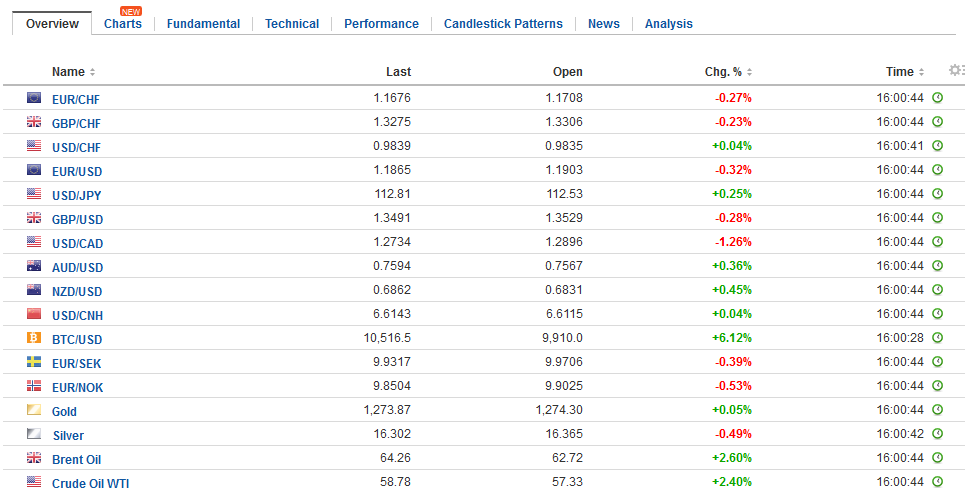

Swiss Franc The Euro has risen by 0.37% to 1.1705 CHF. EUR/CHF and USD/CHF, December 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The release of the manufacturing PMIs confirm that the synchronized global expansion remains intact. The focus today is on three unresolved political challenges: US tax reform, the UK-Irish border and the talks that may produce another grand coalition in Germany. The US dollar is mixed, with the dollar-bloc currencies and Scandis pushing higher. The euro and yen are hugging yesterday’s close, while sterling is paring this week’s gains. In fact, sterling remains the only major currency that gained against the greenback this week. It is

Topics:

Marc Chandler considers the following as important: China Caixin Manufacturing PMI, EUR/CHF, Eurozone Manufacturing PMI, Featured, France Manufacturing PMI, FX Trends, GBP, Germany Manufacturing PMI, Italy Gross Domestic Product, Italy Manufacturing PMI, Japan Household Spending, Japan Manufacturing PMI, Japan National Consumer Price Index, Japan National Core Consumer Price Index, Japan Unemployment Rate, newsletter, Politics, Spain Manufacturing PMI, Switzerland SVME PMI, U.K. Manufacturing PMI, U.S. ISM Manufacturing Employment, U.S. ISM Manufacturing PMI, U.S. Manufacturing PMI, USD, USD/CHF

This could be interesting, too:

Investec writes The Swiss houses that must be demolished

Claudio Grass writes The Case Against Fordism

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

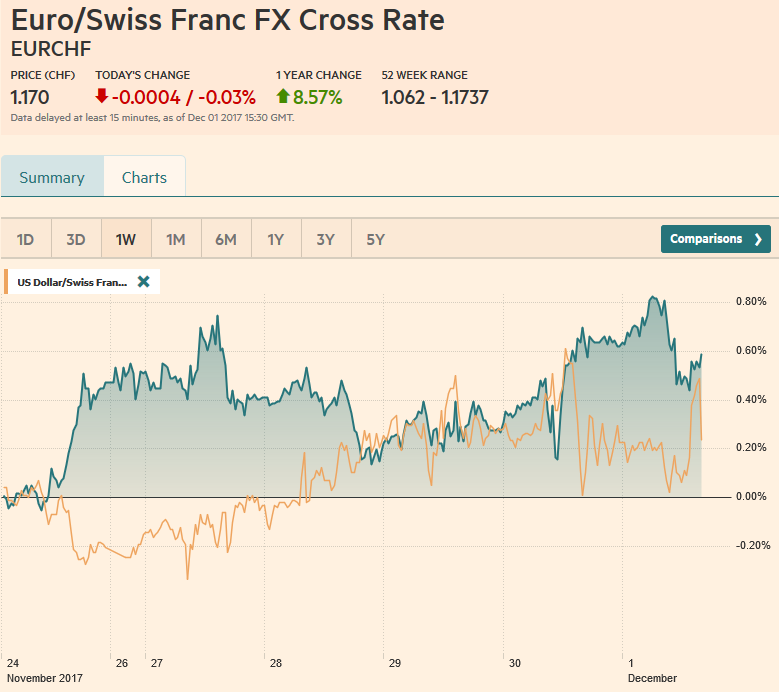

Swiss FrancThe Euro has risen by 0.37% to 1.1705 CHF. |

EUR/CHF and USD/CHF, December 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe release of the manufacturing PMIs confirm that the synchronized global expansion remains intact. The focus today is on three unresolved political challenges: US tax reform, the UK-Irish border and the talks that may produce another grand coalition in Germany. The US dollar is mixed, with the dollar-bloc currencies and Scandis pushing higher. The euro and yen are hugging yesterday’s close, while sterling is paring this week’s gains. In fact, sterling remains the only major currency that gained against the greenback this week. It is holding on to a little more than a 1% gain this week. It is the fourth consecutive advancing week and the largest move seven weeks. |

FX Daily Rates, December 01 |

| Equities were unable to follow the US higher. The MSCI Asia Pacific Index made it a clean sweep with its fifth consecutive decline. The Dow Jones Stoxx 60 is off 0.7%, which would be its largest decline since November 9. It was flat on the week coming into today’s session. Benchmark 10-year yields are mostly 2-4 bp lower, including US Treasuries, which have been turned back from the poke through 2.40% yesterday.

While the UK’s willingness to raise its initial financial offer to the EU for the amputation, the thorny issue of the Irish border is unresolved. The problem comes down to this: The UK’s decision to leave the EU and the single market requires it to have border controls for people, goods, services, and capital. The EU and Ireland insist that there is no hard border between Northern Ireland and Ireland. That is an important basis of the Good Friday Agreement that helped bring peace the Emerald Island. May’s political gambit of snap elections earlier this year resulted in a loss of the Tory’s majority. The government now depends on the Democrat Unionist Party from Northern Ireland. The DUP insists that the hard border is not within the UK, in a Hong Kong-like arrangement. |

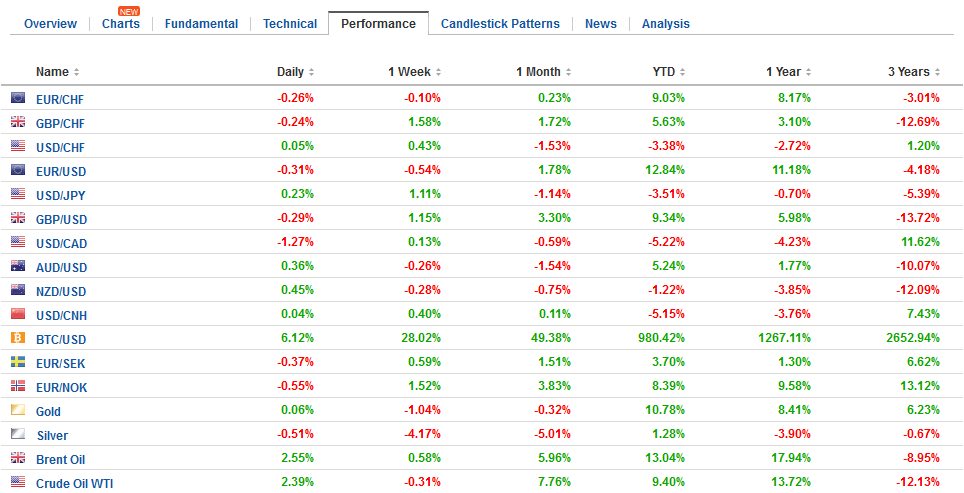

FX Performance, December 01 |

United KingdomHence the problem: the hard border cannot be outside of the UK (between Northern Ireland and the Republic) nor inside the UK (between the UK and Northern Ireland). The DUP is threatening to leave the government if its demands are violated. Monday is the EU-imposed deadline for an agreement that would allow the next phase of negotiations to begin. Prime Minister May is to have lunch with Juncker then and was expected to signal a proposed resolution. The deadline seems soft in the sense that theoretically the real deadline in the middle of the month heads of state summit. |

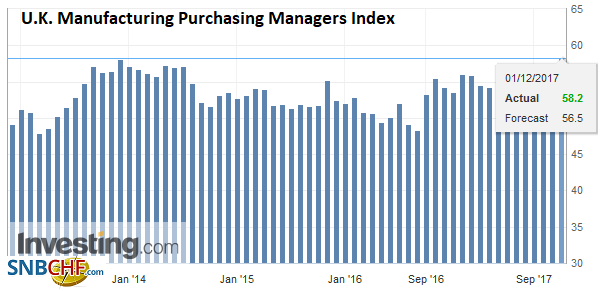

U.K. Manufacturing Purchasing Managers Index (PMI), Nov 2017(see more posts on U.K. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

United StatesIn the US, tax reform in the Senate hit a glitch yesterday. The issue is that the trigger mechanism that was introduced to secure sufficient votes was ruled improper by the Senate parliamentarian. There are four Republican Senators that need to be appeased and to appease them may alienate others. The four senators to watch today are Corker and Flake who want the trigger, Johnson, who wants a greater pass-through tax break, and Collins, who wants to consider the individual mandate for health care separate from the tax reform and the preserve the federal tax break for state and local property taxes. |

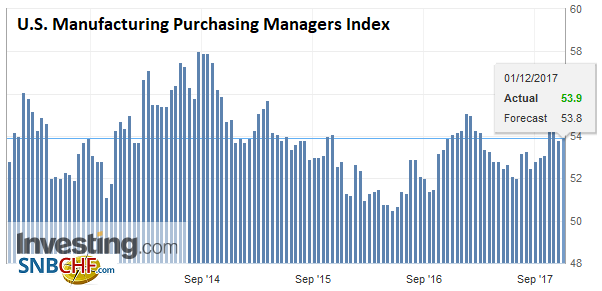

U.S. Manufacturing Purchasing Managers Index (PMI), Nov 2017(see more posts on U.S. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

| Like in the UK, the problem is not so much the opposition but trying to manage the governing coalition. This was the same challenge of the Affordable Care Act. The Republicans agree that they do not like it but cannot agree on an alternative. Moreover, there seems to be little doubt that the tax reform will aggravate the disparity of wealth in the US. The Congressional Research Service estimate that the biggest increase in after-tax income will be experienced by those earning $500k to $1 mln a year, while those earning less than 30k could see a tax increase as early as 2021. |

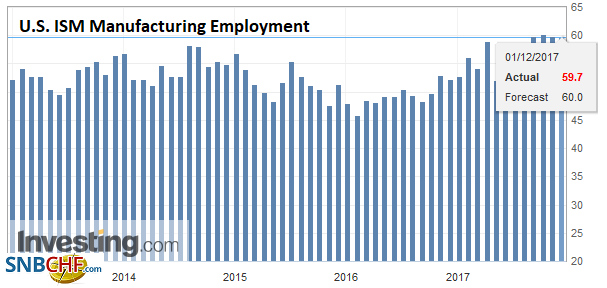

U.S. ISM Manufacturing Employment, Nov 2017(see more posts on U.S. ISM Manufacturing Employment, ) Source: Investing.com - Click to enlarge |

| US corporates have an estimated $2.3 trillion of cash on their balance sheets. The tax cuts envision would give them another $683 bln (over ten years) according to the Joint (Congressional) Committee on Taxation that would have under the current law been paid to the IRS. As a proportion of GDP, US corporate profits are twice as large as when Reagan left office in 1988. |

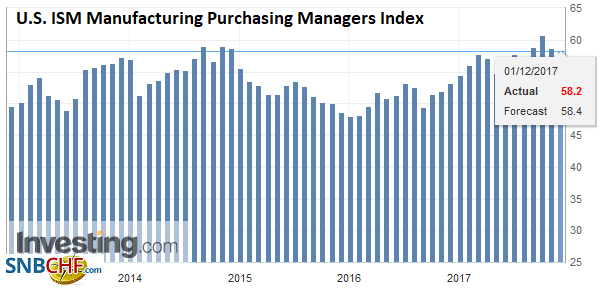

U.S. ISM Manufacturing Purchasing Managers Index (PMI), Nov 2017(see more posts on U.S. ISM Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

GermanyThe third political drama is in Germany. After the Free Democrats abandoned coalition talk, pressure mounted on the Social Democrats to re-enter a Grand Coalition. They have done so in two of three governments led by Merkel. The SPD appears to have lost its way and support by voters fell to its lowest in the modern era. Also, if the SPD enters the government, that would make the AfD the main opposition party and with that comes certain parliamentary privileges that both the CDU and SPD would want to deny it. Merkel meets with the SPD head Schulz today. After a poor campaign, Schulz support within the party has waned. There is no immediate deadline, but the lack of a government two months after the election could pose challenges German’s European positions. |

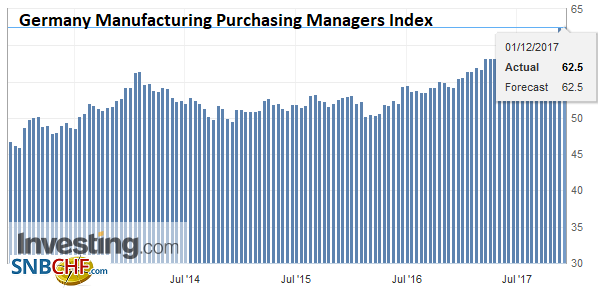

Germany Manufacturing Purchasing Managers Index (PMI), Dec 2017(see more posts on Germany Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

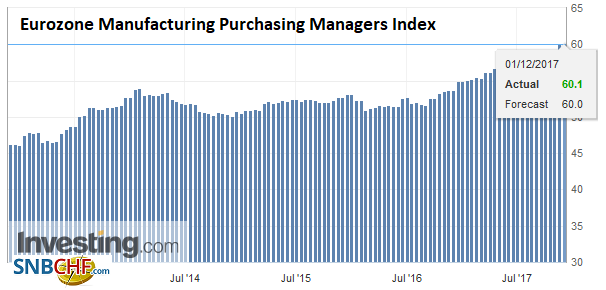

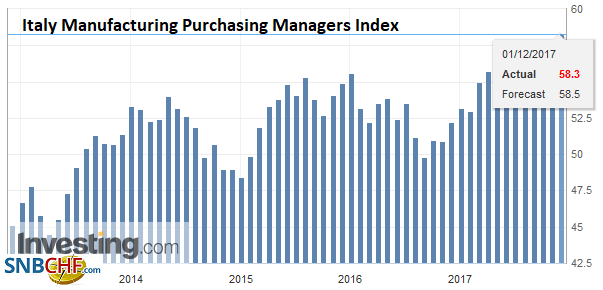

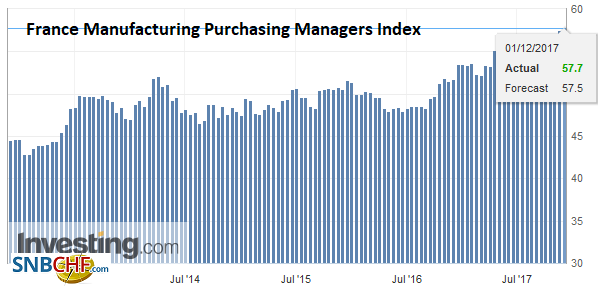

EurozoneEurope is fortunate that the economy is in a strong position. The German manufacturing PMI was confirmed at 62.5, a new multi-year high. It finished last year at 55.6. The EMU aggregate reading ticked up to 60.1 from the flash of 60.0. It was at 54.9 at the end of 2016. It is not just a German story. Consider that Italy’s manufacturing PMI rose to 58.3 from 57.8 and 53.2 at the end of last year. France is also fully participating. The flash manufacturing PMI rose to 57.7 from 57.5 flash reading. It was at 53.5 at the end of 2016 |

Eurozone Manufacturing Purchasing Managers Index (PMI), Dec 2017(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

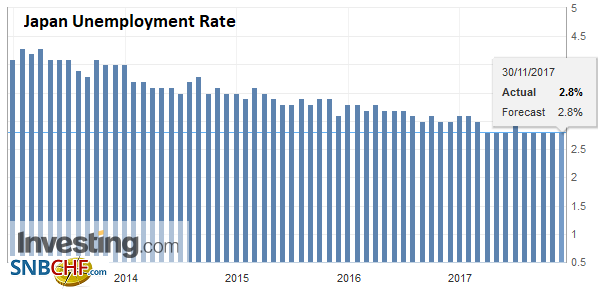

JapanJapan reported a slew of data. The unemployment rate was unchanged at 2.8%, but the job-to-applicant rose to 1.55 from 1.52, which is a new record high. |

Japan Unemployment Rate, Oct 2017(see more posts on Japan Unemployment Rate, ) Source: Investing.bg - Click to enlarge |

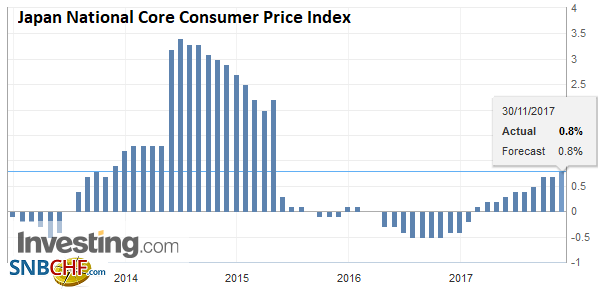

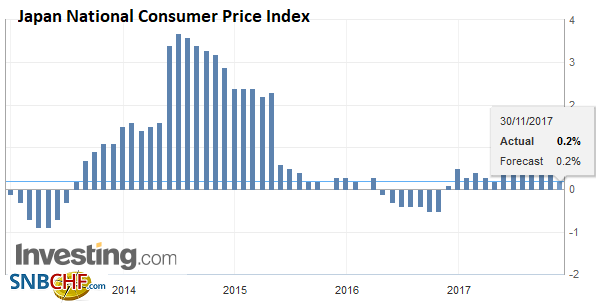

| Inflation was spot on expectations, with the headline rate falling back to 0.2% from 0.7%, due primarily to the base effect. |

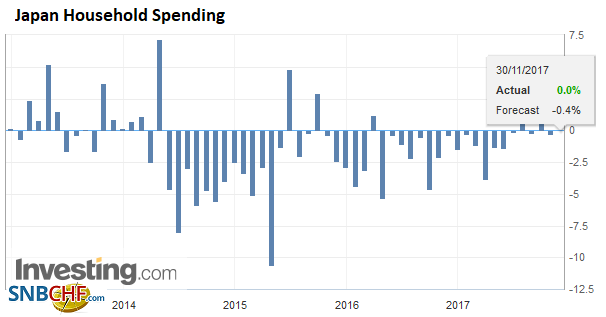

Japan Household Spending YoY, Oct 2017(see more posts on Japan Household Spending, ) Source: Investing.com - Click to enlarge |

| The core rate, which excludes fresh food, ticked up to 0.8% from 0.7%. Recall that it finished last year at minus 0.2%. |

Japan National Core Consumer Price Index (CPI) YoY, Oct 2017(see more posts on Japan National Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| However, excluding both fresh food and energy, and prices rose 0.2%. It was 0.1% at the end of last, but to say it has doubled is misleading. |

Japan National Consumer Price Index (CPI) YoY, Oct 2017(see more posts on Japan National Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| The upside surprise comes from the overall household spending. It was flat year-over-year after contracting 0.3% in September. |

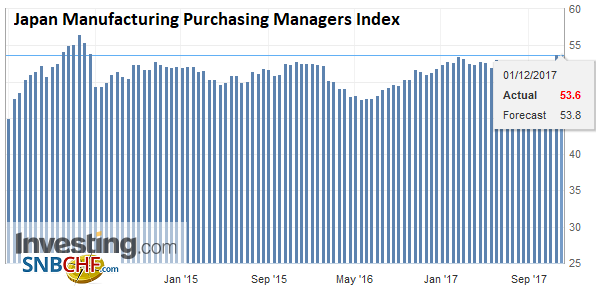

Japan Manufacturing Purchasing Managers Index (PMI), Nov 2017(see more posts on Japan Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

China |

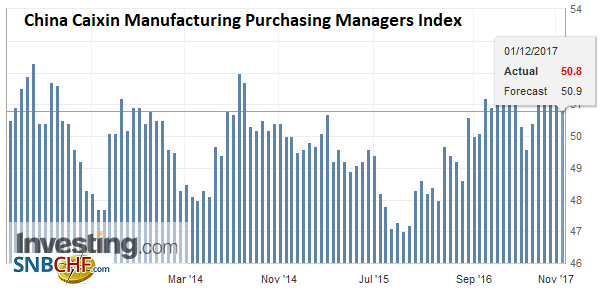

China Caixin Manufacturing Purchasing Managers Index (PMI), Nov 2017(see more posts on China Caixin Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Spain |

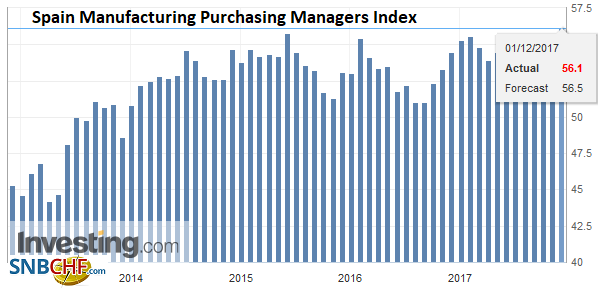

Spain Manufacturing Purchasing Managers Index (PMI), Nov 2017(see more posts on Spain Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

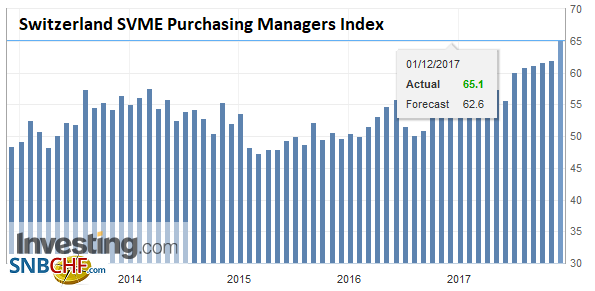

Switzerland |

Switzerland SVME Purchasing Managers Index (PMI), Nov 2017(see more posts on Switzerland SVME PMI, ) Source: Investing.com - Click to enlarge |

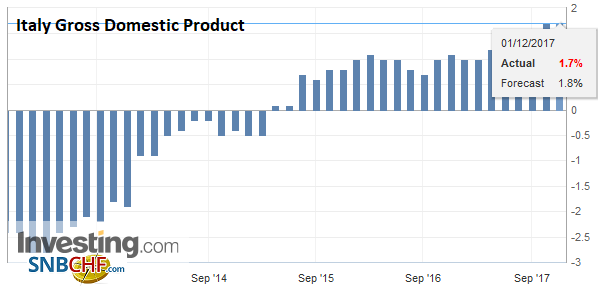

Italy |

Italy Manufacturing Purchasing Managers Index (PMI), Nov 2017(see more posts on Italy Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Italy Gross Domestic Product (GDP) YoY, Q3 2017(see more posts on Italy Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

|

France |

France Manufacturing Purchasing Managers Index (PMI), Dec 2017(see more posts on France Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Outside of the eurozone, Sweden, Norway, and the UK reported strong manufacturing PMIs. Sweden rose to 63.3 from 59.3. Norway’s reading jumped to 57.1 from 54.8, and the UK’s manufacturing PMI rose to 58.2 from a revised 56.6 (initially 56.3).

Several Asian countries reported stronger manufacturing PMI. They include Korea, Taiwan, Malaysia, and Thailand (which moved back above the 50 boom/bust level). Exceptions were China’s Caixin measure, which unlike the official report, slipped to 50.8 from 51.0, and Japan, which saw its manufacturing PMI slip to 53.6 from 53.8.

The North American session will be peppered with data and the Senate vote, if it is held, will likely be well after European markets close. The US sees the manufacturing PMI and ISM, construction spending and auto sales. The PMI and ISM pose headline risk, but the more important number of economists will be the auto sales. The recovery from the storm helps lift auto sales in September to a nearly 18.5 mln unit pace. It eased back to 18.0 mln in October and likely corrected further in November. The average monthly pace this year has been 17.08 mln compared with 17.44 mln last year. Before the storms, that is through August; the average annual pace was 16.8 mln. The Bloomberg consensus is for a 17.5 mln unit pace in November. The risk seems to be on the downside.

Canada reports September monthly GDP and Q3 GDP. After several quarters of strong growth, the Canadian economy hit a wall in the same quarter that the central bank raised rates twice. After an annualized growth pace of 4.5% in Q2, the Canadian economy is expected to have slowed to a 1.6% pace. Canada also reports November employment data. Job growth is expected to have slowed to 10k from 35k in October and a 26.4k average monthly gain this year. Last year, Canada created about 19.1k jobs on average a month.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,China Caixin Manufacturing PMI,EUR/CHF,Eurozone Manufacturing PMI,Featured,France Manufacturing PMI,Germany Manufacturing PMI,Italy Gross Domestic Product,Italy Manufacturing PMI,Japan Household Spending,Japan Manufacturing PMI,Japan National Consumer Price Index,Japan National Core Consumer Price Index,Japan Unemployment Rate,newsletter,Politics,Spain Manufacturing PMI,Switzerland SVME PMI,U.K. Manufacturing PMI,U.S. ISM Manufacturing Employment,U.S. ISM Manufacturing PMI,U.S. Manufacturing PMI,USD/CHF