See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Fundamental Developments The price of gold dropped two bucks, and silver two cents. However, it was a pretty wild ride around the time when some information came out from our monetary masters at their annual boondoggle at Jackson Hole. We will show some charts of Friday’s intraday action, below. The overseers of the developed world’s major currency printing presses at Jackson Hole. It almost looks as if they have been literally put out to pasture, alas, that is not the case. [PT] Photo credit: Reuters - Click to enlarge Gold and Silver Price As always, the question is which moves are driven by fundamentals, and

Topics:

Keith Weiner considers the following as important: Chart Update, dollar price, Featured, Gold and its price, gold basis, Gold co-basis, gold price, gold silver ratio, newsletter, Precious Metals, silver basis, Silver co-basis, silver price

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

Fundamental DevelopmentsThe price of gold dropped two bucks, and silver two cents. However, it was a pretty wild ride around the time when some information came out from our monetary masters at their annual boondoggle at Jackson Hole. We will show some charts of Friday’s intraday action, below. |

|

Gold and Silver PriceAs always, the question is which moves are driven by fundamentals, and which by speculation? We will show graphs of the basis, the true measure of the fundamentals. But first, here are the charts of the prices of gold and silver, and the gold-silver ratio. |

Gold and Silver Price(see more posts on gold price, silver price, ) |

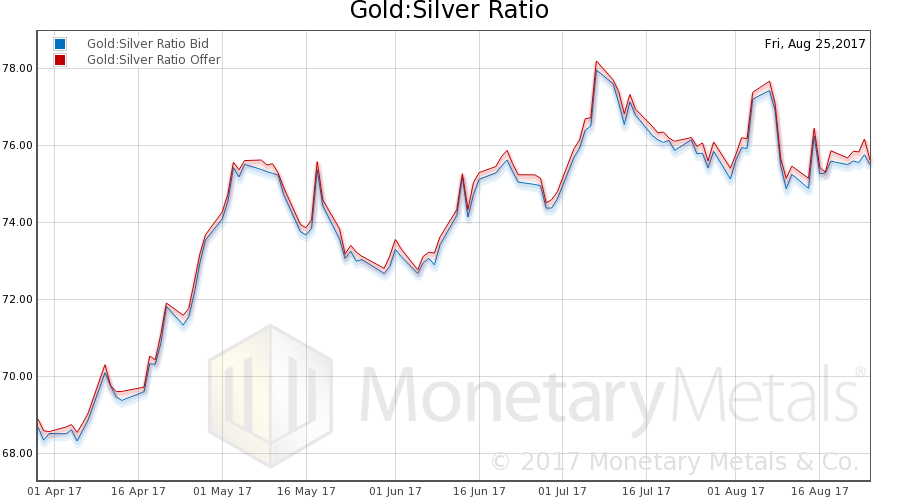

Gold:Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio barely budged.

|

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

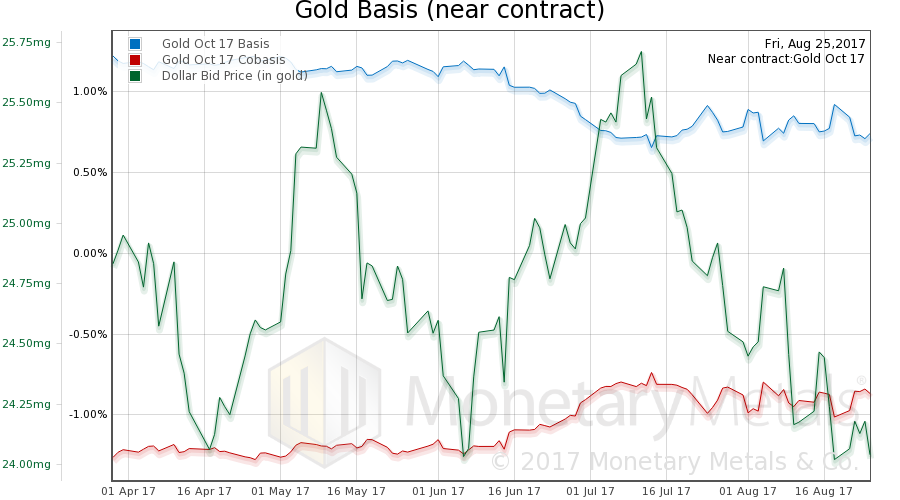

Gold Basis and Co-basis and the Dollar Price

Here is the gold graph. The price didn’t move much, and neither did the basis. So our calculated gold fundamental price was up $5, to $1,330. |

Gold Basis and Co-basis and the Dollar price(see more posts on dollar price, gold basis, Gold co-basis, ) |

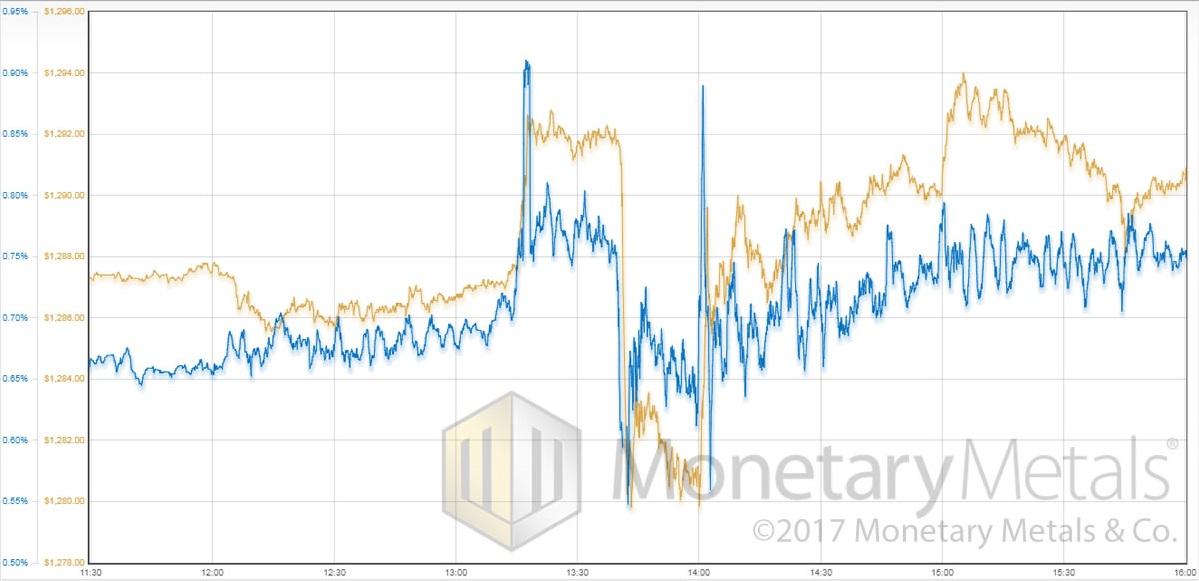

Gold Price and Gold Basis, Friday 25 AugustMore interestingly, let’s look at the basis action when the price was gyrating on Friday. The correlation between basis and price is uncanny, isn’t it? And it works in both directions. Manipulators speculators were buying paper gold from around 13:15 GMT (which is 14:15 BST or 9:15 NY time). Then these same manipulators speculators — or was it a different group, who overpowered the first, hm? — started selling at around 13:40. Then buying resumed at 14:00. We are joking about the manipulation, of course. In our view, superstition thrives where people struggle to explain what they see without a scientific theory. Once upon a time, they saw thunder and lightning and thought the gods were having battle, or perhaps expressing anger at some sin of man. Such mythology could not survive the advent of the field of meteorology (if even that long). The manipulation myth similarly doesn’t belong in a world where there is an arbitrage theory of markets, and daily pictures of the basis and co-basis. Note also the rise in price at 15:00, without a rise in basis. That likely reflects some buying of physical metal. |

Gold Price and Gold Basis, Friday 25 August |

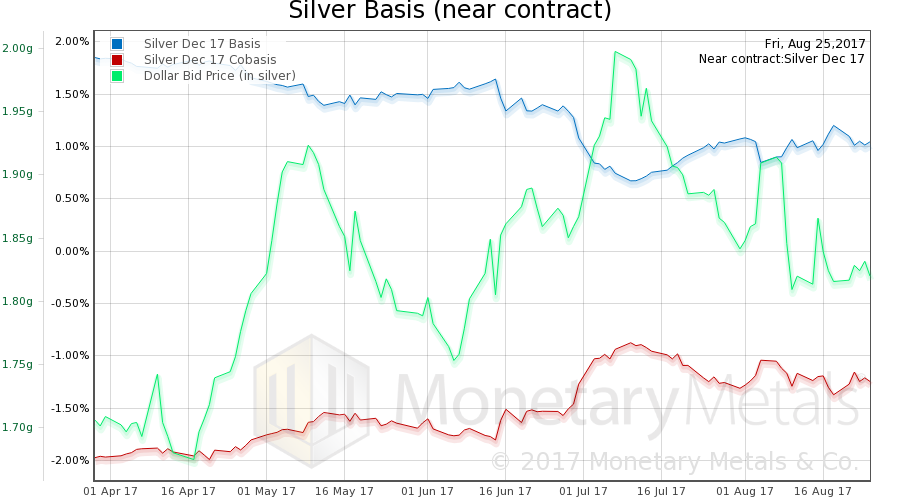

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. The basis fell and the co-basis rose. Not a lot, but it did lift our calculated silver fundamental price $0.20 to $17.18. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

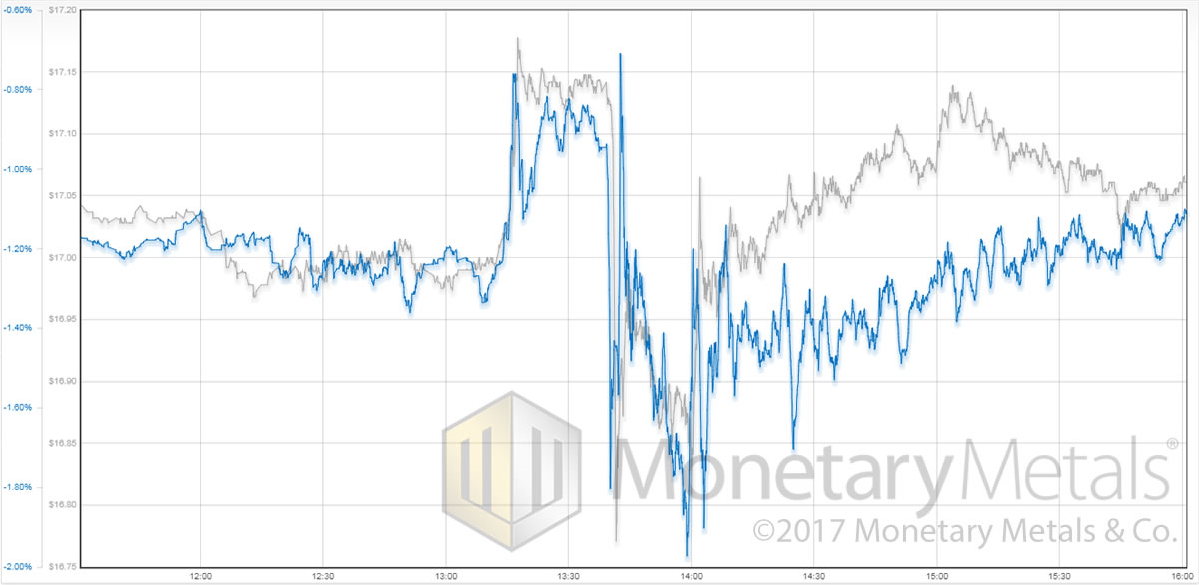

Silver Basis and Co-basis and the Dollar PriceHere is the intraday price and basis graph for silver during Friday’s roller-coaster. As with gold, the basis tracks the price. The moves in both directions were driven by speculative trading. |

Silver Price and Silver Basis, Friday 25 August(see more posts on silver basis, silver price, ) |

Tags: Chart Update,dollar price,Featured,gold basis,Gold co-basis,gold price,gold silver ratio,newsletter,Precious Metals,silver basis,Silver co-basis,silver price