The Fed has not only failed to fix what’s broken in the U.S. economy–it has actively mad those problems worse. The Federal Reserve claims its monetary interventions saved America from economic ruin in 2009, and have bolstered growth ever since. Don’t hurt yourself patting your own backs, Fed governors past and present: it’s bad enough that the Fed can’t fix the economy’s real problems–its policies actively make them worse. After seven long years of politicos and the financial media glorifying the Federal Reserve’s policies as god-like in their power and efficacy, let’s take a quick look at the results of these vaunted policies: ZIRP (zero interest rates), (QE) quantitative easing, both of which are ways of shoving nearly-free money ( a.k.a. liquidity) into the banking sector, where all this free money is supposed to filter into the global economy, working miracles of prosperity. The stated goal of the Fed’s zero-interest rate policy (ZIRP) and quantitative easing (QE) was to make borrowing easier for both corporations and consumers, the idea being that companies would borrow to invest in new productive capacity and consumers would buy the new goods and services being produced with the Fed’s cheap credit.

Topics:

Charles Hugh Smith considers the following as important: Featured, newslettersent, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

|

The Fed’s policies have been an unqualified success for financiers and an abject failure for everyone who has to work for a living. The Fed has not just failed to rectify the nation’s obscene inequality in wealth and income; it has actively widened it by handing guaranteed returns to the banks and financiers while stripmining what’s left of the middle and working classes’ non-labor income, i.e. interest on savings.

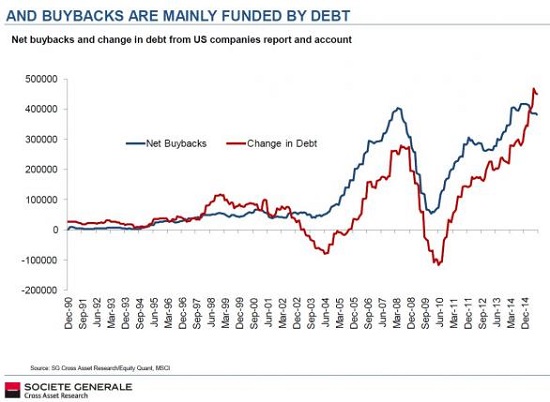

So let’s see what corporations and financiers did with the Fed’s free money for financiers:

They borrowed billions to buy back their own stocks:

|

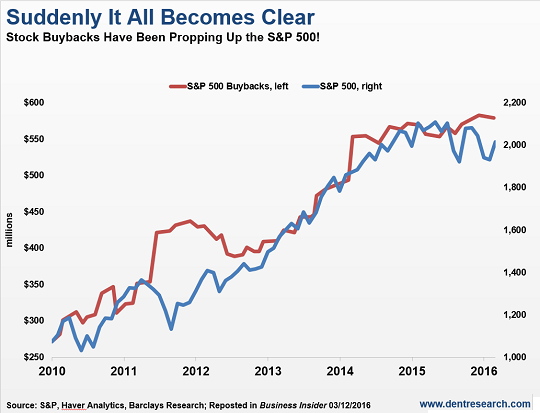

|

| Which boosted the the value of the stocks, enriching the corporate managers and big shareholders: | |

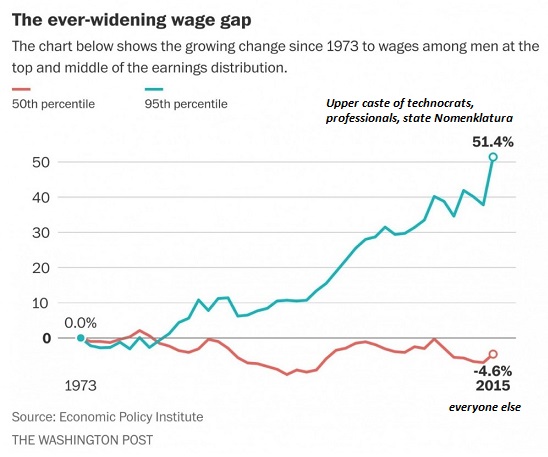

| Did corporations share the wealth with their employees? The top 5% have done very well, the bottom 95%–well, their real incomes stagnated or declined: | |

|

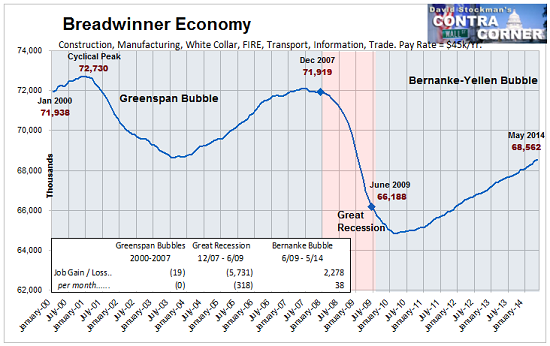

Did corporations and financiers create more breadwinner jobs? That is, full-time jobs that pay enough to support a household (i.e. the employee doesn’t have to live in his/her parents’ basement).

Nope. Breadwinner jobs have declined. The “growth” measured by GDP is mostly increases in prices, not growth in full-time jobs or wages for the bottom 95%.

|

|

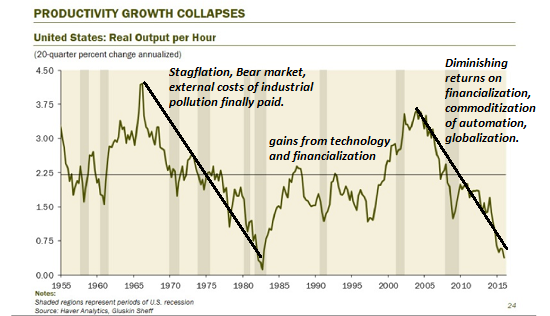

| Did they invest the Fed’s free money for financiers in new productive capacity? No, productivity has tanked: | |

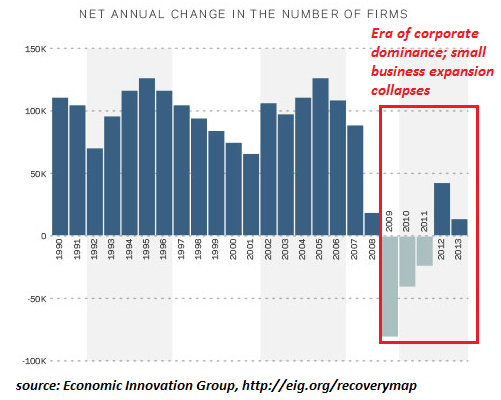

| But the Fed’s near-zero interest rates and easy credit must have encouraged investors and entrepreneurs to launch a tsunami of new businesses, right? Wrong — new business growth has collapsed since the Fed’s policies were put in place: | |

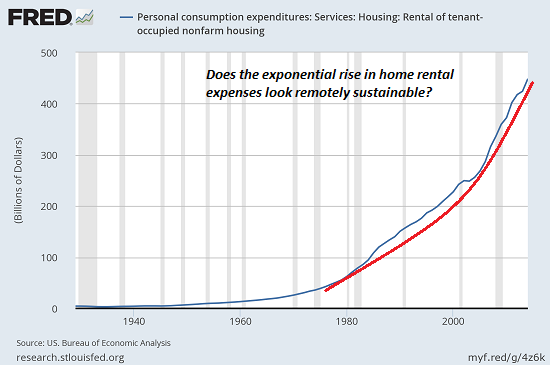

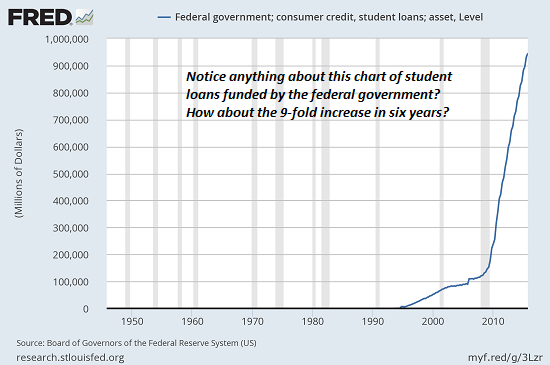

| But certainly the Fed’s policies have kept inflation low, correct? No–not if you pay rent, college tuition or healthcare: | |

| But surely the Fed’s vaunted wealth effect has trickled down to all households? Not even close–wealth/income inequality has soared: | |

|

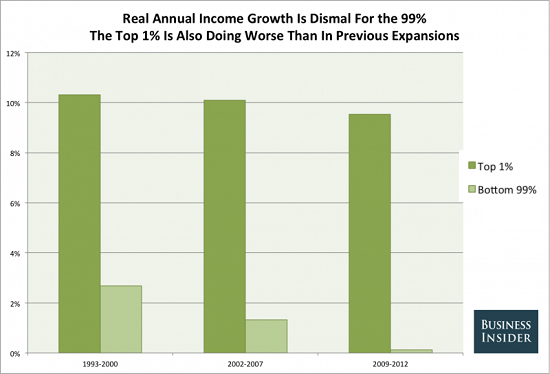

Berkeley economics professor Emmanuel Saez put out an update to his estimates of income inequality, and the headline figure has everybody outraged: 95% of income gains since 2009 have accrued to the top 1%.

The Fed has not only failed to fix what’s broken in the U.S. economy–it has actively made those problems worse. The first step in solving these problems is to eliminate whatever is making them worse–i.e. the Federal Reserve. |

My new book is #5 on Kindle short reads -> politics and social science: Why Our Status Quo Failed and Is Beyond Reform ($3.95 Kindle ebook, $8.95 print edition) For more, please visit the book’s website.