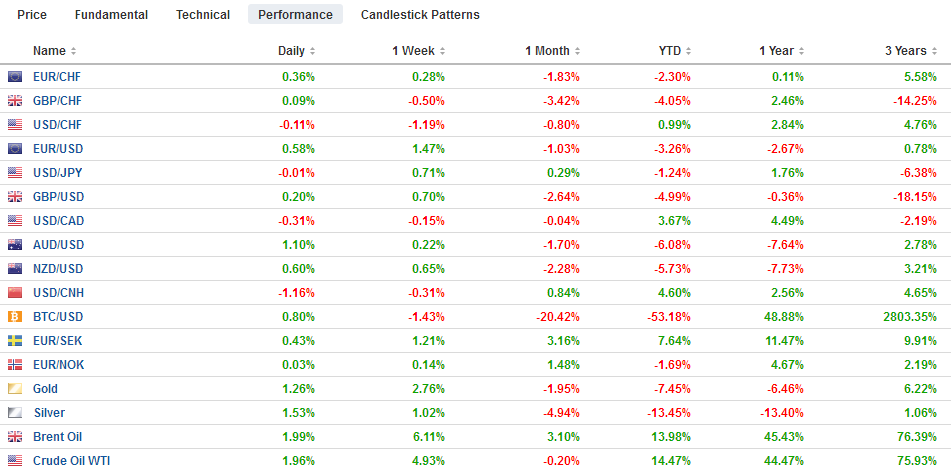

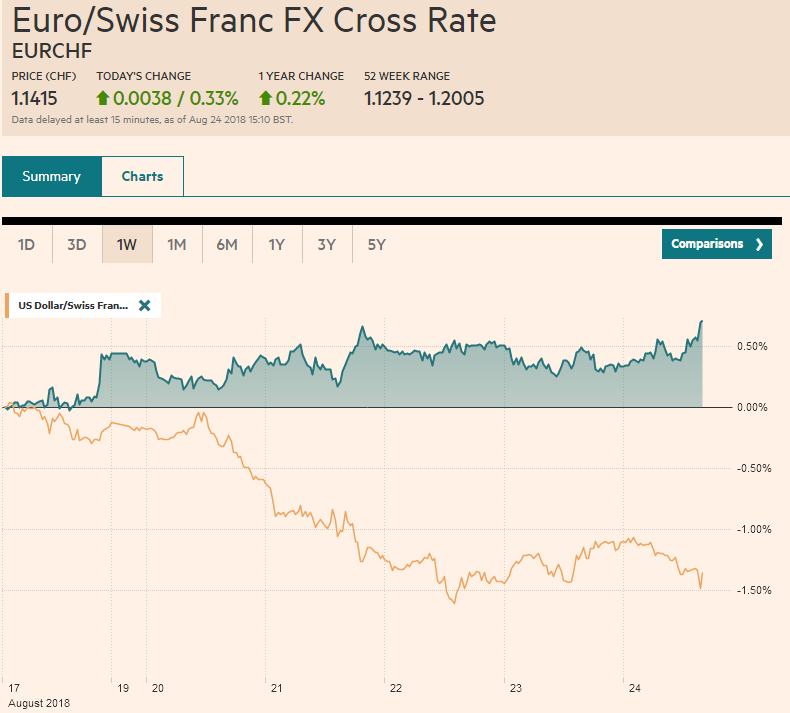

Swiss Franc The Euro has risen by 0.33% at 1.1415. EUR/CHF and USD/CHF, August 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is paring some of yesterday’s gains in quiet turnover ahead of Fed Chief Powell’s speech at Jackson Hole, the week’s last highlight. The euro and sterling are trading inside yesterday’s ranges, which the dollar has extended its gains against the yen to reach a two-week high near JPY111.50. News of a new Prime Minister in Australia has lifted some of the political uncertainty down under, and the Australian dollar has recouped about a third of yesterday’s sharp drop, its largest drop in two years (~-1.4%). The economic calendar

Topics:

Marc Chandler considers the following as important: $CAD $GBP, $CNY, 4) FX Trends, AUD, CAD, EUR, Featured, JPY, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.33% at 1.1415. |

EUR/CHF and USD/CHF, August 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar is paring some of yesterday’s gains in quiet turnover ahead of Fed Chief Powell’s speech at Jackson Hole, the week’s last highlight. The euro and sterling are trading inside yesterday’s ranges, which the dollar has extended its gains against the yen to reach a two-week high near JPY111.50. News of a new Prime Minister in Australia has lifted some of the political uncertainty down under, and the Australian dollar has recouped about a third of yesterday’s sharp drop, its largest drop in two years (~-1.4%). The economic calendar is light today, featuring only the Japanese CPI and US durable goods orders. Japan’s July CPI was unspectacular. The headline pace rose to 0.9% rather than 1.0% as the median forecast had it. It was at 0.7% in May and June. The July read is the highest since 1.1% in March. Most of the increase is energy. Without fresh food, what Japan calls its core rate was steady at 0.8%, but if fresh food and energy are excluded, consumer prices rose 0.3% year-over-year, almost indistinguishable from the 0.2% pace seen in June. A sharp drop in Boeing orders (from a heady 233 orders in June to 30 in July will contribute to soft optics for the US preliminary durable goods orders report, Excluding the volatile sector, the details of the report are expected to be better. That said, ex-transportation equipment and defense orders, durable goods orders rose an average of 0.4 a month in H1 after an average increase of 0.9% in 2017. The tax cuts and other investment inducement do not appear to b having a material impact on capital expenditures. Also, much of the investment that has taken place seems to be concentrated in the energy sector. |

FX Performance, August 24 |

The Bloomberg US economic data surprise index put in a multi-year peak at the end of last year and has been trending lower. It stands near 10-month lows. It is a misuse of the tool to extrapolate the Fed will slow its gradual tightening. Surprise indices say little about the economy itself and much more about economists. According to the index, economists consistently were looking for stronger than expected economic data even as the economy accelerated to a 4.1% pace in Q2, the fastest in four years.

Consider the flash PMI. Both the manufacturing and service components were softer than expected. The composite eased to 55.0 from 55.7, the weakest since April. Should policymakers or investors be concerned? Probably not yet. Put the flash August reading in context. The average in Q1 was 54.6, and the average in Q2 was 55.9. If growth in Q2 was flattered by several one-off factors, as we have suggested appears likely, then a this is what should be expected as the economy moderate to a still fiscally-assisted above-trend growth. The CME’s model shows that the Fed funds futures have discounted a 96% chance of a 25 bp hike in September and a 64% chance of a December hike.

After his July testimony, the President’s criticism, and FOMC minutes, it does not seem like a particularly opportune time for Fed Chairman Powell to innovate the general message. The economy is strong, and prices pressures are near-term. Continued gradual normalization of monetary policy is still appropriate. Its main policy tool continues to be the Fed funds target range, and the unwinding of the Fed’s balance sheet is largely a technical function. Powell may be less at home theorizing about unobservable phenomenon, like r*.

Surely, Powell can address the topic at hand “Managing Market Structure and Implications for Monetary Policy” without addressing the substance of monetary policy. That interest rates may have to remain lower in this cycle that past cycles has already been signaled and understood by investors. Consider that the Fed has been raising rates since 2015 and the current target range is still below headline and core rates of inflation.

We had low expectations for the two-day US-China trade talks and weren’t disappointed. It is too early to know if it achieved what was thought to be the main goal and that was to tee up a meeting between Trump and Xi. Owing to false starts earlier this year and the various voices of the Administration (e.g., Mnuchin, Ross, Lighthizer, Navarro), it seems that if the logjam is to be broken, it will take Trump and Xi.

Also, Chinese officials seem to recognize that the upcoming midterm elections can also influence the US posture. If there is to be a break-through, it appears more likely after the November elections, so the logic goes. That means that the 25% tariff on $200 bln more of Chinese goods, for which the public hearings continue, will likely be implemented as early as next month.

Both sides appear to understand the other’s position. Reports suggest that China has bucketed US demands into three categories. The first covers 30-40% and its entails China buying more US-made goods. This could achieve immediate results. China had previously agreed earlier this year but that Trump pulled back. The second also covers 30-40% of the US demands and includes substantive reforms, which are possible but will take longer to implement. Not unrelated, China announced today it was lifting caps on foreign ownership of Chinese banks and asset management firms. The size of China’s financial sector is estimated at around $40 trillion.

The MSCI Asia Pacific Index eked out a small gain (<0.1%) and managed to rise for the fifth session of the past six. However, excluding Japan, the benchmark would have lost 0.2%. Amid reports of formal or informal pressure, the Shanghai Composite rose (~0.2%) for the second consecutive session and four of this week’s five after falling every day last week. The weekly story is a bit different. Through July and August, the Shanghai Composite as alternated between gaining and losing weeks. This week it gained about 2.25% after falling 4.5% the previous week.

The dollar edged up against the yuan this week. The 0.05% move is small beer, but it is the 11th consecutive weekly gain for the dollar. In fact, since the end of Q1 18, the yuan has risen against the dollar in only three weeks. Meanwhile, the dollar is moving higher against the yen for the fourth consecutive session and is up almost 0.9% against the dollar this week. The JPY111.50 area corresponds to a 50% retracement of the greenback’s decline since peaking near JPY113.20 a little more than a month ago. The 61.8% retracement is found near JPY111.90. Note that a close above last week’s high (~JPY111.45) would constitute a bullish outside up week for the dollar.

The euro has held above yesterday’s low near $1.1530 but ran into offers near $1.1580. Reports that President Trump offered to buy Italian bonds have mostly been ignored by the market. Italy’s 10-year benchmark yield is up four basis points to 3.12%. This is the high yield level of the week, which is 10 bp higher than a week ago. Italy’s threat to hold back EU payments if migrants that come to Italy due to proximity are not re-distributed, while at the same time moving toward a confrontation with the EC over next year’s fiscal plans have weighed debt prices.

There is an option for about 525 mln euros struck at $1.1550 that expire today. There are also options struck half a cent in both directions (for 600 mln euros and 655 mln euros are $1.15 and $1.16 respectively) that will be cut today. The euro’s six-day advance was snapped yesterday with a 0.5% loss. Its 1.1% gain for the week (~$1.1565) is the largest weekly advance since the middle of February.

European bourses slightly firmer. The Dow Jones Stoxx 600 is up about 0.15% in mixed trading. Information, energy, and materials are the leading sectors, while consumer staples, real estate, and telecom are drags. European benchmark bonds yields are mostly higher, with Italy and Portugal leading the periphery, while core bond yields are less than a basis point higher.

Sterling is ending its six-week slide and near $1.2820 is up about 0.55% this week. It reached a two-week high a couple days ago near $1.2935. The $1.2800 level corresponds to a 50% retracement of sterling’s bounce since August 15 low near $1.2660. A move above $1.2850 would help steady the technical tone.

The US dollar rose against the Canadian dollar yesterday for the first time five sessions and is marginally (~0.15% higher on the week around CAD1.3080). Mexico and US NAFTA talks are now expected carry into next week. The greenback needs to get back above CAD1.31 to lift the technical tone.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$AUD,$CAD,$CAD $GBP,$CNY,$EUR,$JPY,Featured,newsletter