In early 2011, Chinese consumer prices were soaring. Despite an official government mandate for 3% CPI growth, the country’s main price measure started out the year close to 5% and by June was moving toward 7%. It seemed fitting for the time, no matter how uncomfortable it made PBOC officials. China was going to be growing rapidly even if the rest of the world couldn’t. Back then, Western Economists were concerned that if prices continued to spiral out of control the situation would threaten what little economic recovery there was everywhere else around the world. From The New York Times in April 2011: As the United States and Europe struggle to get their economies rolling again, China is having the opposite

Topics:

Jeffrey P. Snider considers the following as important: 5) Global Macro, China, CPI, currencies, Dollar, economy, EuroDollar, eurodollar standard, Featured, Federal Reserve/Monetary Policy, global dollar, global money, inflation, Markets, newslettersent, offshore currency, PBOC, rrr

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

In early 2011, Chinese consumer prices were soaring. Despite an official government mandate for 3% CPI growth, the country’s main price measure started out the year close to 5% and by June was moving toward 7%. It seemed fitting for the time, no matter how uncomfortable it made PBOC officials. China was going to be growing rapidly even if the rest of the world couldn’t.

Back then, Western Economists were concerned that if prices continued to spiral out of control the situation would threaten what little economic recovery there was everywhere else around the world. From The New York Times in April 2011:

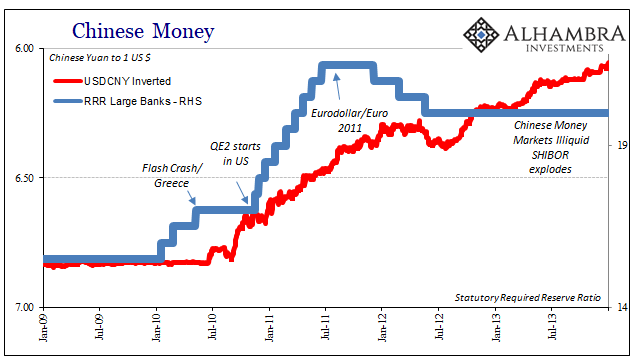

To gain control, the PBOC had raised rates and increased the reserve requirement for banks. Between the start of QE2 in the United States in early November 2010 and June 2011, China’s RRR for large banks was raised nine times. |

Chinese Money 2009-2014(see more posts on USD/CNY, ) |

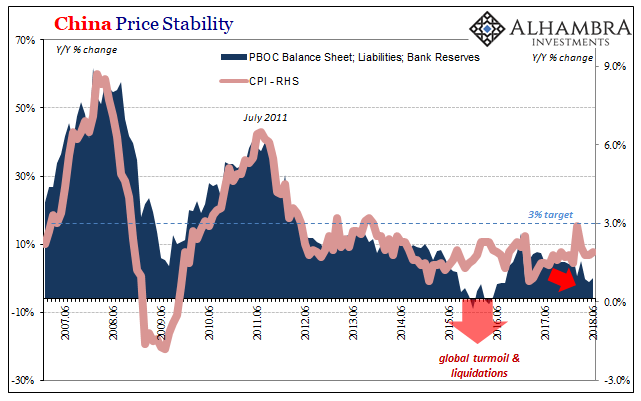

| The world did not have to worry about Chinese consumer prices. The CPI would peak at 6.5% in the month of July 2011. But why July 2011?

Many people have claimed that monetary policy simply worked. The PBOC tightened and, voila, consumer prices were brought under control. The problem with that traditional line of thinking, though, is 2012 and 2013. If the central bank was to be credited with doing such a good job holding the line on inflation, then it must be condemned for doing it too well. That’s not really what happened, of course. China’s central bank was struggling against a rising tide of “dollar” inflows, raising the level of bank reserves by simple accounting, and potentially flooding China was liquidity during a time of huge wastefulness (fiscal “stimulus”) and global misconception (China decoupling). What happened in July 2011 was no mystery; it just wasn’t Chinese in nature. |

China Price Stability 2007-2018(see more posts on China Consumer Price Index, ) |

| The “dollar” inflows stopped because the eurodollar system underwent its second great crisis in close succession. The PBOC didn’t need to raise the RRR past June 2011 as bank reserve growth began to dry up as “dollar” inflows did. The PBOC’s money problem was solved for it (above), only too well.

For if China’s central bankers spent 2010 and 2011 trying to hold back consumer price inflation, they have spent all the years since attempting to restart it. They do not set the pace of prices, they are passengers on the same “dollar” train with all the others like them. China’s CPI rose just 1.9% in June 2018. That’s up from 1.8% in the two months previous, but really no difference going back to 2014 when undershooting inflation really synchronized with CNY’s “devaluation.” Given that these are essentially two sides of the same coin, purposed in the former via the PBOC’s forex asset side basis, that the opposite inflation struggle to 2011 continues for yet another year really isn’t all that surprising or exciting. It is only the occasional upward outliers that make it interesting, not for what they may indicate but for what they reveal about economic and monetary illiteracy (inflation hysteria). In March, for example, China’s NBS reported 2.9% inflation which was the highest since 2013. It was taken as a sign of the supposedly impending worldwide boom rather than the usual upside outlier that never lasts (the only thing that is ever transitory is these “good” months). |

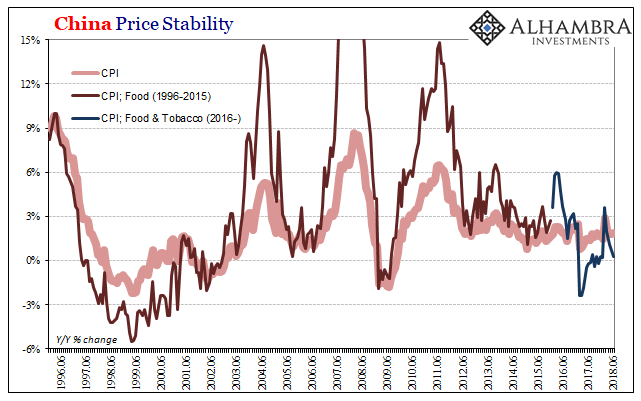

China Price Stability 1996-2018(see more posts on China Consumer Price Index, ) |

PIMCO, for one, looked at Chinese inflation and saw all the right ingredients.

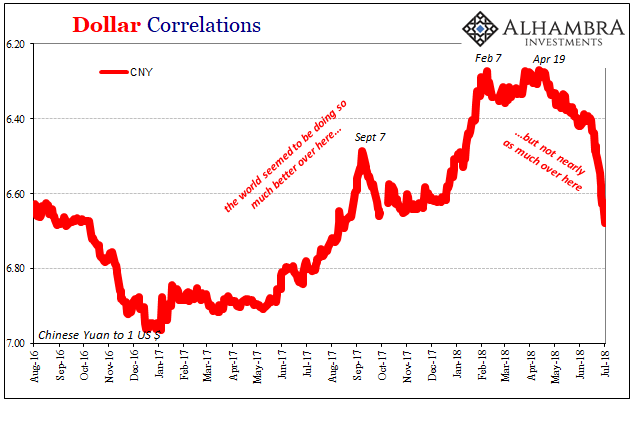

Among the positives they listed were a possible labor shortage (of course), lessening industrial slack as overproduction was curbed by Herculean government effort, and a “stable currency.” Rather than more “normalizing” behavior, the PBOC has gone back to reducing the RRR again this year notably as CNY has dropped sharply once more. The currency has not been stable at all of late, nor has monetary policy. The fight to gain some monetary traction is as palpable in 2018 as it had been during 2015 and 2016. |

Dollar Correlations 2016-2018(see more posts on USD/CNY, ) |

| Everything changed in 2011. There was some modest hope for global recovery up until that summer, the eruption of global crisis that in July proved to eurodollar banks the striking incongruence that proved only central bankers don’t know what they are doing.

There is a huge difference going from “maestro” in global money to bungling idiots. From August 9, 2011 (what is it about mid-August, always the 9th and 10th?)

China’s CPI peaked in the month before the Federal Reserve’s head of its Open Market Desk was struck with such incredulity about the obvious incongruence. Mere coincidence? The New York Times article quoted above was right in noting the close global economic links, it just arranged them as everyone else did in the wrong way. Money problems in China do reverberate from Wal-Mart to Wall Street but that’s as a second step (reverberating reverberations). The first is what happens out there in the world in between all these conventionally laid distinctions, conventions that in practice don’t actually matter. Offshore currency is still the ghost in the shadows. Seven years later and still nobody can see what’s in the dark. Well, not nobody. |

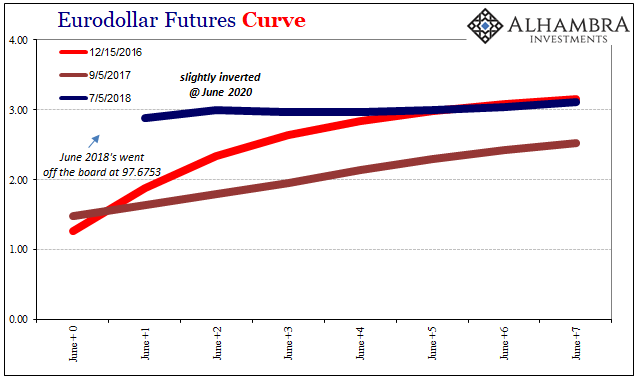

EuroDollar Futures Curves Inverted |

Tags: China,CPI,currencies,dollar,economy,EuroDollar,eurodollar standard,Featured,Federal Reserve/Monetary Policy,global dollar,global money,inflation,Markets,newslettersent,offshore currency,PBOC,rrr