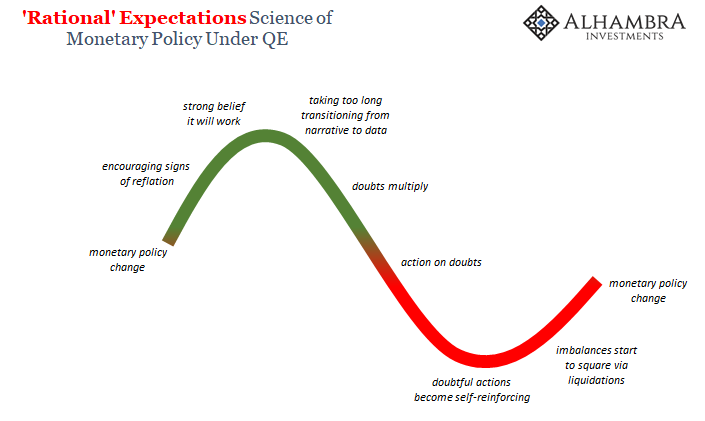

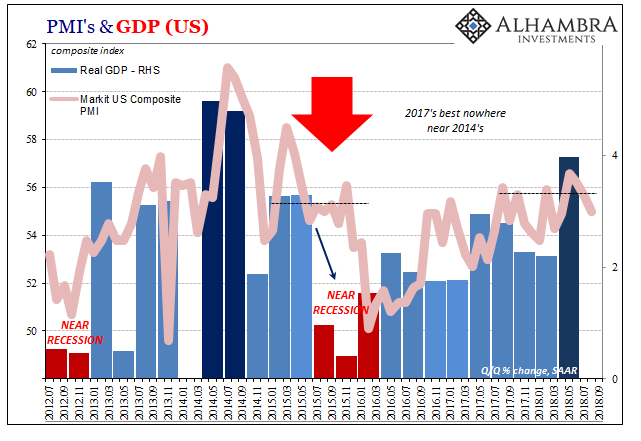

That’s been the basis of this thing from Day 1; or, more accurately, Day 3.01. Reflation #3 wasn’t really any different in type from either Reflation #1 or Reflation #2 (though, I have to admit, with the last benchmark GDP revisions I am moving closer to separating Reflation #1 from Reflation #1a with now two negative quarters sitting in 2011; meaning Reflation #3 was really Reflation #4, and consequently this Eurodollar Event #4 may be Eurodollar Event #5). It began with the same promise of legitimate recovery waiting for everyone. If there was something different about this one it was in how relatively unenthusiastic markets were even at its heyday in early 2017. They were reasonably jaded after so many false dawns, however many there may have been unofficially. Markit today released its flood of flash PMI’s for a major swath of the global economy, including the composite indices for both the US and Europe. There wasn’t any good news in either, and not really much bad news to be honest. It was instead more of the same 2018 lethargy. But this is lethal lethargy in the context of where the economy this year was supposed to have been. There are now too many questions (risks) about the status of the global economy, which puts us solidly in the red in terms of the cycle. These PMI’s won’t do anything to change that, which can only mean (important) market participants (not stocks) are going to be characteristically edgy moving forward. Without some more reasonable assurance about economic upside (opportunity) these obvious and immediate risks are again more and more absolute. |

Dollar Cycles General, June 2018 |

For the US economy, Markit had this to say – from their press release to eurodollar market ears:

|

US PMIs and GDP, August 2018(see more posts on U.S. Gross Domestic Product, U.S. Markit Composite PMI, ) |

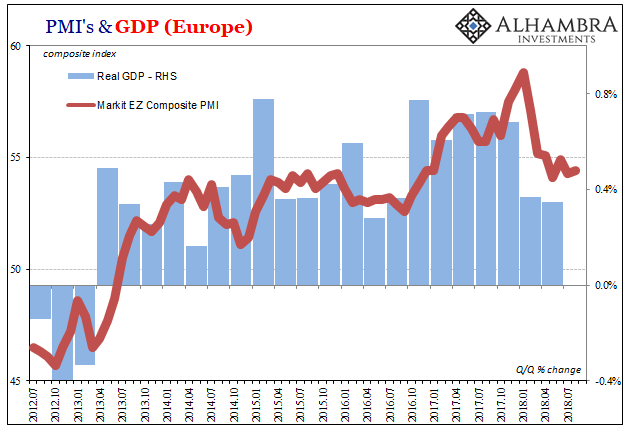

In Europe, the composite PMI is hanging in at its diminished level. But is that economic stabilization, or the euro’s from May 29 to August 9? If the latter, then what Markit describes won’t help even though the index was the smallest fraction higher in August:

|

Eurozone PMIs and GDP, July 2012 - August 2018(see more posts on Eurozone Composite PMI, Eurozone Gross Domestic Product, ) |

After achieving very little momentum in either the US or Europe over the past two years, the idea that the global economy may already be rolling over is pure liquidity risk. It is far too consistent with May 29, not that you might otherwise know it given how everything is characterized.

It really is a cycle, in that we are repeating the last one in 2014. Same things then, only with more emphasis for Reflation #2 as compared to Reflation #3. In the US there were two quarters of robust growth rather than just the one, and both were ~5% instead of only 4%. It didn’t end up making any difference because by the time they happened the global economy was already in trouble.

Eurodollar Event #3 was already well underway by the time growth superficially appeared to be picking up. In other words, it was already rolling over just when everyone was getting so excited about recovery. That’s why in late 2014 the dichotomy was so obvious and jarring; increasingly certainty accompanying proclamations about growth at the same time commodities were crashing alongside major currencies (and central banks like the Swiss and eventually Chinese).

Here we are again. Deflation seemingly picking up and broadening, early indications of the economy rolling over, and the mainstream still lodged firmly in the dreamland of global growth.

Tags: currencies,dollar,economy,EuroDollar,Europe,Eurozone Composite PMI,Eurozone Gross Domestic Product,Featured,Federal Reserve/Monetary Policy,GDP,IHS Markit,manufacturing,Markets,newsletter,PMI,service sector,U.S. Gross Domestic Product,U.S. Markit Composite PMI,US